- Pellet inventories at Chinese ports decline

- Portside prices in China edge lower

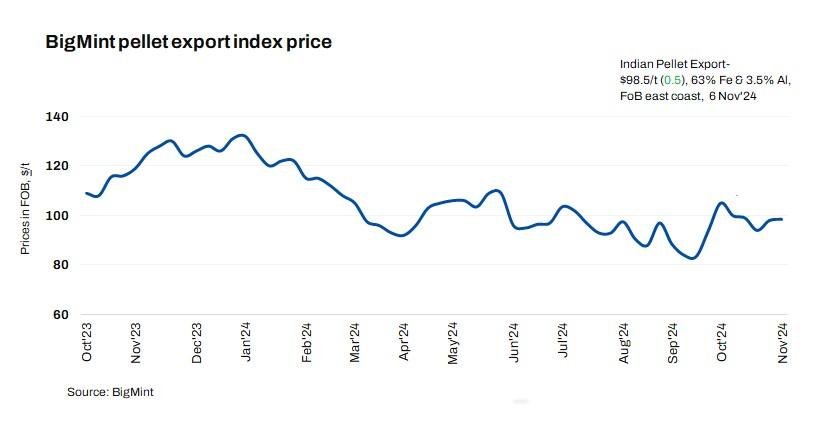

BigMint’s India pellet (Fe 63%, 3% Al) export index (FOB east coast) remained largely stable w-o-w at $98.5/t on 6 November 2024. No export deal was heard concluded so far in this publishing window.

The stability in pellet export prices is further reinforced by the inability of Chinese buyers to match the competitive prices offered by domestic Indian sellers. This domestic advantage has shifted Indian suppliers’ focus toward local markets, reducing the urgency to push exports and stabilizing prices in the seaborne market.

According to reports, pellet liquidity remains subdued, with limited inquiries in the seaborne market. Although some Chinese mills are purchasing spot cargoes to replenish low inventories, the utilization rates of pellets in blast furnaces continue to be relatively low.

Pellet inventories at Chinese ports have been steadily declining, primarily due to limited supply in the seaborne market. This trend reflects ongoing constraints impacting the availability of pellets for import.

Rationale:

- No pellet export deal was recorded in the last one week and was not taken under price calculations. Hence these were accorded 0% weightage in the index calculation Click here for detailed methodology.

- Nine (9) indicative prices were received and seven(6) were considered for calculation of the index and given a 100% weightage.

Factors impacting pellet exports

- Iron ore fines prices rise by $3/t w-o-w: The benchmark iron ore fines index increased by $3/t w-o-w to $96/t CFR China on 5 November. Prices were supported by optimistic market sentiment driven by expectations of potential macroeconomic stimulus announcements from the ongoing Chinese National People’s Congress meeting. This anticipated policy support has spurred increased trading activity and buying interest, particularly for medium-grade fines, reflecting positive outlook on economic measures that could bolster demand.

- DCE futures remain largely stable w-o-w: Iron ore futures on the Dalian Commodity Exchange (DCE) for the January 2025 contract inched down by RMB 4/t ($1/t) w-o-w to RMB 781.5/t ($109/t) on 6 November. On a d-o-d basis, futures prices fell by RMB 10/t against RMB 791/t ($110/t) yesterday.

- Portside pellet prices in China drop w-o-w: Chinese sources said that Qingdao portside offers for Indian pellets (Fe 63.5%) decreased by RMB 10/t ($1/t) w-o-w to RMB 905/t ($126/t) on 6 November, inclusive of all import taxes and port charges. Meanwhile, prices recorded a fall of RMB 10/t ($1/t) d-o-d.

- Pellet inventories at Chinese ports fall w-o-w: Pellet inventories at China’s major ports fell by 0.3 mnt to 5.3 mnt on 31 October, 2024 compared to last week, according to SteelHome data.

Outlook

According to BigMint, prices are likely to remains stable, with limited upward momentum due to higher domestic subdued international demand.

Article credit Bigmint