- India’s ore demand outstrips domestic supply

- H1 crude steel output rises, supports ore imports

- Smelters restock ahead of likely demand up-cycle

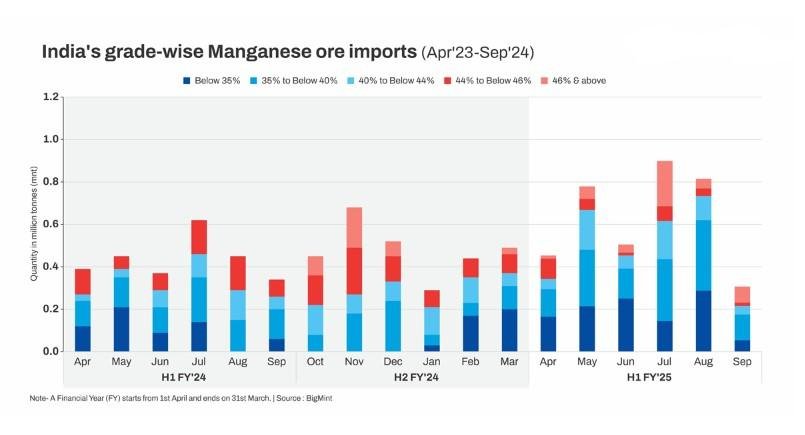

Morning Brief: India’s manganese ore imports increased a sizeable 44% y-o-y in April-September of the current fiscal year (H1FY’25) to 3.76 million tonnes (mnt) against 2.62 mnt recorded in the corresponding period last year (CPLY).

South Africa continued to remain the largest source of imports at 2.16 mnt (up 38% y-o-y) followed by Gabon, but volumes from the latter were down 38% at 0.86 mnt (1.38mnt). Gabon exports high-grade manganese ore required in the production of superior quality manganese alloys, which India mainly exports to Europe, Middle East & North Africa (MENA) and the US.

Grade-wise break-up

Lower grade ores sustain uptrend: Notably, imports of manganese ore grades below 35% sustained the uptrend being seen for some time, rising a whopping 80% y-o-y growth at 1.12 million tonnes (mnt) in H1FY’25 compared to 0.62 mnt in CPLY. A focus on cost-containment amid volatile global manganese ore pricing possibly drove this increase.

The 35-below 40% grade also saw a sizeable 46% y-o-y increase to 1.28 mnt.

Higher grade imports rise: Interestingly, the 46% and above also saw 0.44 mnt coming into India in H1 against nil in CPLY. That apart, imports of the 40-44% range experienced a substantial 37% y-o-y increase to 0.63 mnt in H1 F’25 from 0.46 mnt in CPLY.

Mid-range sees decline: However, the 44-45% range witnessed a 57% decline to 0.28 mnt from 0.66 mnt in CPLY, suggesting a potential shift in buying strategies. The availability of domestic manganese ores of similar grades led to a decreased reliance on mid-range imports.

Factors that increased manganese ore imports in H1FY’25

Domestic ore production rises, but supply gap persists: Domestic manganese ore production experienced a y-o-y increase of 16% during April-September 2024 to 1.85 mnt compared to 1.60 mnt seen in CPLY. This uptick can be attributed to increased output from both MOIL and local miners. However, it is important to note, this production level still falls short of meeting India’s annual manganese ore demand, which is estimated at 8.5-9 mnt, leaving the door ajar for imports.

Manganese alloys production sees significant growth: India’s manganese alloys production witnessed a substantial increase of 43% y-o-y in H1FY’25 at over 3mnt. This growth highlights the increasing demand for manganese alloys across industries, including steel, and in other metallurgical applications.

India’s H1 crude steel production up: India’s production of crude steel increased by around 4% y-o-y in H1FY’25 to 73 mnt as against 70-odd mnt in the year-ago period. BigMint data reveals that the share of BF-BoF in H1FY’25 increased to 43% from 41% in H1FY’24, underscoring the higher need for manganese alloys. The latter is required in the BF-BoF route of steel-making as a hardening and purifying agent amongst others.

Smelters stock up ahead of peak demand season: Indian smelters proactively increased their manganese ore inventories in anticipation of a surge in demand in the upcoming peak steel demand season which generally spans from October till March of next year. This strategic move aims to ensure a steady supply of raw materials and avoid potential supply disruptions, especially during the rains seen in southern India during this period as well as festivals. By securing sufficient inventory, smelters are well-prepared to meet the anticipated increase in steel production and subsequent rise in demand for manganese alloys. This proactive approach demonstrates the industry’s focus on supply chain resilience and its commitment to meeting the evolving needs of the steel sector.

Global price drop favour imports: Imported manganese ore prices saw a steep drop since June.For instance, South African lump ore of 37% Mn content, averaged $4.98/dmtu on CNF basis over April-September 2024, which translates into $184/t CNF ($4.98×37).MOIL’s prices, on the other hand, excluding taxes, averaged INR 17,733/t or $211/t in dollar parity. Thus, the lower prices of imported ore were more attractive to smelters, driving them to stock up on the same ahead of the demand up-cycle.

Cyclone incites panic buying of high-grade ore: High grade manganese ore was in short supply because of frenzied Chinese inquiries for the Gabonese grades after supplies from Australia-based mining major South32 were disrupted due to extensive damage to infrastructure from cyclone Meghan in the last week of March 2024. This led to panic buying by Indian smelters in a bid to secure inventory. Also, smelters were anticipating a resumption in European buying after the winter vacation and wanted to be well-prepared to catch this demand uptick.

Outlook

Subdued demand for manganese alloys, both domestically and internationally, will influence the pace of imports of the ore into India. However, smelters in India are maintaining sufficient inventory levels to meet current and near-term demand. This strategic approach, coupled with the ongoing production adjustments by major producers, will likely keep the market stable.

Potential production cuts by global miners may support prices which are expected to remain stable.

Article credit Bigmint