- Pakistani buyers resist higher offers on ample inventories

- Turkish mills raise domestic tags; imported market steady

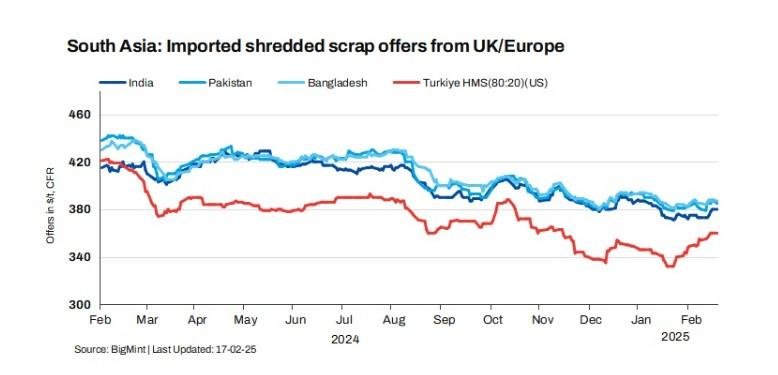

South Asia’s imported ferrous scrap market remained sluggish as buyers across India, Pakistan, and Bangladesh showed limited interest amid weak steel demand, ample domestic availability, and currency fluctuations. Indian and Pakistani buyers resisted higher offers, while Bangladesh’s demand was moderate despite stalled construction activities. Offers for shredded from the UK/Europe edged down by $3/tonne (t) in Pakistan and $1/t in Bangladesh, while they were unchanged d-o-d in India.

In Turkiye, domestic scrap prices rose, as major mills increased purchase rates. However, imported scrap tags remained unchanged, as mills pushed back against further hikes. The US-origin HMS (80:20) market saw stable offers, but with Turkish buyers hesitant, a market stand-off emerged, limiting near-term price expectations. US bulk HMS (80:20) offers remained unchanged for Turkiye compared to the last close on Friday.

Overview

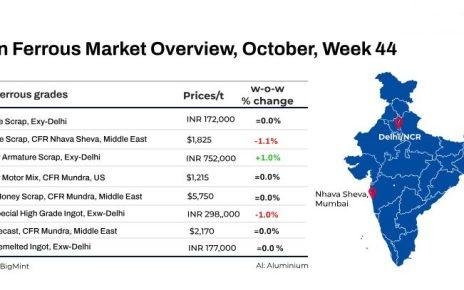

India: Indian buyers remained silent due to weak buying interest, as competitive domestic scrap availability and slower-than-expected steel sales, compounded by currency fluctuations, kept demand subdued. Shredded offers from the US and UK/Europe were heard at $380-385/t CFR Nhava Sheva, while bids remained lower at $370-375/t CFR. HMS (80:20) offers from the UK/Europe and West Africa ranged within $345-355/t CFR.

Pakistan: Pakistani buyers showed limited interest in higher offers, as major mills have partially restocked for the coming month, while a sluggish steel market further dampened buying momentum. Shredded offers from the UK/Europe were heard at $380-385/t CFR Qasim, while bids were lower at around $373-375/t CFR.

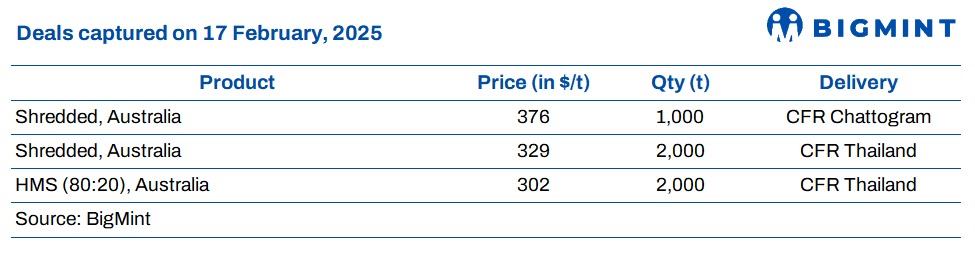

Bangladesh: Bangladesh’s demand for imported scrap remained moderate, despite a sluggish domestic steel market and a lack of government projects, which dampened construction activity. Shredded offers from Australia were reported at $375-380/t CFR Chattogram, while Hong Kong PNS was heard at $378-380/t CFR.

Turkiye: Turkiye’s domestic scrap market saw an uptrend, as major steel mills, including Kardemir and Oyak Maden Metalurji, raised purchase tags by TRY 100-150/t ($2-4/t) due to strong imported scrap pricing. However, the imported scrap market remained unchanged, with mills resisting further increases amid weak finished steel demand.

US-origin bulk HMS (80:20) imported scrap offers were assessed at $360/t CFR, with offers ranging within $355-362/t CFR. Market sentiment was cautious, with recyclers holding firm on offers while mills pushed for price concessions. Despite a bullish US domestic scrap market, Turkish buyers were hesitant, leading to a stand-off and limited upside expectations in the near term.

Price assessments

India: UK-origin shredded indicatives were assessed stable at $380/t CFR Nhava Sheva compared to the last close on Friday.

Pakistan: UK-origin shredded indicatives were at $385/t CFR Qasim, down by $3/t compared to the last close on Friday.

Bangladesh: UK-origin shredded was assessed at $387/t CFR Chattogram, down by $1/t compared to the last close on Friday.

Turkiye: US-origin HMS (80:20) bulk scrap prices remained unchanged at $360/t CFR Turkiye compared to the last close on Friday.

Article From Bigmint