- Bangladesh’s competitive pricing weighs on India

- Pakistan battles economic instability, ship shortages

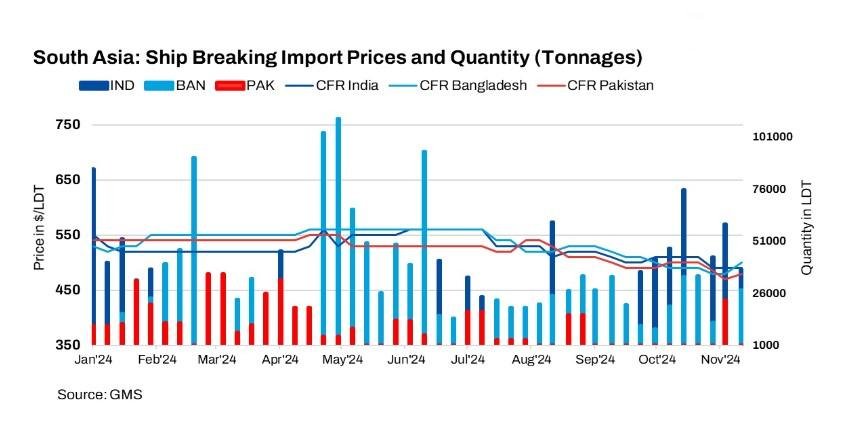

This week, the South Asia ship recycling markets showed mixed trends. India’s market slowed due to a scarcity of tonnage and competition from Bangladesh, which surpassed India in vessel pricing. Pakistan’s market struggled, with nil activity at Gadani, hindered by economic instability and a dollar shortage. Meanwhile, Bangladesh showed signs of recovery, with several Panamax bulkers sold at higher prices, helping it surpass India in market rankings.

India’s activity declines amid competition from Bangladesh

India’s ship recycling market saw a decline in activity after several weeks of higher-than-expected sales. The market slowed down as Bangladesh surpassed India in vessel pricing ($500/LDT CFR in Bangladesh as compared to $490/LDT CFR in India for containers). The ongoing shortage of available ships has contributed to one of the slowest recycling years in Alang over the past decade.

The Indian economy remains unstable, with the Indian rupee falling to a record low against the US dollar and inflation at 5.35%. Additionally, the Reserve Bank of India has delayed interest rate cuts to control spending.

Although local steel prices remain low, influenced by fluctuations in Chinese steel prices, the ongoing competition from Chinese imports continues to pressure India’s domestic steel sector, making it challenging for ship recyclers.

Despite this, Alang was the busiest ship recycling hub globally in recent weeks, with a steady flow of HKC-compliant ships observed. The fourth quarter is starting to see a pick-up in activity, with smaller feeder containers and bulkers expected, suggesting a busier end to the year.

The total tonnage received at Alang Port this week was 37,052 light displacement tonnage (LDT). In the previous week, 59,043 LDT were received.

Pakistan hampered by US dollar shortage

Pakistan’s ship recycling market struggled this week, with nil activity at Gadani. The country has remained largely on the sidelines in recent times due to low demand and limited supply of ships, making it the weakest among all ship recycling markets in the Indian subcontinent.

The instability in Pakistan’s economy contributed to the slowdown, with the Pakistani rupee falling significantly. Local steel prices are also under pressure due to competition from cheaper Chinese imports. These challenges have made it harder for ship recyclers to operate effectively.

Additionally, Pakistan faces a severe shortage of US dollars. While remittances have eased some external debt, the lack of available ships and economic instability have hindered the ship recycling industry. As a result, Gadani’s market continues to struggle, with no new ships expected for the rest of 2024.

Notably, no tonnage was received at Gadani Port this week. In the previous one, 22,746 LDT were received.

Bangladesh market recovers amid limited ship supply

Bangladesh’s ship recycling market showed signs of recovery this week, with several Panamax bulkers sold at around $470/LDT. This boost in activity helped Bangladesh surpass India in market rankings, although the overall market remained slow due to a shortage of available ships.

Despite the recent uptick, Bangladesh’s economy faced challenges such as inflation, political instability, and high unemployment. Steel prices remained weak at $528/LDT, and the Bangladeshi taka hit a record low against the US dollar. With US dollar reserves shrinking and the government limiting letter of credit (LC) issuances, only a few buyers could secure ships.

The total tonnage received at the Chattogram Port this week rose to 27,420 LDT compared to 18,860 LDT in the previous week.

Article Credit: Bigmint