- Trade-level HRC offers rise up to INR 1,700/t w-o-w

- Leading mills hike BF rebar prices by INR 500-750/t

- HRC imports to edge lower, capacity utilisation likely to rise

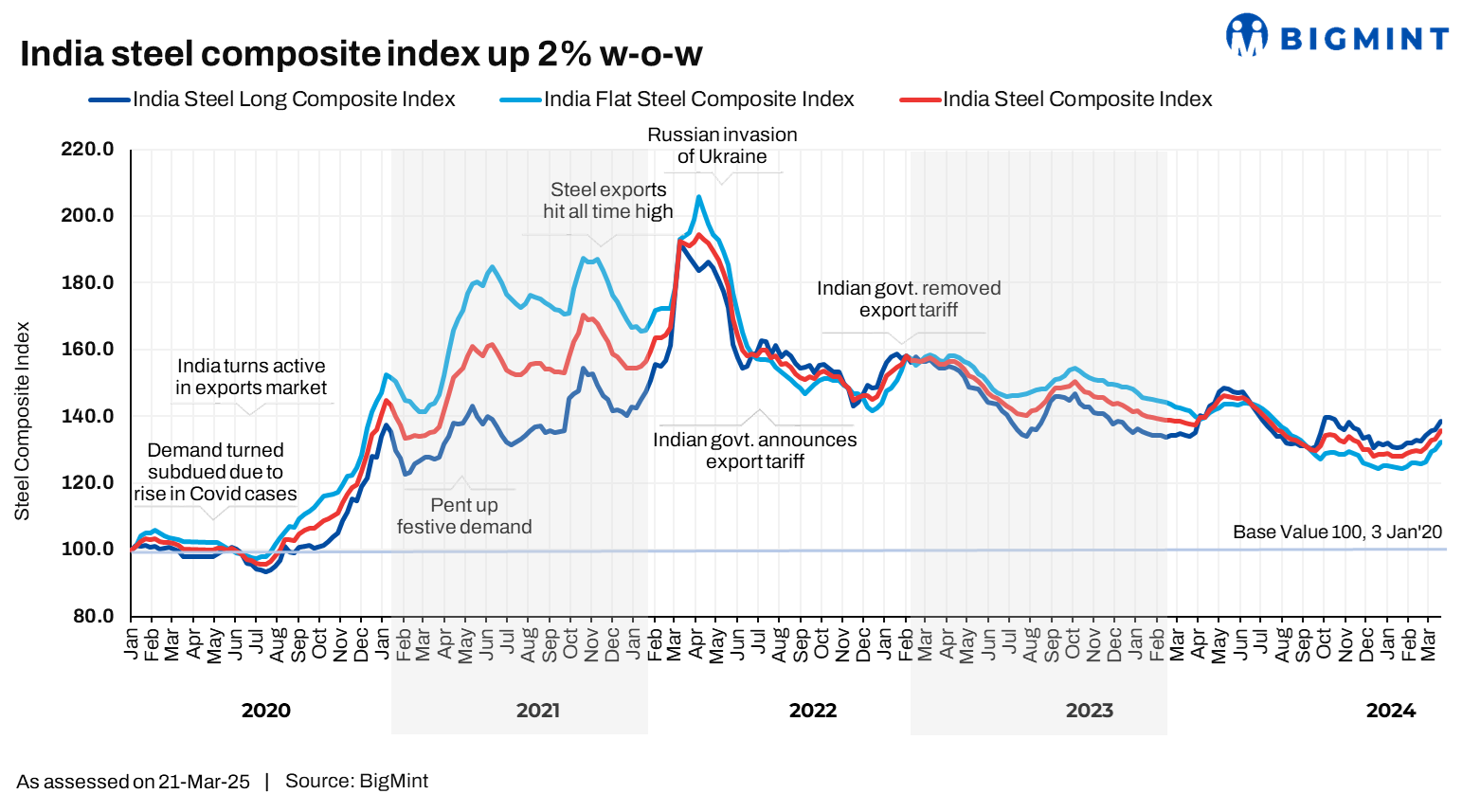

Morning Brief: BigMint’s India steel composite index, a barometer of the domestic market, witnessed an uptick of 2% w-o-w to reach 135 points on 21 March, 2025 following the much-awaited announcement of a 12% provisional safeguard duty recommendation by the Director General of Trade Remedies (DGTR) on imports of alloy and non-alloy flat steel products.

