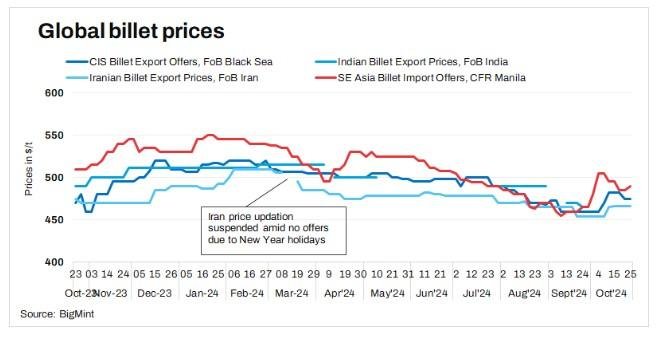

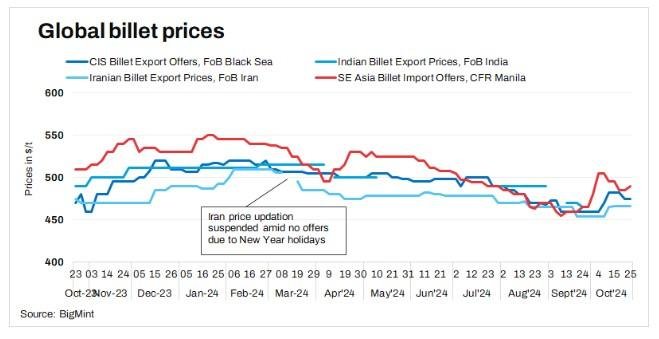

The global billet market remained quiet this week amid weak buying interest and lack of tenders. Market participants were cautious due to higher prices of semi-finished steel and weak sentiments in the long steel sector.

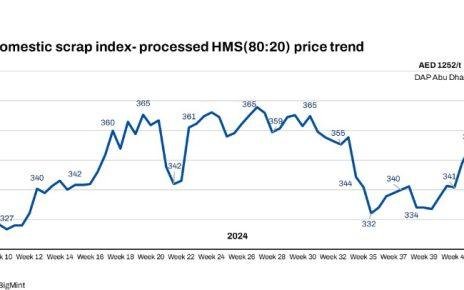

Turkish imported bulk scrap prices remained largely stable w-o-w after a sharp decline last week. This was due to a slowdown in domestic rebar sales that affected fresh inquiries from steel mills. BigMint’s assessment for US-origin HMS (80:20) bulk scrap stood at $372/tonnes (t) CFR, up by $1/t w-o-w.

Market highlights:

- SE Asia billet prices remain rangebound w-o-w: Southeast Asian billet (150 x 150 mm, 3SP) prices remained largely range-bound w-o-w at $490/t CFR Manila on 25 October 2024, as per BigMint’s bi-weekly assessment. Offers in the SE Asian market were heard at around $490-495/t CFR for billets (150 x 150 mm, 5SP). Weak buying interest and the absence of trades kept prices under pressure.

- Vietnam’s billet export offers drop w-o-w: Vietnam’s blast furnace (BF)-grade billet export offers dropped by $5/t w-o-w to $495/t FOB.

- Iranian billet prices remain stable w-o-w: The Iranian billet export market remained silent due to weak buying interest and witnessed absence of export tender this week. Iranian billet prices stood at $466/t on 25 October, stable w-o-w.

- Chinese billet prices rise by RMB 40/t ($6/t) w-o-w: Billet prices in Tangshan rose by RMB 40/t ($6/t) to RMB 3,110/t ($437/t) on 25 October against 18 October. Prices include 13% VAT. Supportive market sentiments in raw materials, hike in rebar futures along with expected policy support from the government have kept prices supported. Meanwhile, SHFE rebar futures (January 2025 delivery) increased by INR 40/t ($6/t) to RMB 3,376/t ($474/t) on 25 October against 18 October.

Article Credit: Bigmint