- Rebar profits plunge, but HRC margins improve

- Medium plates turn profitable, reverse Sep’24 loss

Mysteel Global: Chinese blast-furnace (BF) steel mills managed to earn some profits on their steel sales in October, though their production costs moved higher with the climb in prices of major steelmaking raw materials, according to Mysteel’s latest monthly survey of the 91 BF mills it tracks.

Last month, although the sampled steelmakers’ average profit on rebar sales fell by a significant RMB 108/tonne (t) ($15/t) m-o-m to just RMB 16/t, their average profit on sales of flat steel improved. Mills’ margin on the sales of hot-rolled coils (HRCs) rose by RMB 17/t m-o-m to stand at RMB 33/t, while the average profit on sales of medium plates was RMB 58/t, in contrast to the loss of RMB 28/t in September.

The profit margins earned on finished steel sales were mainly attributed to the better performance of steel prices during the first half of October. However, prices retreated later with softening market sentiment, as demand from end-users fell short of expectations, despite October usually being a good month for steel consumption.

China’s long steel prices experienced much more significant fluctuations last month compared with those for flats, Mysteel Global noted.

For example, the national price of HRB400E 20-mm dia rebar, a bellwether of domestic steel market sentiment, was assessed by Mysteel at RMB 3,631/t, including 13% VAT, on 31 October, sliding by RMB 313/t m-o-m. During the same period, the national average price of Q235 4.75-mm HRC under Mysteel’s assessment slipped by RMB 107/t m-o-m to RMB 3,598/t, including VAT.

Steel sales in the physical market remained depressed last month, with the daily trading volume of construction steel, comprising rebars, wire rods, and bar-in-coils, among the 237 trading houses under Mysteel’s tracking averaging 121,307 t/d, down by 1,333 t/d m-o-m.

Domestic mills’ production costs moved higher in October, as prices of iron ore and coke increased in tandem with higher consumption from the recovery in steel output.

Last month, the average cost of making hot metal among the 91 surveyed mills was assessed by Mysteel at RMB 2,650/t, excluding 13% VAT, up by RMB 108/t or 4.2% m-o-m.

During October, the Mysteel SEADEX 62% Australian fines index for iron ore averaged $103/dry metric tonne (dmt) CFR Qingdao, up by $9/dmt m-o-m, while prices of second-grade metallurgical coke in North China under Mysteel’s assessment jumped by RMB 212/t m-o-m to RMB 1,800/t on average.

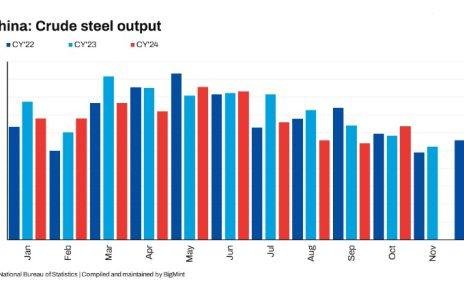

Encouraged by the healthy profit margins, many Chinese steel producers maintained relatively high production levels last month, with daily crude steel output in October averaging 2.64 million tonnes, rising by another 2.8% from the previous month, based on production data released by the National Bureau of Statistics.

Note: This article has been written in accordance with a content exchange agreement between Mysteel Global and BigMint.