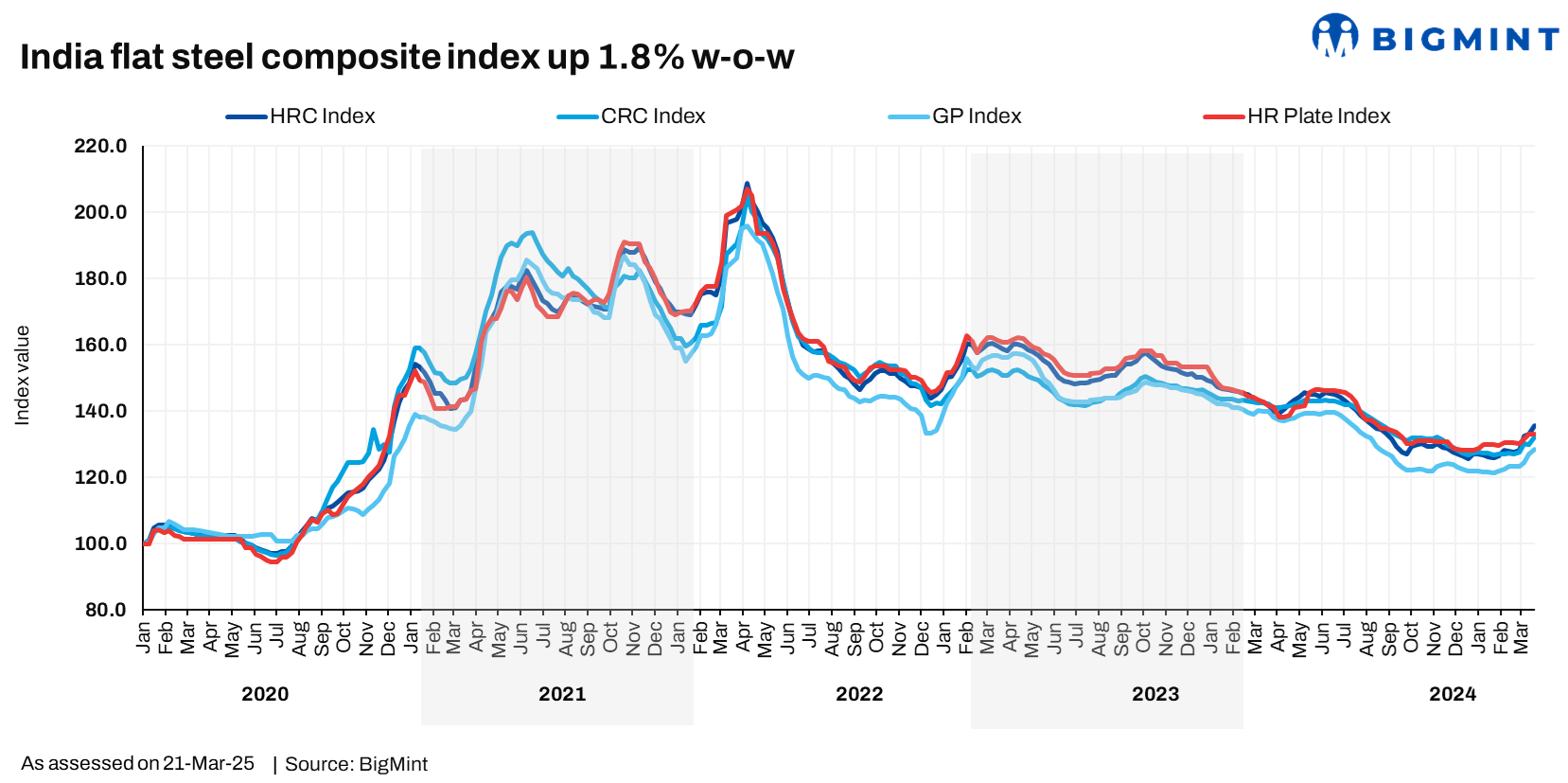

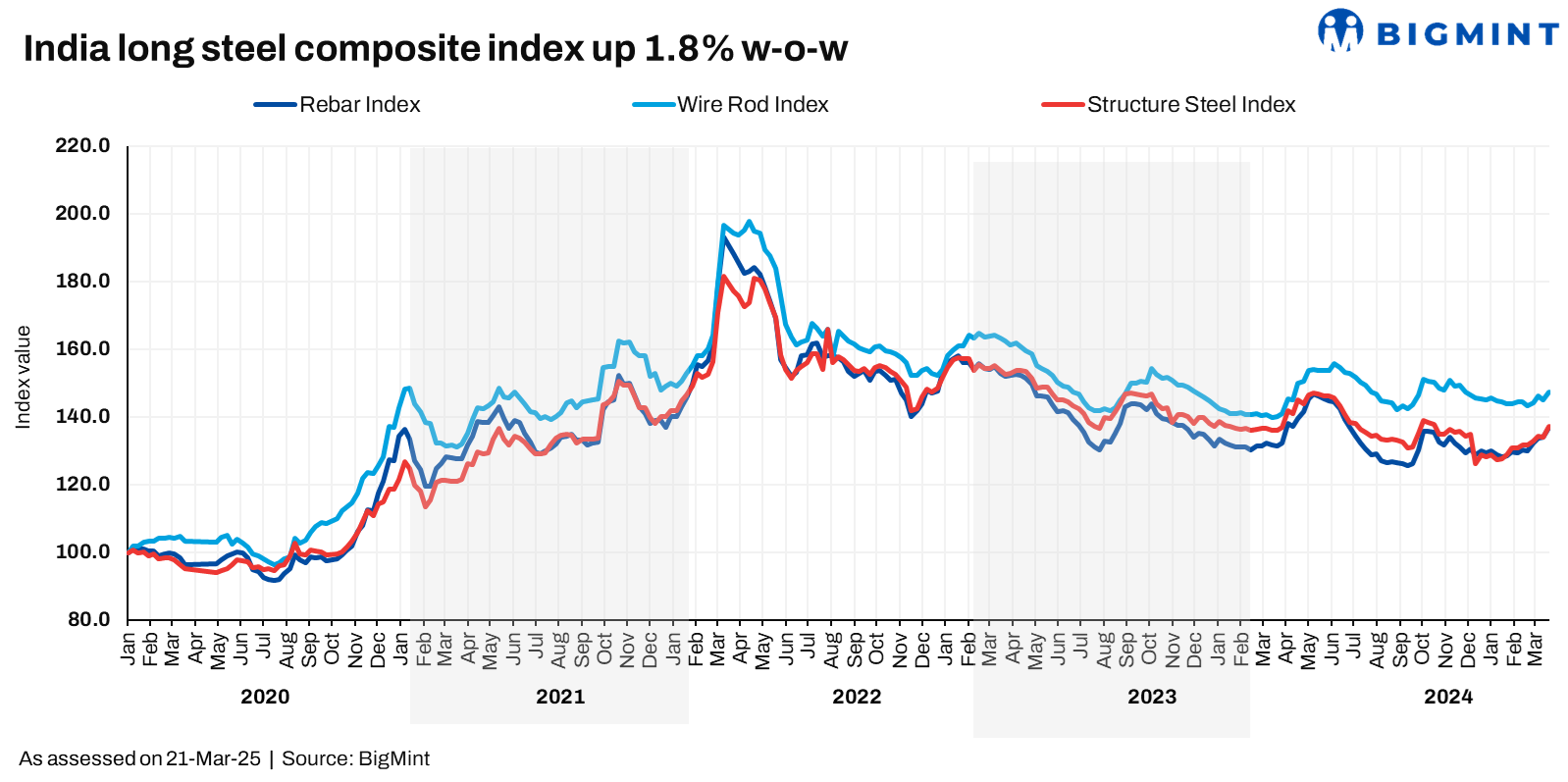

The flat steel sub-index inched up by 1.8% on the week to 132.3 points, while the longs index – a composite of different product-based sub-indices – saw a similar rate of weekly gain to settle at 138.5 points.

