- India’s offers to Europe stable w-o-w

- Chinese offers to the ME unchanged

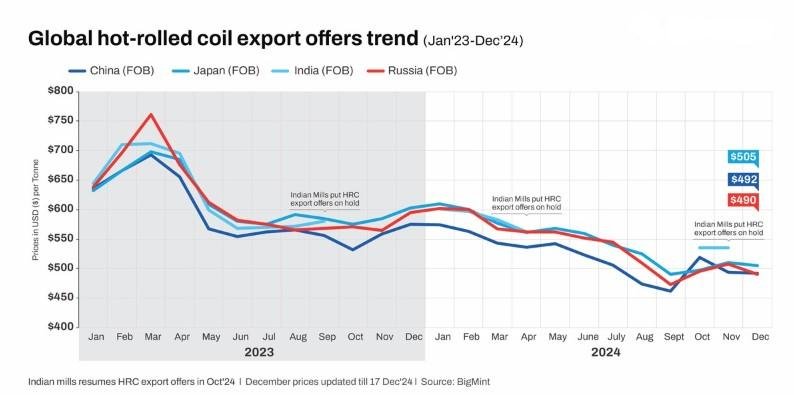

Indian hot-rolled coil (HRC) export offers to the Middle East (ME) witnessed a w-o-w decline as regional trading activity ground to a near halt ahead of the upcoming New Year holidays, according to sources based in the ME. The significant slowdown in trading activity was largely attributed to buyers adopting a cautious approach, opting to postpone procurement decisions until after the holiday period.

Meanwhile, the European market also experienced subdued trading activity, with many market participants already absent due to the approaching holiday season. The dwindling market engagement in both regions resulted in a relatively quiet trading environment, with prices reflecting lack of demand.

Market updates

1. India’s offers to ME drop w-o-w: Indian HRC export offers to the Middle East remained dropped w-o-w to $535-540/tonne (t) CFR UAE against $540-545/t, a week ago. Slow demand led to limited trade activities in the region, sources informed BigMint. However, competitive Chinese offers remain a concern. Chinese HRC export offers to the ME remained stable w-o-w to $515-520/t.

2. India’s offers to Europe stable w-o-w: India’s HRC export offers to Europe remained steady w-o-w at $590-595/t CFR Antwerp ($540-545/t FOB east coast India) for S275, 3mm material. However, European buyers refrained from booking imports due to the ongoing holiday season, as well as pending anti-dumping investigations and extended lead times, which further subdued trading activity in the region.

3. China’s offers to Vietnam fall w-o-w: China’s HRC (SAE1006) export offers to Vietnam dropped by $5/t w-o-w to $495-500/t CFR Ho Chi Minh City (HCMC) amid volatility in Shanghai Futures Exchange (SHFE) prices. Futures remained largly stable w-o-w at RMB 3,421/t ($469/t) on 30 December against 3,417/t ($468/t) on 24 December.

Outlook

The global HRC market is anticipated to experience a period of subdued activity in the short term, primarily due to the upcoming holiday season. Key regions, including the Middle East and Europe, are expected to witness muted trading activity as market participants observe the holidays, resulting in reduced engagement and limited transactional flow.

Article From Bigmint