- Bid-offer mismatch, festive holidays keep Indian buyers away

- Pakistani mills cautiously optimistic amid monetary push

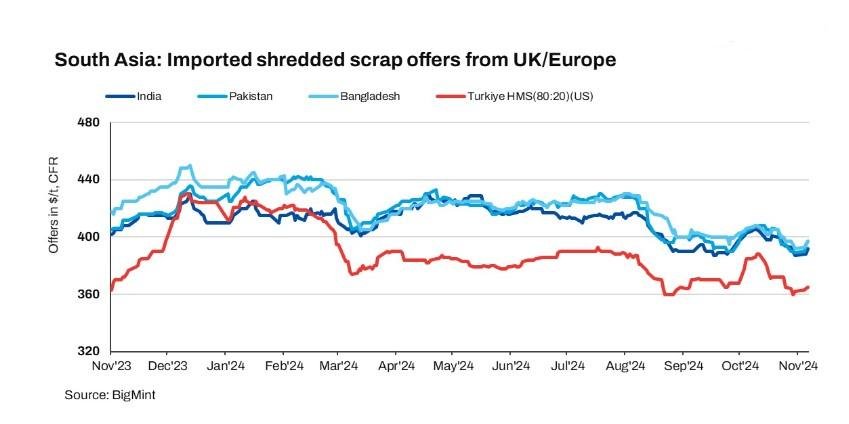

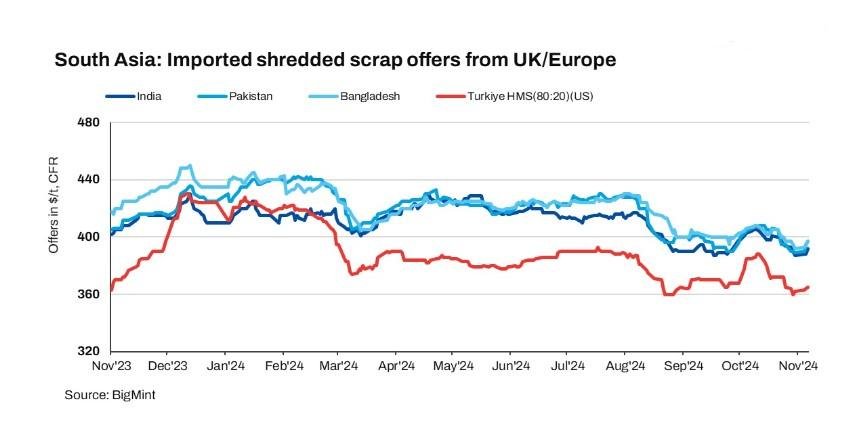

South Asian ferrous scrap offers witnessed a slight uptick despite limited buying interest across markets. In India, bid-offer mismatches and festivities put a brake on seaborne scrap activity, though recent steel price hikes hint at a possible rebound in demand.

Meanwhile, Pakistan’s imported scrap market showed slight gains amid limited local activity, bolstered by recent policy rate cuts and incremental steel price rise. Bangladesh remains quieter, as slow construction and high inventories keep scrap demand muted. In Turkiye, the market has stayed firm, supported by rising expectations for demand recovery post-US elections and potential Chinese stimulus.

Overview

India: Indian buyers remain cautious in the seaborne scrap market held back by bid-offer mismatches, weak buying interest, and slowed activity due to regional festivities. However, recent price hikes by primary Indian steel producers have raised hopes for demand recovery, which could uplift prices and scrap consumption in the secondary sector. Indicative offers for UK/European shredded scrap inched up today to $390-395/t CFR Nhava Sheva, while buyers kept their price ideas closer to $385/t CFR. HMS (80:20) offers also rose slightly to $370-375/t CFR, with buyer expectations at around $365-370/t CFR.

BigMint’s domestic end-cutting scrap index, tracking the Mandi Gobindgarh market, rose by INR 300/t d-o-d to INR 36,200/t ($429/t) DAP on 6 November. Most steel mills maintained stable production, operating at 90-100% with regular scrap purchases, while medium-sized mills ran at below 80% capacity. The current steel production charge mix comprises 80-85% scrap, complemented by sponge iron.

Pakistan: Pakistan’s imported scrap market showed slight gains, with UK-origin shredded offers up $2/t to $397/t CFR Qasim, although buyer activity was limited amid a subdued domestic market. Local rebar prices rose recently, reaching PKR 250,500-252,000/t, and the State Bank’s policy rate cut has stirred cautious optimism for a demand recovery.

Market sources reported shredded offers between $390-400/t CFR, with some trades concluded at $390-395/t. The recent price adjustments and policy measures, including the IMF program support, are expected to stabilise the market, while rising remittances may bolster import activity. Although trade remained light, steelmakers are hopeful that these economic boosts will lift demand, especially in the construction sector, in the coming days.

Bangladesh: Bangladesh’s imported scrap market was quiet today, with demand remaining low and no bulk deals seen over the past two months. Containerised offers faced a $10-15/t gap between buyer and seller expectations, with shredded scrap from Australia/USA priced at $400-405/t CFR Chattogram and busheling at $405-410/t CFR. Construction activity remains slow, and high inventories are further dampening buying interest.

Recent rebar price cuts of BDT 2,000/t by major mills, along with additional discounts, have caused buyers to delay purchases in anticipation of further price drops.

Turkiye: The Turkish imported scrap market remained firm, supported by recent price increases and hopeful expectations for post-US election and Chinese stimulus-driven demand. However, no new offers for premium HMS (80:20) emerged, and activity stayed quiet. North American sellers pegged HMS (80:20) at $370/t CFR, while EU-origin offers ranged around $362-363/t CFR. A few Turkish mills were looking for deepsea cargoes, especially from the EU, for December shipments. Rising Benelux collection costs also lent some support. The market saw $365/t CFR as a near-term benchmark, with Turkish HMS (80:20) from the US assessed at $365/t, up by $1 d-o-d.

Price assessments

India: UK-origin shredded indicatives rose by $4/t d-o-d to $392/t CFR Nhava Sheva.

Pakistan: UK-origin shredded indicatives edged up by $2/t d-o-d to $397/t CFR Qasim.

Bangladesh: UK-origin shredded prices stood at $397/t CFR Chattogram, up $2/t d-o-d.

Turkiye: US-origin HMS (80:20) bulk prices inched up by $1/t at $365/t CFR Turkiye compared to yesterday.

Article credit: Bigmint