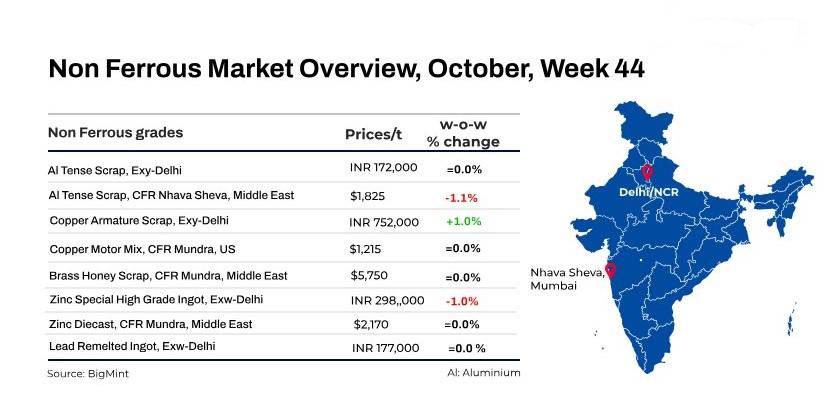

- Aluminium, zinc prices see slight decline

- Lead stable, copper tags show variations

At the close of trading, base metals prices on the London Metal Exchange (LME) showed negative trends, with lead recording the sharpest drop of 0.92% w-o-w. Meanwhile, LME warehouse stocks exhibited mixed trends, with nickel increasing by 11.27% w-o-w.

On the LME, three-month aluminium futures decreased by 0.46% w-o-w to $2,600/tonne (t), and nickel prices fell 5.64% w-o-w to $15,944/t. Copper prices were at $9,570/t, down 0.57% w-o-w, while zinc decreased by 0.65% w-o-w to $3,069/t. Lead fell by 0.92% w-o-w to $2,053/t.

Aluminium prices edge down

- Imported aluminium scrap prices in India remained largely stable, with a slight fall w-o-w, while LME aluminium remained range-bound at $2,500-2,600/t. Buying interest was weak due to Diwali festivities. Notably, imported aluminium tense stood at $1,825/t CFR Nhava Sheva this week compared to $1,845/t last week.

- BigMint’s benchmark assessments showed that tense scrap originating from the US was at $1,825/t, slightly lower by 1.1% w-o-w, and zorba 95/5 from the UK was at $2,070/t, slight drop by 1% both CFR west coast, India.

- The aluminium industry has urged the government to raise the basic customs duty on primary aluminium and aluminium scrap to prevent dumping in India, which is discouraging new investments in the sector. According to an industry body, India possesses all the elements necessary to become a global aluminium hub.

- Domestic spot prices of aluminium ADC12 alloyed ingots remained almost unchanged w-o-w in both the northern and southern regions of the country, pressured by weak demand and stable raw material costs. BigMint’s benchmark assessments for ADC12 (non-OEM) grade stood at INR 202,000/t in Delhi and INR 204,000/t in Chennai.

Copper shows mixed movements

- Domestic copper armature prices were assessed at INR 752,000/t ex-Delhi, a rise of 1% w-o-w, while imported scrap prices remained stable as compared to the previous week, with BigMint’s assessment indicating that the US-origin copper motor mix was at $1,215/t.

Zinc records slight drop

- Domestic zinc ingot prices stood at INR 298,000/t, down 1% w-o-w. Hindustan Zinc (HZL) raised zinc prices by INR 1,000/t ($12/t) to INR 314,100/t ($3,736/t).

Lead remains largely stable

- Domestic lead primary ingots stood at INR 190,000/t and remelted ingots at INR 177,000/t, stable compared to last week. Additionally, HZL’s lead prices stood at INR 203,700/t ($2,422/t) ex-Jodhpur, a drop of INR 500/t ($7/t).

Global updates

- Vietnam’s aluminium industry charts strategic path forward: The 2nd Congress of the Vietnam Aluminium Profile Association convened to set a transformative five-year agenda (2024-2029) for the country amid rapid sectoral growth. Despite doubling output to 1.3 mnt annually, Vietnam’s industry faces challenges such as reliance on imported raw aluminium, fluctuating global prices, and trade barriers. The association plans to focus on trade defence, aiming to bolster resilience and sustainable growth.

- Copper prices decline amid China’s stimulus concerns: Copper prices fell as China’s stimulus measures failed to alleviate demand worries. Despite a drop in Shanghai inventories and increased imports, concerns persist. Investors look toward a potential RMB 10 trillion stimulus at the upcoming National People’s Congress.

Article From: Bigmint