- Market activities subdued due to Diwali

- Miners keep offers stable amid absence of trades

Odisha’s iron ore market remained stable this week as market participants took a break from trading activities due to the Diwali festivities. Iron ore prices stayed at last week’s levels, with minimal fluctuations observed as miners, traders, and buyers largely remained away from the market. Trades were mostly on hold, as buyers showed no interest in fresh deals, likely anticipating a post-festival adjustment period.

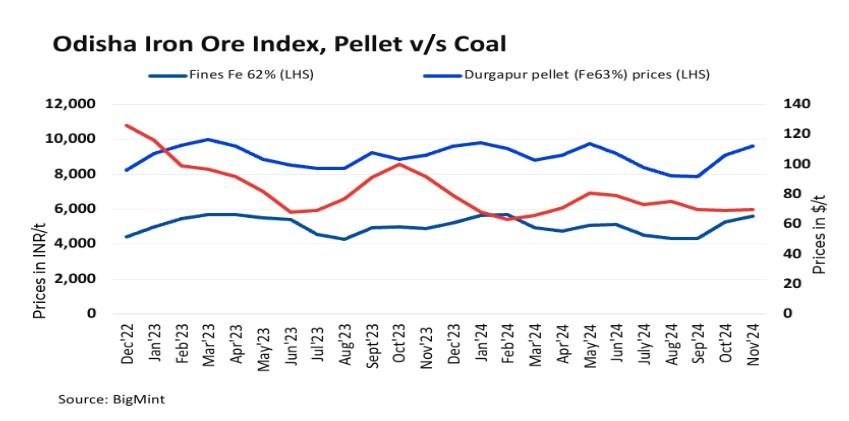

BigMint’s Odisha iron ore fines (Fe 62%) index remained stable w-o-w at INR 5,600/t ($67/t) ex-mines on 2 November 2024. No deals for higher grades were recorded this week amid muted market sentiments.

With the downstream steel market facing sluggish demand, several miners chose to maintain their previous offers, while some decided to temporarily pause their offers.

“The steel sector is currently facing challenges, mainly low demand, so we felt it was best to hold our prices for now. The holiday season has seen reduced market activity, and we expect the momentum to pick up only after Diwali.” a miner said.

A steelmaker based in the eastern region said, “The market needs time to stabilize. Right now, everyone is waiting to see how demand will look like in the coming weeks. We are looking for signs of recovery in the steel market before committing to new purchases.”

Rationale

- T1 – No deals of Fe 62% fines were recorded in the publishing window and was not considered for price computation and was given a 0% weightage for index calculation.

- T2 – BigMint received twelve (12) offers and indicative prices under T2 offers, indicative, and bids in this publishing window. Eight (8) were taken into consideration and given a 100% weightage. To check BigMint’s iron ore assessment, pricing methodology, and specification document, click here.

Market highlights

- Domestic pellet prices fall w-o-w: Pellet prices in the domestic and seaborne markets showed a mixed trend this week with fluctuations in the global iron ore fines index. Pellet (6-20 mm, Fe 62.5%) prices in Odisha’s Barbil fell by INR 350/t ($5/t) w-o-w to INR 8,600/t ($107/t) loaded to wagon. Pellet (Fe 62.5%, 6-20 mm) prices in Durgapur fell by INR 300/t ($5/t)w-o-w to INR 9,700/t ($115/t) exw on 2 November. BigMint’s India pellet (Fe 63%, 3% Al) export index (FOB east coast) increased by $4/t w-o-w to $98/t on 2 November.

- Fines export prices rise w-o-w: BigMint’s bi-weekly Indian low-grade iron ore fines (Fe 57%) export index increased by $4/tonne (t) w-o-w to $64/t FOB east coast, India, on 30 October 2024. After a considerable period, Indian sellers concluded some deals in the export market. Reportedly, an Odisha-based miner sold a 55,000-t cargo of iron fines (Fe 57%) at $78-79/t CFR China, but BigMint could not confirm this at the time of publication. Additionally, another Indian miner sold a cargo of iron fines (Fe 56-57%) at around $77-80/t CFR China this week.

- Sponge iron prices decline w-o-w: BigMint’s assessment of sponge iron C-DRI (FeM 80%) prices in Rourkela sharply fell by INR 1,100/t ($14/t) w-o-w at INR 26,800/t ($318/t) on 2 November. Meanwhile, steel billet (100*100 mm) offers in Rourkela decreased by INR 500/t ($6/t) w-o-w to INR 37,800/t ($449/t) today.

Outlook

Prices are expected to remain volatile in the coming days amid fluctuations in pellet and downstream steel prices. Trade activities may resume next week with the correction in iron ore offers by miners.

Article credit: Bigmint