- Trump eyes reduced reliance on Chinese imports

- US election may impact China steel prices

- China unveils measures to curb tariff challenges

Morning Brief: The new US President-elect played a skilled and winning hand, flashing out his trump card of “MAGA”-Making America Great Again”. Waiting and watching was China, yet another country amongst the most powerful in the global trade arena, apprehending a new US tariff regime in which it could be the worst hit. China has reasons to be worried since its economic growth has been slowing and may not achieve the targeted 5% while overseas trade has been adding balm to ailing home demand.

In fact, Barclays projected that “a Trump presidency could force China into drastic measures“.

China’s counter offensive?

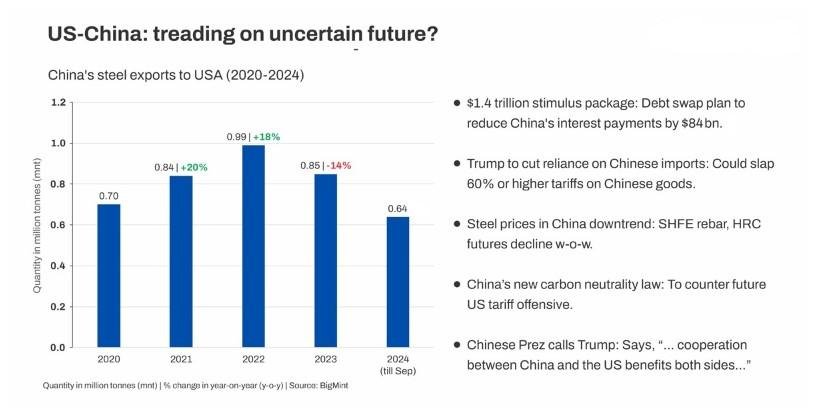

One of which-came close on the heels of the US elections. Approval to a $1.4 trillion stimulus package was given by China’s top legislative body, the National People’s Congress, on 8 November, which many deem as a security measures against future Trump tariff threats. Amongst these, the debt swap plan, spread over three years, will help reduce China’s interest payments by RMB 600 billion ($84 billion) over five years, freeing up resources for development.

That apart, China has been readying security measures from earlier in the year. In April 2024, it passed a New Tariff Law formalising norms for imposing anti-dumping and counter-tariffs on imports.

Further fiscal measures are expected next year, possibly after Trump assumes office.

On November 7, 2024, President Xi Jinping called Donald Trump to congratulate him on his election as President of the United States. Xi noted: “History teaches us that cooperation between China and the US benefits both sides, while conflict harms both. A stable, healthy, and sustainable China-US relationship aligns with the common interests of both countries and the expectations of the international community.”

How will the Trump Administration likely impact China?

Pledge to reduce reliance on China: Trade, which also includes metals, is the most critical component of the US-China policy agenda. Both the Republicans and Democrats intrinsically believe, Uncle Sam needs to reduce its trade deficit with China and chip away at its imports reliance on the dragon too. President Trump, during his first tenure, had initiated a trade war with China in 2018, imposing tariffs of up to 25% on a range of Chinese goods under Section 301 of the Trade Act of 1974. President Biden not only maintained these but also increased or introduced new duties on strategically important goods.

A key aim of Trump’s “America First” protectionist trade strategy is to bring back manufacturing jobs to the US that have been lost to overseas competitors-particularly China. Trump has pledged to “end reliance on China” by adopting a range of trade barriers, of which the most extreme is revoking China’s most-favoured national (MFN) status, which would allow the US to subject it to discriminatory and unilateral trade tariffs and could include suggested 60% or higher blanket tariffs on Chinese goods. In fact, Trump has pledged to adopt a four-year plan to “phase out all Chinese imports of essential goods“, including “everything from electronics to steel to pharmaceuticals“.

