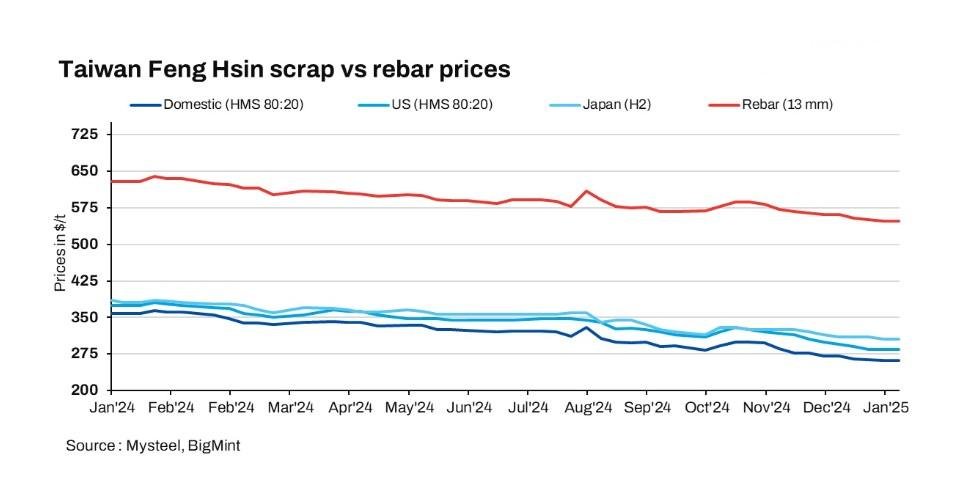

Mysteel Global: Feng Hsin Steel, Taiwan’s largest rebar producer headquartered in Taichung in central Taiwan, has decided to roll over its rebar list prices and local scrap buying prices again for transactions over January 6-10 after noting the uncertainty in global scrap markets, according to a company official. This marks the third straight week Feng Hsin […]

Author: Inter Steel BD

BigMint’s daily trade sheet – 7 Jan’25

BigMint’s bi-weekly domestic pellet (Fe63%) index dropped by INR 100/tonne ($1/t) to INR 9,450/t ($110/t) DAP Raipur on 7 January 2025 compared to the previous assessment on 3 January. BigMint’s daily assessed billet index fell slightly by INR 50/t d-o-d to INR 39,250/t exw-Raipur on 7 January. The daily assessed Indian sponge iron prices decreased […]

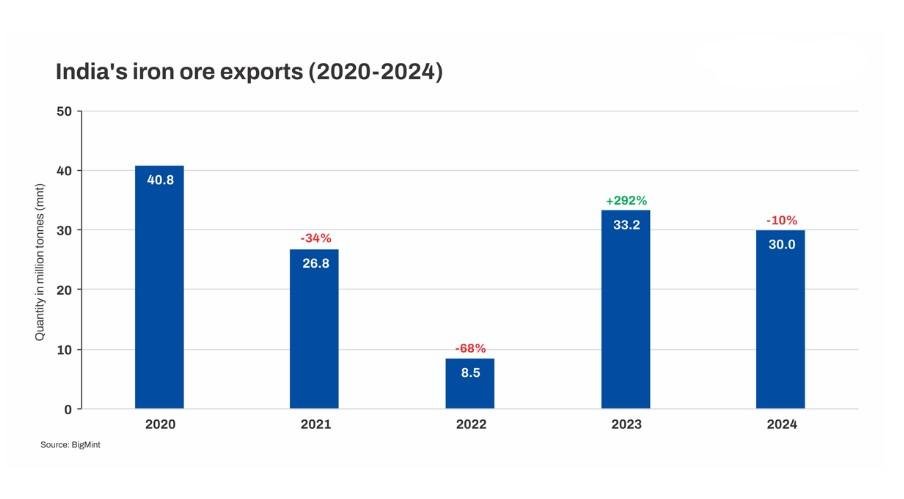

Indian iron ore exports drop 10% y-o-y in CY’24. Will downtrend continue in CY’25?

