- India’s HRC quota will be reduced by 23%

- Import quotas will feature caps on CRC, HDG and plates

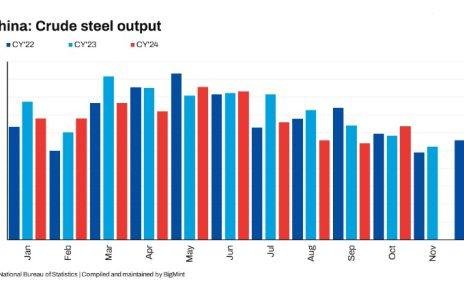

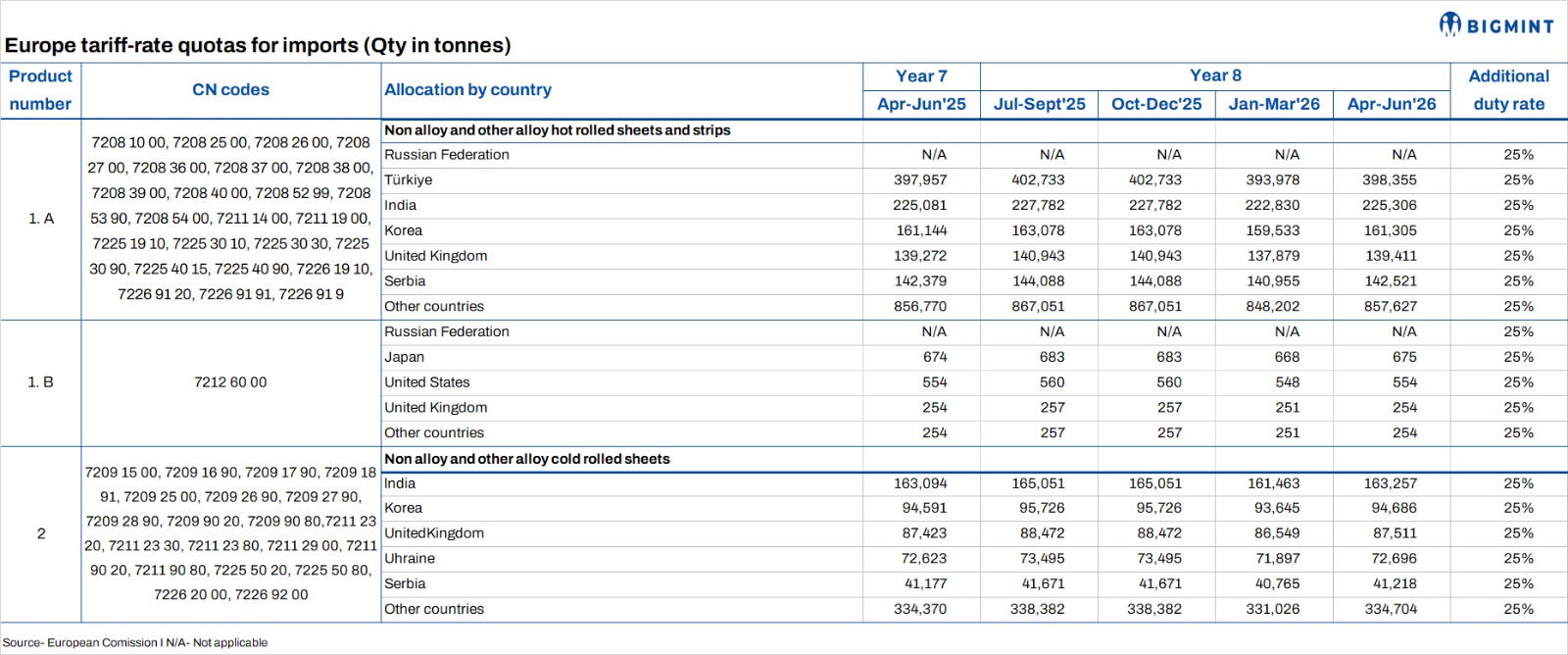

The European Commission’s steel import policy will see significant adjustments from 1 April 2025. Suppliers of hot-dip galvanised (HDG) and cold-rolled coils (CRC) will face new limits within the “other countries” quota, varying between 13-25% based on the product. Additionally, the quarterly duty-free hot-rolled coil (HRC) quota will decrease by 12.1% to 1.9 million tonnes (mnt), primarily due to the elimination of Russian volumes.

This change notably India’s HRC quota by 23% and also impacts quotas for plate, wire rod, and hollow sections.

