- Bid-offer disparities put buyers off fresh bookings

- Muted construction sector weighs on rebar demand

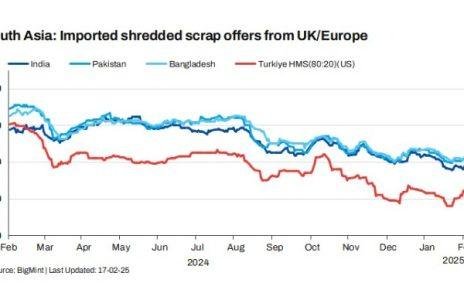

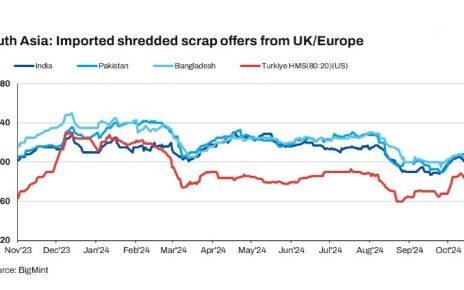

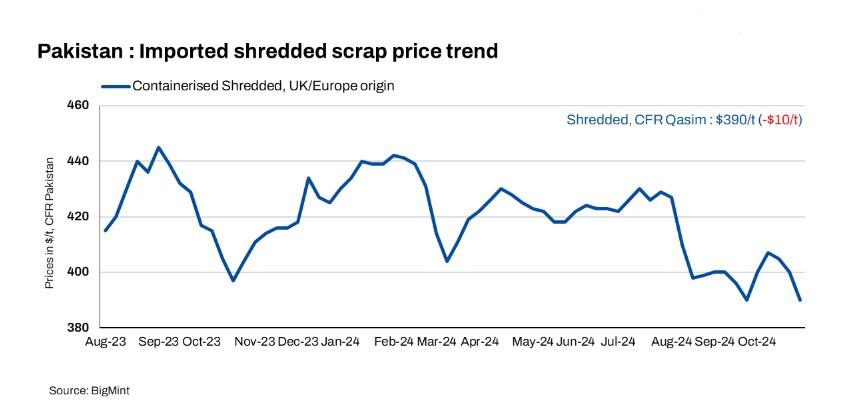

Imported ferrous scrap offers to Pakistan softened by $10/tonne (t) this week amid limited demand, with BigMint’s weekly assessment of European shredded pricing it at $390/t CFR Qasim, down from $400/t CFR a week ago.

As per market insiders, Pakistani buyers have become more cautious as previously contracted materials are now available at more competitive prices than current offerings. This situation, coupled with sluggish rebar sales, has increased downward pressure on the market.

Arrived material with cheaper prices makes buyers avoid fresh bookings

As per a source from a major trading house, new shipments arriving in Pakistan were offered at $394-395/t CFR Qasim, while bids were reportedly in the range of $385-386/t CFR. Buyers sought workable prices below $385/t for shredded, following deals heard at $388-390/t.

“Around 2-3 deals were heard booked from the UK/EU, and 2,000-3,000 t of imported shredded, priced at $388-390/t, arrived in Pakistan in the last seven days,” explained another source.

An official from a steel mill commented, “Although a considerable volume has arrived recently, people are struggling to release it due to bid-offer disparities. Hence, they are offering it at much lower prices. Cash flows have worsened.”

Domestic market scenario

Current rebar prices in Pakistan stood at PKR 251,500-252,500/t($905-908/t), while local scrap stood at PKR 150,000-152,000/t($540-547/t). Billet offers edged up to PKR 207,000-210,000/t($745-756/t) exw.

The average selling prices of rebars stood at PKR 252,000-254,000/t ($907-914/t)in Punjab and PKR 257,000-258,000/t ($925-928/t)in Sindh.

The market price showed signs of recovery, with scrap rates increasing by PKR 5,000-8,000/t($18-29/t) w-o-w to PKR 150,000-151,000/t($540-543/t) exy.

Rebar prices rise, market weakens

In recent developments, the Gujranwala Steel Furnace and Re-Rolling Mills Association unanimously agreed on new rebar rates, effective 26 October 2024. Accordingly, several steel mills in the domestic market adjusted their ex-factory prices, raising them by up to PKR 4,000/t($14/t) in the last three days.

Sales remain weak, with reputable companies holding their prices steady between PKR 245,000-250,000/t($882-900/t).

Local steel bars that previously avoided sales tax have increased their prices due to pressure from tax authorities, reflecting the impact of full tax recoveries. Previously, tax payments were neglected, allowing discounts to be offered to customers.

For example, in one case, a sale price of PKR 210,000/t($756/t) included a tax of PKR 7,000/t($25/t) resulting in a total price of PKR 217,000/t($781/t).

In another instance which is the current scenario, the same sale price of PKR 210,000/t now incurs a tax of PKR 26,000/t($94/t), leading to a total price of PKR 236,000/t($849/t).

As per a Karachi-based steel mill, the rebar market is weak, with dull sales. Amid the recent rise in prices, the market is not in a hurry to purchase following the muted construction sector in major regions.

Price updates from steel producers

- Aziz Steel: Effective 29 October 2024, prices of deformed bars were increased to PKR 246,000-248,000/t($885-892/t) ex-factory Lahore.

- FF Steel: Management raised the prices of grade 60 and grade 80 steel rebars by PKR 2,000/t($7/t), effective immediately for quotations and new sales orders.

- Moiz Steel: Effective 29 October 2024, prices of deformed grade 60 rebars will increase by PKR 2,000/t.

- KAMRAN Steel: Prices of deformed bars increased to PKR 246,000-248,000/t($885-892/t), effective 29 October 2024.

Market updates

FBR reduces minimum sales tax values

The Federal Board of Revenue (FBR) in Pakistan lowered the minimum sales tax values for four locally-produced steel products to ease tax burdens. The new minimums are PKR 205,000/t for steel bars, PKR 175,000/t for steel billets, PKR 160,000/t for steel ingots, and PKR 154,000/t for ship plates. Values for other re-rollable iron and steel scrap remain unchanged at PKR 160,880/t. Sales tax will apply to any sales above these new minimums.

Pakistan urges China to raise currency swap agreement limit

Pakistan’s Finance Minister requested China’s Vice Minister of Finance to increase the currency swap agreement limit from 30 billion to 40 billion yuan. This follows China’s recent extension of a $4.3 billion facility. Additionally, Pakistan has secured a $600 million commercial loan at an 11% interest rate, unrelated to its IMF bailout package. Pakistan has formally requested a supplementary loan of RMB 10 billion (approximately $1.4 billion) from China to tackle ongoing financial issues.

Outlook

Market insiders foresee continued downward pressure on deals and inquiries. While rebar prices have risen due to a revised tax, weak demand is likely to negatively impact the market outlook.

Article Credit: Bigmint