- Falling EU exchange rates further pressuring US exporters

- Turkish mills with multiple offers, but domestic steel sales remain slow

The US ferrous scrap export index has experienced a w-o-w decline, primarily due to weakened demand from Turkiye, which is currently focusing on pushing the imported price down amid cheap availability of European material.

Additionally, the falling EU exchange rate is likely to support European suppliers in lowering their offers for Turkiye further impacting the US’s firm stance on export offers.

Price assessments

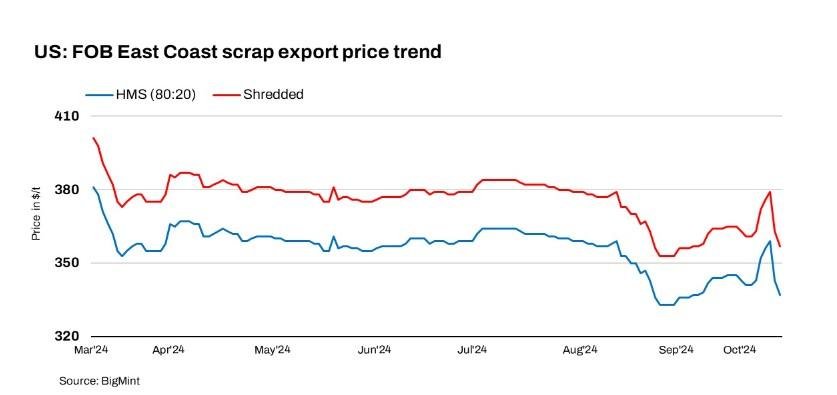

- BigMint’s assessment for HMS (80:20) bulk FOB US East Coast decreased by $6/t w-o-w to $337/t on Friday from $343/t a week ago.

- BigMint’s assessment for shredded bulk FOB East Coast also decreased by $6/t w-o-w to $357/t on Friday from $363/t a week ago.

CFR assessments

- The weekly assessment for US-origin HMS (80:20) bulk scrap stood at $365/t CFR Turkiye, down by $7/t w-o-w.

- The weekly assessment for deep-sea bulk US cargoes of HMS (80:20) CFR Vietnam stood at $366/t, down by $2/t w-o-w.

- The weekly assessment for US-origin HMS (80:20) bulk prices were at $381/t CFR Chattogram, down $4/t as compared to the last week.

Market sentiments

Turkiye: Turkish imported bulk scrap prices witnessed a sharp drop w-o-w owing to recent low prices in European deals that again pressurised US exporters to reduce their offers. There was a continued slowdown in Turkish domestic rebar sales, which has dampened fresh inquiries from steel mills.

“Around 1-2 bulk scrap cargoes were booked from Europe which was unusual in terms of prices, as their exchange rate is falling, which will help them reduce their offers,” a European yard owner mentioned.

A US recycler commented on the Turkish market: “The Turkish market isn’t as appealing to us as it once was, but there aren’t many reasons for Turkish mills to pay higher prices.” This sentiment reflects the cautious stance of Turkish buyers amid market uncertainties.

Market insiders indicate that while the mood in the US is optimistic, suppliers are hesitant to lower prices. “Buying scrap is tough for Turkish mills with slow rebar sales, and pushing scrap prices down only leads to more pressure from rebar customers.”

Bangladesh: Bangladesh’s demand for imported ferrous scrap from the US is currently weak, with offers for HMS (80:20) at around $385-390/t. Several major buyers stayed inactive for the past two months due to sufficient inventories and issues with letters of credit leading to limited purchasing activity.

A representative from a Bangladeshi trading house stated, “Demand is low, with no pressure to buy.” While overall demand remains sluggish, some small-scale bookings are still happening.

Recent offers from the US indicate HMS (80:20) at $390-392/t, with bids ranging from $375-380/t. Shredded scrap is offered at $400-402/t, with bids are at $395-396/t. But overall interest remains low.

Outlook

Near-term market sentiment remains largely bearish as there are ample offers for Turkish mills but finished steel sales are slow, forcing buyers to adopt a wait-and-see approach. However, the US may shift its focus to South Asia where recent bulk bookings from India is cause for renewed optimism for US exporters.

Article credit: Bigmint