EU’s steel imports rise 13% in 11MCY’24

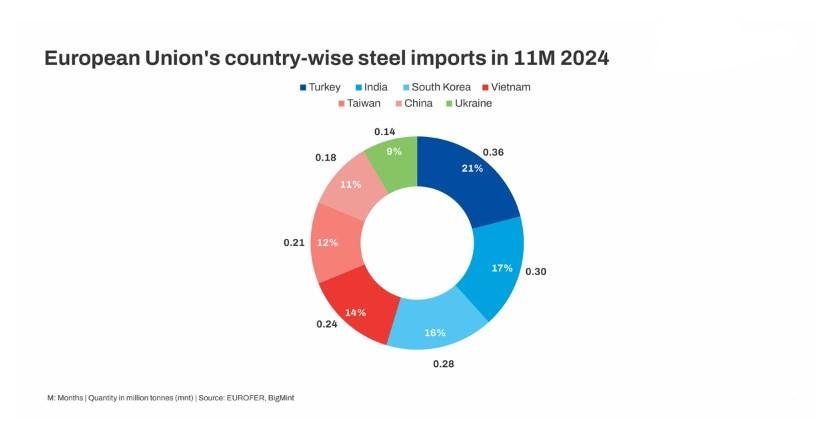

During 11MCY’24, imports of all steel products witnessed an uptick of 13% y-o-y. Imports of finished products climbed up by 9%, with flats shipments rising by 10% and longs by 8%.

During the same period, leading exporters of finished goods to the EU were Turkiye (15% share), India (12%), South Korea (11%), Vietnam (10%), and Taiwan (9%), accounting for 57% of total arrivals.

While shipments from Turkiye skyrocketed by 87% y-o-y, those from Vietnam and India rose a robust 27% and 14%, respectively. Meanwhile, imports from Taiwan were up by 6% and from South Korea by 4%.

In contrast, imports of finished products plunged from Japan (18%) and China (10%).

CRC restrictions

A 13% cap will affect major suppliers like Vietnam, Taiwan, Japan, and Turkiye. The “other countries” CRC quota for April-June will be 334,369 tonnes (t), resulting in a 43,467 t limit per supplier. This mirrors the cap previously imposed on HRC quotas.

HDG adjustments

Galvanised steel imports will also face stricter limits. A 20% cap is placed on 4B auto-grade HDG imports from “other countries,” affecting Turkiye, Vietnam, and Japan. The cap reaches 25% for 4A HDG quotas, impacting Turkiye, Vietnam, and Taiwan. This translates to 118,012 t per country for 4A HDG, total quota 472,049 t and 20,955 t per country for 4B HDG, total quota is 104,770 t. Notably, beginning 1 July 2025, remaining volumes from previous quarters will not be carried over for CRC and 4A HDG, though the carryover mechanism remains for 4B HDG.

New caps on HR plate imports to affect South Korea

The EU’s revised steel safeguard quotas will also include a 20% cap on hot-rolled plate imports under the “other countries” quota, limiting imports from key sellers. The proposed quarterly plate quota is approximately 550,000 t, a decrease of about 15,000 t from January-March levels. Suppliers like South Korea, Indonesia, and India, previously unrestricted, will now be limited to 110,000 t per quarter, or about 440,000 t per year. However, the unused quota volumes will no longer be carried over for heavy plate and some other products.

The implementation of these changes is scheduled for 1 April unless any objection is raised by the World Trade Organization (WTO). New EU import regulations will significantly impact South Korean plate exports, which totalled 760,000 t in 2023, exceeding the new 440,000 t limit. This could result in a 42% reduction for South Korea, while other exporters like Indonesia and India are expected to be minimally affected. Conversely, countries with lower export volumes, such as Brazil and Japan, may benefit from the resulting gap. The changes are anticipated to reduce overall EU plate imports and intensify competition among EU producers.

Impact on suppliers, EU market

The recent EU safeguard review is expected to alter the flow of HDG steel imports. Reduced Vietnamese exports to the EU may create opportunities for Turkish suppliers. However, Turkish producers will also be subject to the same quota limitations and anti-dumping duties. This shift is likely to redistribute import volumes within the EU, given Vietnam’s previous significant quota share.

Eurofer has requested substantial quota reductions for flat steel products, as well as an increase in safeguard duties for volumes exceeding allocations. The steel industry association also proposed restrictions on Chinese steel and a reduction in the HRC quota for other countries.

Industry sources expect significant changes, indicating that the European Commission understood the challenges faced by European mills. However, the final changes are less severe than those requested by Eurofer. The safeguard measures will remain in effect until 30 June 2026.

Outlook

The EU’s revised steel import policies are set to significantly reshape the European steel market. Reduced HRC quotas and new caps on CRC, HDG, and plate imports will redistribute market share, impacting major suppliers like India, Vietnam, South Korea, and Turkiye. While some countries may benefit from the resulting gaps, overall EU import volumes are expected to decrease, intensifying competition among domestic producers.

The elimination of quota carryovers for certain products further tightens import controls, signalling a more protectionist stance by the EU. These changes, though less drastic than initially sought by Eurofer, will necessitate strategic adjustments by global steel exporters to navigate the evolving European market landscape.

Article From Bigmint