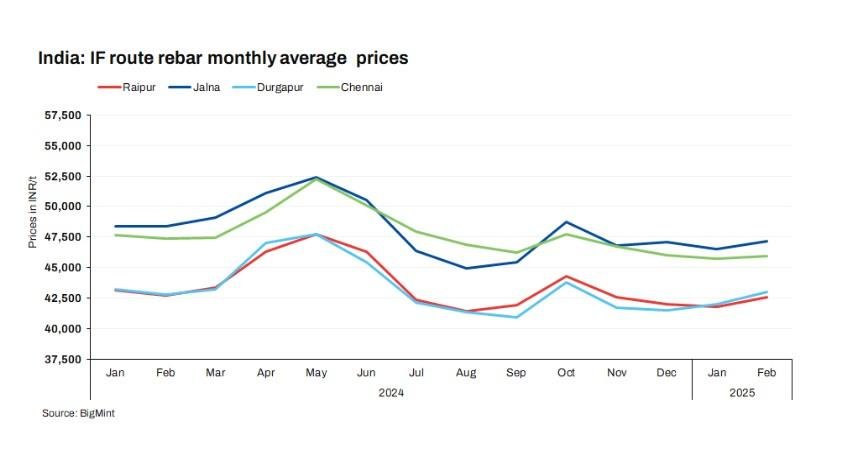

India’s induction furnace (IF) route rebar prices rose in February 2025. Rebar (Fe 500) prices showed an increase in the range of INR 100-2,000/tonne (t) m-o-m, as per BigMint.

In the first half of the month, buyers were hesitant due to a lack of confidence and market clarity. However, in the second half, demand increased as raw material support helped boost purchases, particularly by retailers.

With better demand and smooth delivery of previously ordered materials, manufacturers began raising their prices. With steady material movement, mill inventories have come down to around 8-10 days.

Notably, India’s rebar production (including both IF and BF routes) reached 47.2 million tonnes (mnt) in CY’24, marking a growth of over 6.7% compared to 44.2 mnt during the same period in 2023, according to JPC data.

Factors propelling market

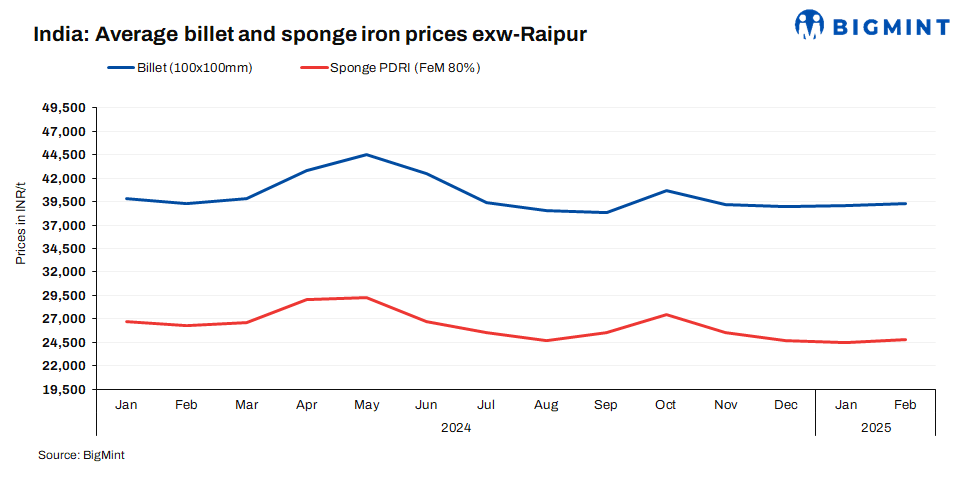

Raw material price trend: Prices of steel billet and sponge iron the basic raw material of IF route also supported the IF route finish market. Moderate buying enquiries and trades in nearby market supported manufacturers to keep prices either stable or fluctuate as per demand and supply in market. Considering the benchmark of Raipur market, billet prices increased by INR 650/t to INR 40,000/t and sponge iron (PDRI FeM 80% +/- 1) marginally decreased by INR 250/t exw to INR 25,000/t m-o-m.

On the other hand, Iron ore fines (Fe 62%) prices of BigMint’s Odisha index have increased by around INR 100/t to stand at INR 5,000/t following premium bids in recent Odisha Mining Corporation (OMC) auction driven by increased demand and a shortage of higher-grade material.

Also, India’s prices of domestic 60-14 grade silico manganese increased by INR 3,260/tonne (t) ($37/t) m-o-m to around INR 73,160/t ($837/t) exw Raipur in Feb’25 compared INR 69,900/t ($800/t) in Jan’25 , as per BigMint’s assessment which further supported the finish market.

BF-route price trends: Trade level BF-rebar prices rose by INR 500/t m-o-m to average of INR 52,800/t exy-Mumbai in February 2025. Limited material availability in the trade channel lifted prices upwards, meanwhile slow demand weighed on the market sentiments. Logistics disruptions have impacted supplies, and this has created a dearth of material in the distribution channel. In addition, rebar inventories were at all-time low at the stockyards. In the projects segment, prices rose by INR 1,100/t m-o-m to monthly average price of INR 50,600/t FOR Mumbai last month. Mills have secured substantial project orders but face challenges in fulfillment due to limited stock availability.

Outlook

IF rebar prices are likely to increase in the near term. Manufacturers are likely to attempt to raise prices, as now they are relieved from inventory pressure but the market will depend on how buyers respond to price hikes.

Article From bigmint