- Exports to China plunge by 52% m-o-m

- Australian coal prices drop $5/t m-o-m

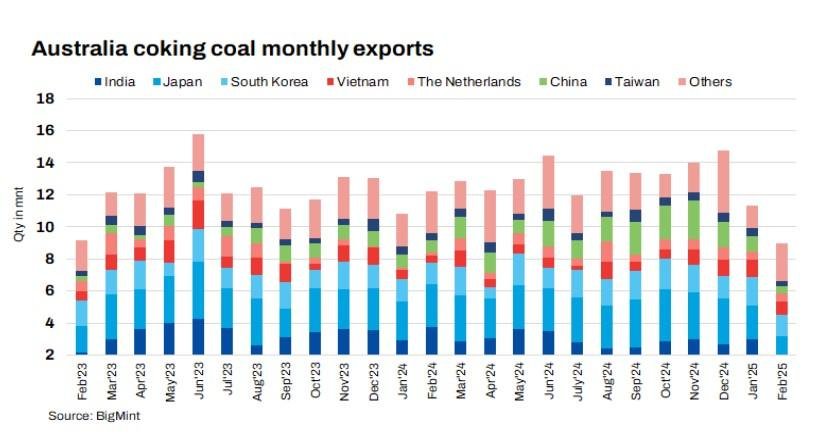

Australia’s coking coal exports experienced a significant 21% m-o-m decline in February 2025, with total shipments at 8.99 million tonnes (mnt) against 11.33 mnt in January. Meanwhile, exports dropped by a sharper 27% from 12.24 mnt in February 2024.

A key driver behind the reduced exports appears to be limited allocations from major coal miners at the end of the year, which led to a slowdown in shipments during February.

Exports to key markets drop

Exports to key markets such as India, China, Taiwan, and South Korea saw notable declines. Shipments to India fell by 45% to 1.63 mnt in February from 2.98 mnt in January. Exports to China saw a steeper drop of 52%, to 0.48 mnt from 0.98 mnt. Shipments to Taiwan decreased by 43%, to 0.27 mnt from 0.47 mnt, while exports to South Korea saw a more moderate decline of 28%, to 1.31 mnt from 1.82 mnt.

Port performance declines across board

Australia’s coal terminals also reflected this downturn, with most ports seeing a drop in export activity. Dalrymple Bay Coal Terminal (DBCT) experienced a sharp 36% decline in shipments, to 2.40 mnt. Shipments from Gladstone Port decreased by 4%, totalling 3.39 mnt, while Hay Point Port saw a modest 1% drop to 2.12 mnt. Abbot Point Port recorded a substantial 44% fall, with exports shrinking to just 0.7 mnt. Port Kembla saw a 30% decline, handling 0.32 mnt, and Newcastle Port experienced a dramatic 72% decrease to a mere 0.07 mnt.

Prices edge down m-o-m

On the pricing front, Australian coking coal saw a slight drop of $5/t m-o-m in February, with the monthly average at $188/t FOB. This price decline reflects the broader slowdown in global coal exports and lower demand, driven by falling steel tags and uncertain economic conditions.

Outlook

Australia’s coal industry is on high alert as Cyclone Alfred, an exceptionally powerful tropical storm, approaches the east coast. The impending cyclone threatens to unleash destructive winds, heavy rainfall, and severe flooding, posing a major risk to coal export operations. With port closures, submerged rail networks, and mine suspensions expected, the disruption could have far-reaching consequences for global supply chains.

Article From bigmint