Interestingly, while long products were outside the purview of the safeguard investigation, the overall buoyancy in the domestic steel market resulted in an increase in prices across commodities.

Key factors impacting index

Trade-level HRC offers surge: Trade-level HRC offers surged by up to INR 1,700/t w-o-w to reach INR 49,400-52500/t while cold-rolled coil (CRC) prices increased by up to INR 1,000/t w-o-w to INR 55,000-58,800/t. BigMint’s benchmark assessment (bi-weekly) for HRCs (IS2062, Gr E250, 2.5-8 mm/CTL) increased by INR 1,700 /t w-o-w to INR 51,500/t on 21 March. CRC (IS513, Gr O, 0.9 mm/CTL) prices increased by INR 600/t w-o-w to INR 57,600/t.

Apart from the safeguard duty, market sentiment was influenced by reports suggesting that mills are planning to raise their list prices by INR 1,000-1,500/t this week, accompanied by a reduction in price support measures. Further, mills are expected to implement an additional increase in next month’s list prices, ranging from INR 1,500-2,000/t.

BF rebar trade prices edge up: The major private steel mills increased rebar prices last week by INR 500-750/t ($6-8/t) and, post-revision, list prices are at INR 54,500-55,000/t ($632-638/t) on a landed basis.

Trade-level BF rebar prices increased by INR 600/t ($7/t) w-o-w to INR 55,000/t ($638/t) exy in Mumbai on 21 March, exclusive of GST at 18%. In the projects segment, prices hovered at around INR 53,500-54,500/t ($621-632/t) FOR Mumbai.

Prices ticked up as IF rebar tags showed an increase, raw material costs refused to edge lower, and global cost pressure amid trade wars and tariffs affected the market. Notably, the longs segment had been left unscathed by rising imports, although overall domestic downtrend had affected prices.

IF rebar prices rise w-o-w: Induction furnace (IF) rebar trade prices increased w-o-w amid strong procurement sentiment cutting across markets. Mills increased their list prices and sold sufficient quantities. Finished steel tags were also supported by an uptick in semi-finished steel prices and positive market sentiments. Inventory idling time decreased to seven-eight days, with no selling pressure on mills.

According to BigMint’s assessment, IF rebar prices stood at INR 49,400/t ($/t) exw-Mumbai on 20 March.

HRC export prices remain stable: BigMint’s (HRC, SAE 1006) export index (for Middle East and Vietnam) remained unchanged w-o-w at $495/t FOB. Indian mills did not actively offer HRCs to the Middle East amid competitive Chinese prices and sluggish market activities. However, offers to the EU resumed after India was exempted from the provisional anti-dumping duties proposed by the European Commission (EC) following its preliminary investigation. Vietnamese buyers opted for domestic material despite rising mill prices.

Outlook

India’s bulk imports of HRCs and plates touched 200,685 t on 17 March, according to vessel line-up data. An additional 35,344 t are expected to arrive by the end of this month.

BigMint has calculated the impact of the 12% safeguard duty on HRC from both FTA and non-FTA countries. Calculations show that the post-duty landed cost of HRC (assuming a currently prevailing CFR price, BCD, currency rate, cess, port handling charges, etc.) works out to INR 55,067/t, while domestic benchmark HRC trade prices are hovering at INR 51,500/t, making these cheaper by well over INR 3,500/t. The final landed price of HRC imports from FTA countries works out to INR 54,173/t, a tad lower than the non-FTA price.

Therefore, going forward, imports are expected to edge lower thereby helping the primary mills, in particular, to shore up margins and price hikes already seem to be on the anvil. This will also boost domestic capacity utilisation vis-a-vis CY’24.

However, apprehension of inflationary pressure likely to be faced by steel end-users is also widespread. Therefore, the government may choose to focus on ensuring an import parity price for the MSMEs to tame cost inflation.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.

Article From Bigmint

Do Follow: Intersteelbd