- Major global miners reduce offers on declining demand

- Indian silico manganese prices dip following early October surge

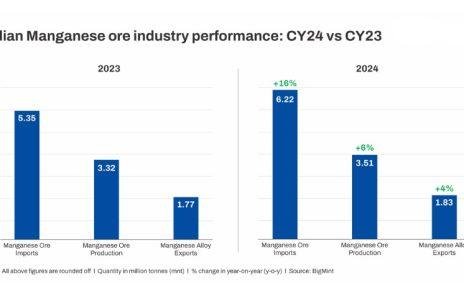

India’s leading manganese ore producer, MOIL, has announced new prices effective 1 November 2024. Grades above 44% will experience a 7% price reduction, while grades below 44%, including SMGR and fines, will be lowered by 1% m-o-m.

Factors impacting MOIL’s price revision

Imported ore prices drop m-o-m: Monthly average prices of South African manganese ore (Mn37%) inched down by 2% m-o-m to $3.86/dry metric tonne unit (dmtu) in October 2024 as against $3.93/dmtu in September. However, Australian-origin (46%) manganese ore prices stood at $4.64/dmtu in October as against $5.66/dmtu in September, down by 18% m-o-m. Meanwhile Gabonese (44%) ore was assessed at $4.3/dmtu, a decrease of 19% m-o-m. Uncertainties in alloy demand and supply constraints have played a key role in this reduction.

Global miners lower offers for Nov’24 shipments: Eramet has revised its 2024 targets for manganese activities in Gabon, reducing production estimates to 6-6.5 mnt (against 6.5-7 mnt previously) amid a significant drop in carbon steel output in China. This decline has led to oversupply, stemming from lower manganese ore purchases and higher low-grade ore supply from South Africa. Additionally, key miners like Eramet and South 32 have also reduced their offers for November shipments.

Indian silico manganese prices dip following early October surge: Monthly average prices of Indian silico manganese inched up by around INR 2,440/t ($29/t) in October, with prices of grade 60-14 rising by 4% m-o-m to settle at INR 68,980/t ($820/t) compared to INR 66,540/t ($791/t) exw-Raipur in September, as per data maintained with BigMint.

Silico manganese prices remained largely stable after a slight increase earlier last month, driven by improved steel prices backed by Chinese stimulus announcement. However, demand waned later in the month, leading to minimal trades. Manufacturers in various regions reduced production to manage rising input costs effectively.

Silico manganese export offers edge up m-o-m: Silico manganese (60-14) export prices witnessed a 4% m-o-m rise of $29/t to reach $841/t FOB in October compared to $812/t in September. Meanwhile, silico manganese (65-16) also inched up by 2% ($16/t) m-o-m to $930/t FOB India in October as against $914/t in September.

The Indian silico manganese export market has seen price stability this month, driven by cautious buying and limited demand domestically and internationally. Although there was a recent price increase, the market has stabilized, reflecting reduced trades at ports and few new export inquiries at higher rates.

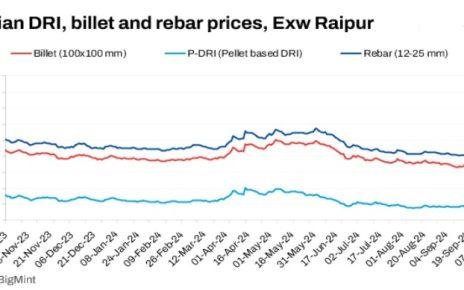

Billet prices inch up m-o-m: Domestic billet prices were largely stable, with a marginal hike of INR 2,300/t ($27/t) to INR 40,600/t ($483/t) exw-Raipur in October, up from INR 38,300/t ($456/t) in September. Buying activity in both semi-finished and finished steel segments remained moderate last month, initially supporting steel prices. This stability in demand also bolstered domestic billet offers contributing to overall market resilience.

Article Credit: Bigmint