Morning Brief: India’s exports of iron ore, excluding pellets, dropped 10% y-o-y in calendar year 2024 (CY’24). Iron ore exports fell to a little under 30 million tonnes (mnt) from over 33 mnt in CY’23, as per latest data available with BigMint. Shipments had reached a three-year high in CY’23 after the government rescinded a 50% […]

China: BF mills’ production hits 3-month low amid approaching CNY holidays

Mysteel: Production among Chinese blast-furnace (BF) steel producers continued to decline steadily, driven by increasing maintenance stoppages amid the approaching Chinese New Year, Mysteel’s latest survey showed. The average capacity utilisation rate of the 247 BF steelmakers under Mysteel’s tracking fell for the seventh consecutive week by another 1 percentage point w-o-w to a three-month low […]

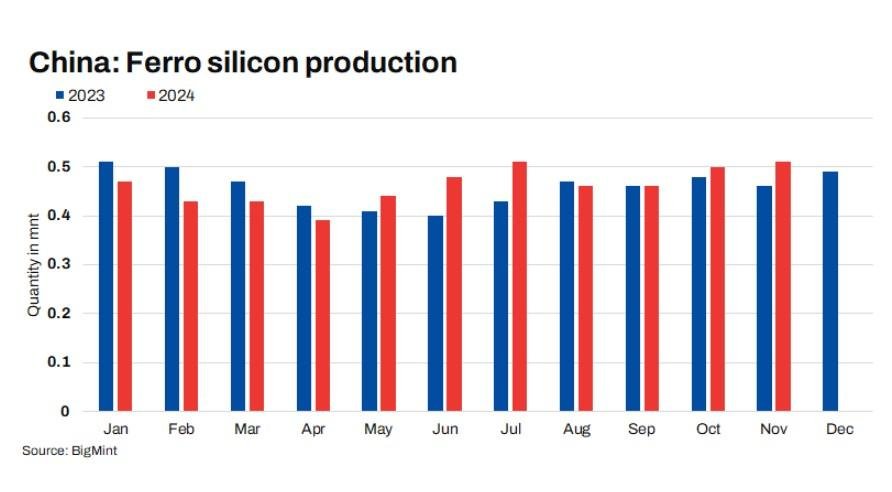

Weak demand to weigh on China’s ferro silicon market in 2025

Mysteel Global: China’s ferro silicon (FeSi) market was dragged down by subdued demand from end-users throughout 2024, and market watchers remain cautious about demand growth in 2025, anticipating lower consumption of Chinese FeSi in both domestic and overseas markets. The shrinking of demand for the ferro alloy was most evident in the domestic carbon steel market […]

India steel index holds firm w-o-w; market sees slow start to CY’25

Morning Brief: The New Year started on a mellow note for the Indian market, with BigMint’s Steel Composite Index crawling up by 0.3% w-o-w to settle at 129.0 points on 3 January 2025. Interestingly, all sub-indices either recorded increases or were stable w-o-w, in what may be early signs of a gradual improvement in trade momentum. […]

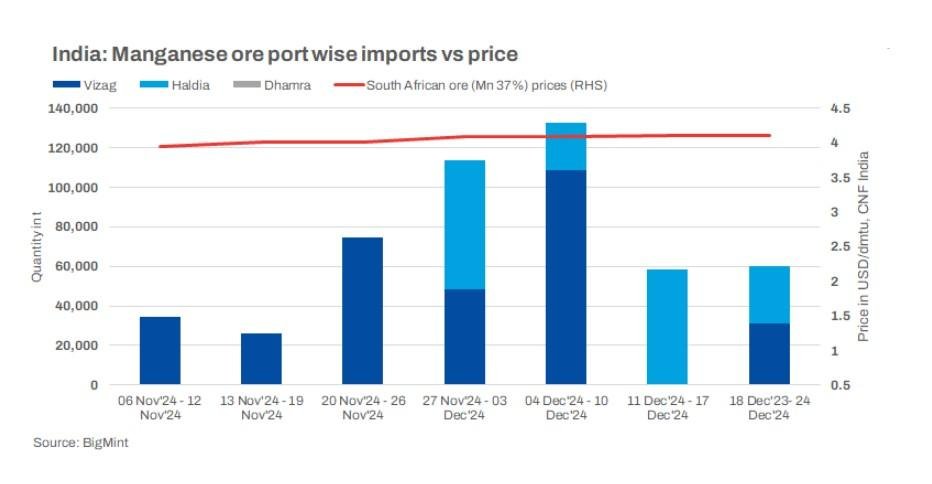

India: Imported manganese ore prices remain constant even amid strengthening alloys tags

