- Imported scrap offers follow global cues

- Major steel mills cut rebar prices

- Bangladesh Bank lifts restrictions on LC openings for 6 banks

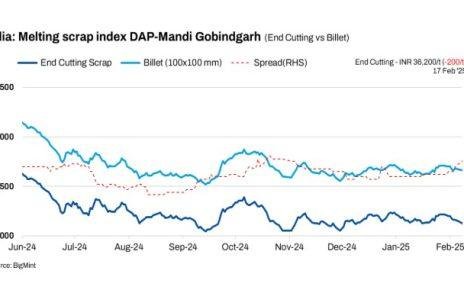

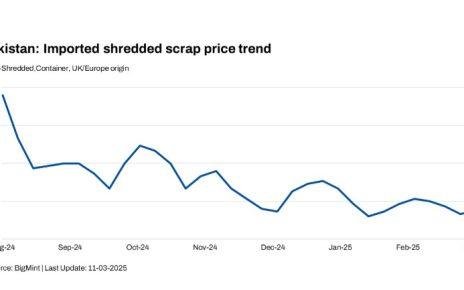

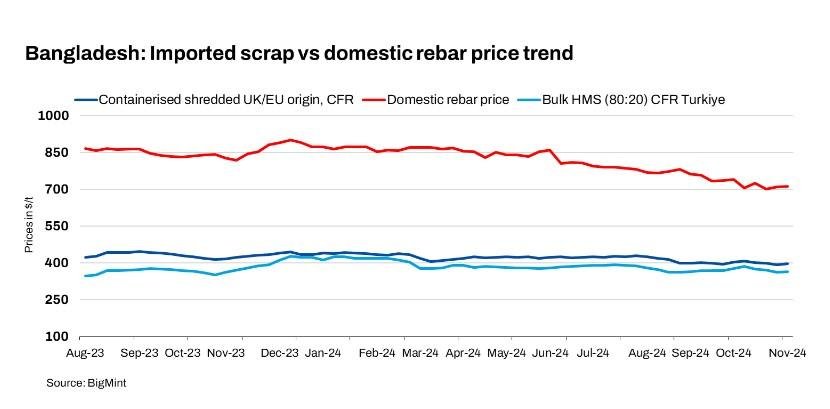

In Bangladesh, UK-origin shredded scrap prices rose following global cues despite sluggish demand, LC constraints, and construction delays impacting the market.

European HMS (80:20) was offered, while the containerised scrap market stayed quiet as major buyers favoured smaller deals. US bulk offers remained largely unviable.

Market comments

- As per a major steel mill based in Dhaka, Bangladesh’s scrap demand remains low, with no bulk deals seen in two months and a $10-15/t gap between offers and bids in containers. Shredded is offered at $400-405/t, busheling at $405-410/t, but high inventories keep buyers cautious. Limited demand improvement is expected in winter as construction remains slow.

- As per another Chattogram-based steel mill representative, long steel demand is unlikely to rise significantly in the coming months, though predictions remain uncertain. HMS prices from Europe are at $380-385/t, with shredded at $395/t. “We are currently opting for small bulk shipments from nearby regions, as US bulk offers remain unfeasible above $390/t,” he said.

- “Bulk bookings have surprisingly increased after the July-August political disturbances. Despite a bearish market and 40-50% production cuts, major players like KSRM, BSRM, and AKS have capitalised on falling prices, purchasing scrap to build stock. Their financial strength allows them to maintain high inventories, driving the rise in bulk scrap volumes amid ongoing instability,” said a representative of a major trading house.

BigMint’s weekly assessments

- Europe-origin containerised shredded scrap rise by $5/t w-o-w to $397/t, while HMS (80:20) prices increased $4/t to $384/t.

- US-origin HMS (80:20) bulk prices rose by $2/t to $380/t.

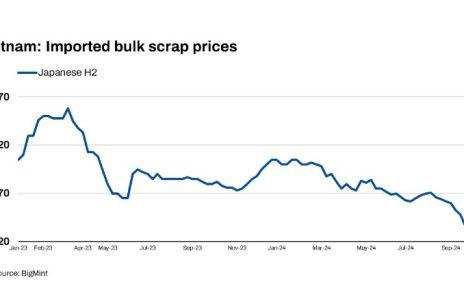

- Japan-origin H2 bulk prices rose by $1/t w-o-w to $370/t CFR Chattogram.

Around 2,500t of HMS (80:20) from Australia sold at $370-372/t, and 500 t of GI bundle from the Philippines sold at $350/t on a CFR Chattogram basis.

Domestic market

Major rebar producers like BSRM and AKS recently reduced rebar prices by BDT 2,000/t ($17/t) and are offering special discounts, leading buyers to delay bookings in hopes of further price drops.

Dhaka-based producers have kept their rebar prices at BDT 81,500/t ($681/t) exw with quantity and cash discounts available. Chattogram-based producers and BSRM rebar prices range from BDT 85,000-86,000/t ($710-719/t), and local scrap is at BDT 51,000-52,000/t ($426-435/t) exy-Chattogram.

Bangladesh’s ship recycling market showed a slight uptick this week with cautious buyer activity, despite weak sentiment and prices nearing $450/LDT. Notable sales included the Armada Sejati (3,322 LDT) at $470/LDT and Fatma Sari (8,012 LDT) at $488/LDT, including quality premiums. Local recyclers remained uncompetitive due to stagnant steel prices and a depreciating taka (BDT 119.99). With a lowered GDP forecast and ongoing political instability, significant market improvements are unlikely. Total tonnage received at Chattogram Port rose to 18,860 LDT, up from 12,141 LDT last week.

Bangladesh Bank (BB) has decided to lift restrictions on opening letters of credit (LCs) for six troubled banks, a measure imposed in August that required a 100% margin. The decision followed a meeting with BB officials, including Governor Ahsan H Mansur, and representatives from Bangladesh Commerce Bank, Padma Bank, Union Bank, Social Islami Bank, First Security Islami Bank, and ICB Islami Bank.

The banks also requested expedited liquidity support via the inter-bank money market and lower profit rates, citing challenges amid deposit withdrawal pressures. However, BB officials stated that profit rates were market-driven and would not be regulated. A senior bank official noted that incremental liquidity support was inadequate for urgent cash flow needs, calling for more immediate, bulk assistance.

Adani Power has halved its supply to Bangladesh due to unpaid dues of $846 million, leading to a 1,600 MW power shortfall. This disruption is severely impacting industries, especially manufacturing and textiles, which rely on stable electricity. The ongoing dollar shortage further hampers Bangladesh’s ability to settle energy payments, worsening the economic strain and causing setbacks in industrial production and exports.

Outlook: Several government projects, including the recently approved metro rail and the elevated expressway extension, may support long and structural steel demand in the coming months. However, the near-term outlook remains subdued due to low construction activity. While LC restrictions are expected to ease following Bangladesh Bank’s recent decision, their impact on demand is unlikely to be significant this year.

Article credit Bigmint