- Smelters take cautious approach to procurement

- Mn alloys market weakens amid bid-offer mismatch

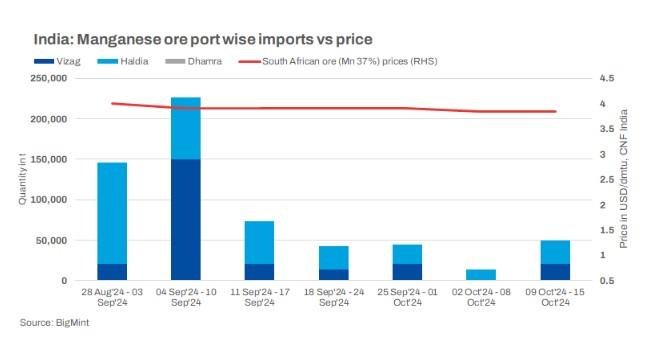

Imported manganese ore prices to India remained relatively stable this week, with major manganese ore producers adjusting their output to tackle weak market sentiments.

Price trends

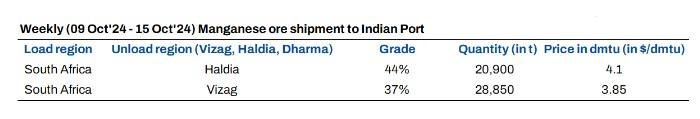

- Australian high-grade manganese ore (46% Mn): Prices remained stable w-o-w at $4.40/dry metric tonne unit (dmtu).

- Gabonese high-grade manganese ore (44% Mn): Prices remained unchanged w-o-w at $4.10/dmtu.

- South African lumps (Mn 37%): Prices remained constant w-o-w at $3.85/dmtu.

Market overview

Smelters maintain cautious approach: Indian smelters exercised caution regarding manganese ore procurement, opting to rely on existing inventories to meet their immediate operational requirements. This measured approach, combined with strategic production adjustments by certain miners and the upward trend in steel prices, collectively contributed to a sense of stability within the manganese ore market.

Indian manganese alloys market weakens: Domestic buyers were reluctant to purchase manganese alloys at higher prices, which led to a bid-offer misalignment that exerted downward pressure on silico manganese values. This trend led manganese alloys producers to adopt a wait-and-watch approach to manganese ore purchases. Additionally, the export market for Indian manganese alloys weakened, reducing demand for imported manganese ore. However, offers stayed stable.

Indian silico manganese prices declined this week, as steel mills, facing weak demand, adopted a more cautious procurement strategy. Notably, prices of the 60-14 grade decreased by INR 950/t ($11/t) w-o-w to INR 66,900-68,200/t ($796-811/t) exw in Raipur, Durgapur, and Visakhapatnam. The slowdown in silico manganese was exacerbated by market uncertainty and limited export demand. Conversely, stable offers for imported ore provided some support to prices.

Silico manganese (65-16) prices stood at $926/t FOB Vizag/Haldia, India, inching down by $6/t w-o-w.

South32 and Eramet trim Mn ore production: Major manganese ore producers, South32 and Eramet, have adjusted their production strategies in response to challenging market conditions. South32’s manganese ore production in Q1FY’25 declined by 5% y-o-y to 0.597 wet million tonnes (wmnt), while Eramet’s production in Q3CY’24 decreased by 5% y-o-y to 2 mnt. Both companies have implemented measures to optimise production and maximise margins in the face of lower demand and price volatility. These adjustments may tighten the manganese ore supply market and impact market dynamics.

Import arrivals to India up w-o-w: Manganese ore import arrivals to India surged 274% w-o-w, with shipments totalling 42,286 t between 16 October and 22 October compared to 13,305 t in the previous week.

Article Credit: Bigmint