Imported manganese ore prices have remained relatively stable this week despite a recent increase in demand. Market overview Smelters tread carefully amid market volatility: Indian smelters are adopting a cautious approach to manganese ore procurement, prioritising inventory management in the face of an uncertain market outlook. With sufficient inventory levels to meet current demand, smelters […]

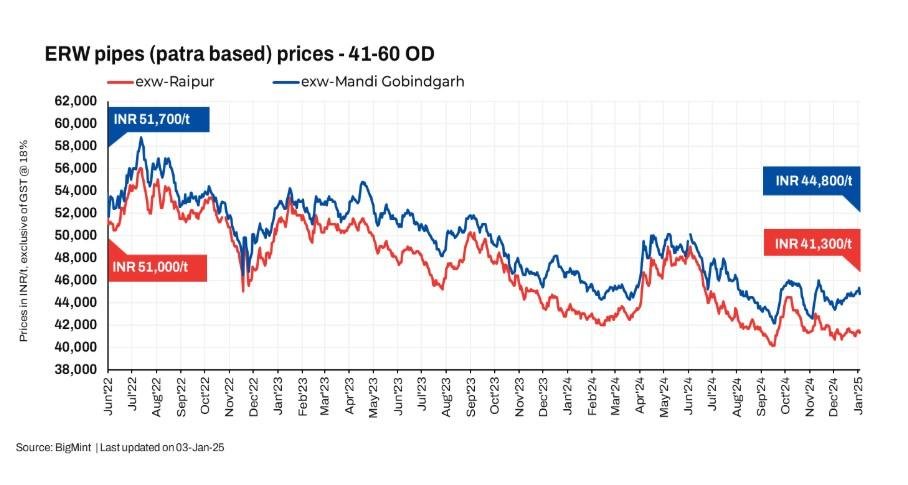

India: ERW patra pipe prices increase by INR 300/t w-o-w; market reflects mixed sentiments

ERW Patra pipe prices (41-60 OD) showed mixed trends w-o-w. Prices increased by around INR 300/tonne (t) w-o-w in Raipur as on 3 January 2025. The increase in raw material prices led to an increase in pipe prices during the week. However, in Mandi Gobindgarh, prices dropped back to the previous week’s levels after increasing […]

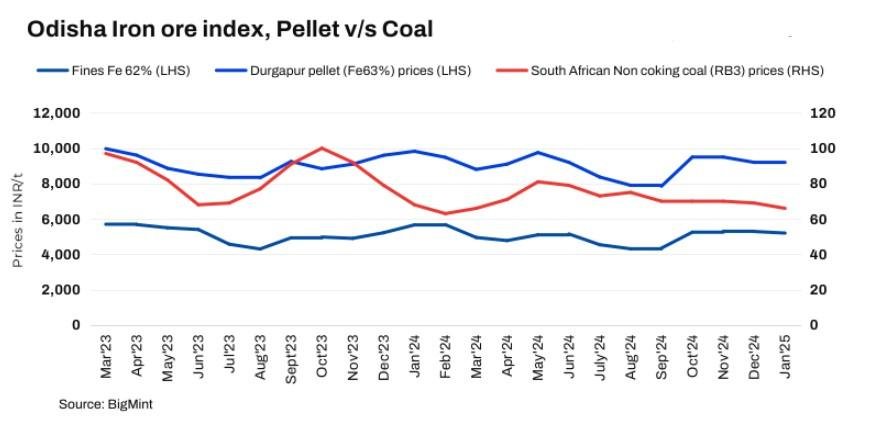

India: Odisha iron ore fines index falls INR 50/t ($0.5/t ) w-o-w

Iron ore prices in Odisha remained under pressure in the first week of CY’25 following lower bids from buyers for raw material purchases. A few miners reduced their prices by INR 200-300/t to encourage trade amid muted buying interest. However, buyers appear to be holding back, anticipating further price reductions before committing to new deals. […]

India: Odisha iron ore fines index falls INR 50/t ($0.5/t ) w-o-w

Iron ore prices in Odisha remained under pressure in the first week of CY’25 following lower bids from buyers for raw material purchases. A few miners reduced their prices by INR 200-300/t to encourage trade amid muted buying interest. However, buyers appear to be holding back, anticipating further price reductions before committing to new deals. […]