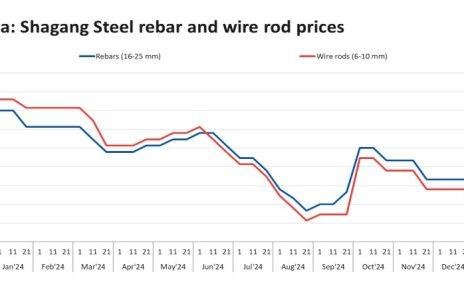

Will Chinese steel prices downtrend? China’s steel prices may face greater downward pressure, and domestic steel manufacturers may encounter more serious losses than this year, feels a Chinese analyst. This is because Trump will take more radical measures against China, he feels. Although only a small part of steel products is shipped directly to the United States, the impact on China’s direct steel exports is relatively small, but Trump may increase tariffs on major downstream steel imports from China, such as construction machinery, home appliances, new energy vehicles and other products. In a knee-jerk reaction to US elections, BigMint’s data shows, SHFE rebar futures have been falling steadily on the week from RMB 3,364/t ($468/t) on 2 November to RMB 3,343/t ($465/t) on 9 November and till 11 November, there was a perceptible downtrend. SHFE HRC futures too fell from RMB 3,530/t ($491/t) to RMB 3,515/t ($489/t) and has declined further till date.

It is well-known that China’s domestic steel demand has nosedived since the collapse of its once-mighty property construction sector, resulting in huge losses for its mills. Over January-September, the total profit of Chinese steel mills touched RMB 29.18 billion ($4.05 billion), a y-o-y decrease of 56%. In contrast, steel export volumes were relatively good, ending 2023 with above 90 million tonnes (mnt) while 2024 is expected to end with a growth of over 20%, even though export values have been drastically declining. For instance, the average offers for HRCs in January-October 2024 have shown a decline of almost 13% y-o-y.

It may be recalled, in March 2018, President Trump had slapped a 25% tariff on steel and 10% on aluminium imports. Subsequently, in May 2024 President Biden had announced additional tariffs on a variety of Chinese imported products, including semiconductors, batteries, solar cells and steel, among which the tariffs on steel and aluminium products were increased from 0-17% to 25%. In September, the United States Trade Representative announced the final Section 301 tariff increases of 25%-100% on imports from China on a plethora of products, including electric vehicles, steel and aluminium. The US administration feels their country is suffering from unfair competition from China’s overcapacity in both commodities.

“China’s steel exports to the United States have been on a downward trend in recent years. Currently, direct exports to the United States account for a small proportion of the country’s total exports, probably less than 1%,”said a source. In 2023, China’s total steel exports to the United States were only 0.85 mnt in the total amount of over 90 mnt. The United States is also imposing restrictions on the alloy content of imported steel products, and exports will be banned if the requirements are not met. Others in China feel the newly elected US President may also put pressure on his allies in the future to increase tariffs or impose anti-dumping duties on Chinese steel products, which will weaken demand for the same.

Key metals slide: Right after the election results, prospects of industrial metals appeared bleaker than for energy commodities. London copper contracts slumped 4.1% on Wednesday, ending at $9,343/t, the weakest close in nearly two months. China is the world’s largest buyer of copper and iron ore. Singapore iron ore futures fared somewhat better, but still ended down 1.2% at $104.16/t, while zinc contracts in London dropped 4.2% to $2,973/t. Iron ore is the key steel-making raw material, while zinc is mainly used in galvanising. Both are heavily exposed to China, and therefore face the prospect of lower demand if exports from the world’s second-biggest economy are hit by Trump’s planned tariffs. This may lead to a likely slowdown and re-ordering of global trade.

China’s new carbon neutrality law to fight tariff curbs? China has stepped on the accelerator to clean up its polluting industries after some post-Covid setbacks. On 8 November, it not only renewed its pledge to decarbonise the economy by 2060, but passed a new energy law to “promote… carbon neutrality” which would “actively and steadily promote carbon peaking and carbon neutrality“.

The law was formulated to “promote high-quality energy development, and ensure national energy security.” Many analysts feel, China’s green stimulus support will need to evolve further, to accommodate any tariff curb that may be placed by the Trump 2.0 administration.

Outlook

The President-elect came up trumps with his highly protectionist poll pledge, which might have far-reaching ramifications on global trade, especially with China. On the other hand, there is bound to be some retaliation. Trump’s vow to impose 60% duties on imports from China, raises concerns that Beijing will retaliate by reducing imports of US farm products. A source in China said, to cope with possible further tariff increases, Chinese steel mills may increase exports in the short term, but the negative impact on exports in the medium-to-long term will be greater. Of course, it needs to be seen, to what extent, Trump will implement his election rhetoric.

A tough tariff regime could have an overall downside risk for commodities.

Credit: Bigmint