- Steelmakers’ coke demand low amid maintenance work

- Mills likely to require another round of price cuts soon

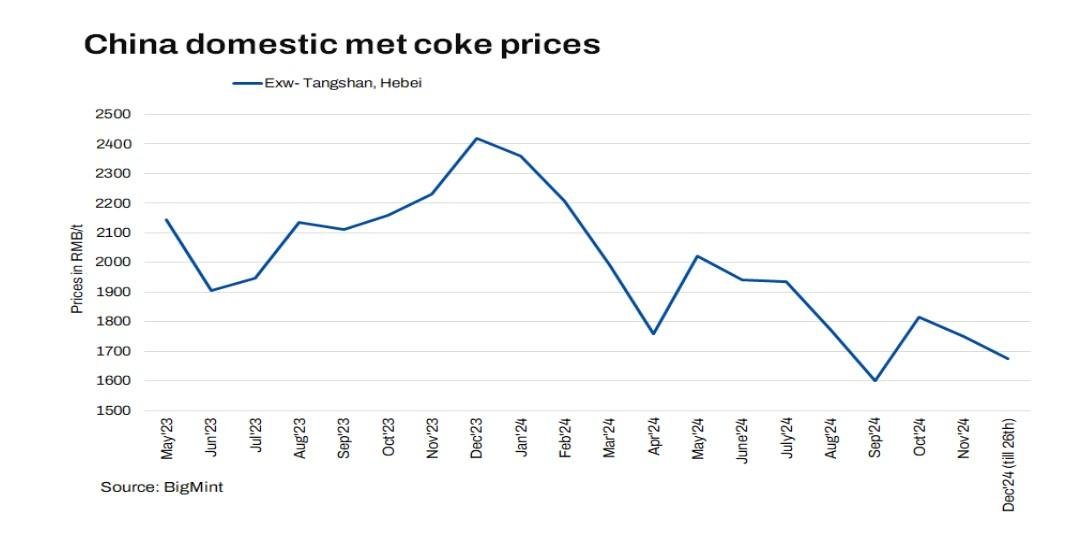

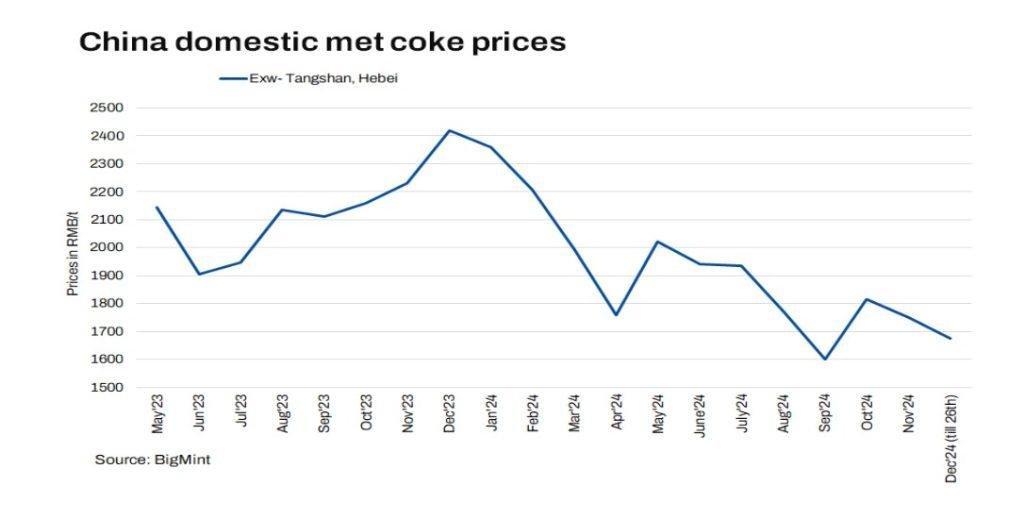

Mysteel Global: The Chinese metallurgical coke market showed signs of weakening on 24 December, as downside pressures came from stable coke supply, steelmakers’ waning demand for the material, and declines in coal prices.

“Under these circumstances, China’s coke market is expected to lose ground in the near term, with domestic steel mills likely to require another round of coke price cuts soon,” a Shanghai-based analyst said.

On Tuesday, China’s national composite coke price under Mysteel’s assessment was stable d-o-d at RMB 1,660.4/tonne (t) ($227/t), including 13% VAT.

Domestic coking coal prices have headed lower so far this week, which has reduced costs and enabled coke producers to enjoy some profits on coke sales. As such, most coke plants maintained stable operational rates recently, suggesting a steady supply of this steelmaking material in the near term and allowing mills to shun stockpiling the material, Mysteel Global learnt from sources.

For coke producers in North China’s Shanxi province, for example, their profits came in at RMB 31/t and RMB 79/t on Tuesday for selling wet-quenching and dry-quenching quasi-first-grade met coke, respectively, with earnings from main by-products also included. Both amounts were higher by RMB 7/t d-o-d, respectively, Mysteel’s survey showed.

On the demand side, some domestic steel producers have started their maintenance work with the year-end approaching, and they only purchased enough coke to feed their steelmaking facilities, according to market sources.

China’s portside coke market stayed cool on Tuesday as domestic coastal buyers were cautious in placing additional orders, sources shared.

At Rizhao and Qingdao ports in East China’s Shandong province, coke stocks totalled 1.18 million tonnes (mnt) as of Wednesday morning, up by 35,000 t w-o-w, Mysteel’s tracking data show.

Note: This article has been written in accordance with a content exchange agreement between Mysteel Global and BigMint.

Article From Bigmint