- China accounts for over 60% of global chromium demand in 2024

- Indian FeCr producers among most affected by rising energy costs

The global ferro chrome market will see steady demand, especially in Europe, where consumption is projected to rise 10% by 2026, said industry experts at Chromium 2024, a two-day conference held by the International Chromium Development Association (ICDA) in Cape Town, South Africa, on 6-7 November 2024.

BigMint shares key insights from the summit below.

Global chromium markets

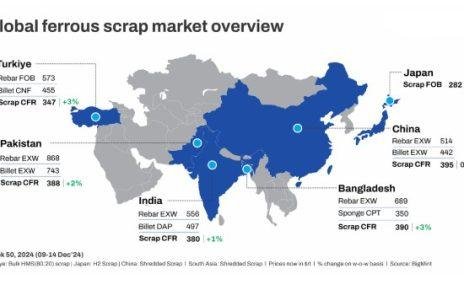

- China’s chromium consumption accounted for over 60% of global demand in 2024, driven by stainless steel production.

- The global chrome market is dominated by South Africa, which holds 72% of the world’s chromite resources, followed by Zimbabwe with 12%. Despite abundant reserves, Zimbabwe ranks fifth in production, highlighting a significant gap in resource exploration and development globally.

- South Africa remains the leading chromium ore supplier, contributing nearly 50% of global exports.

- India and Kazakhstan have strengthened their market presence in the low-carbon (LC) and medium-carbon (MC) ferro chrome segments.

- Zimbabwe holds the world’s second-largest chrome ore reserves. Power accounts for approximately 35% of the cost of production for Zimbabwe smelters. To address the shortage of power, companies are working to generate their own electricity in collaboration with the power authority (ZESA).

- Long-term risks include geopolitical tensions and environmental regulations impacting mining practices.

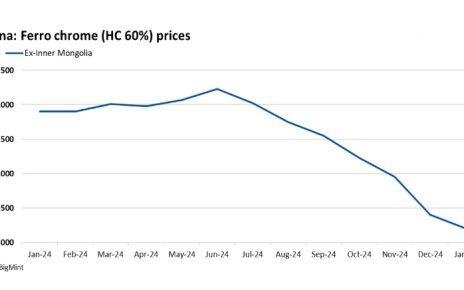

Ferro chrome market

- Analysts forecast steady demand for ferro chrome, particularly in Europe, where consumption is expected to rise 10% by 2026.

- Increased adoption of UG2 chromite as a cost-effective input was highlighted as a key trend, especially in China.

- Rising energy costs globally pose significant hurdles, with South Africa and India among the most affected.

- Regulatory compliance, particularly in Europe, adds to operational costs, potentially reshaping market dynamics.

- Diversification of supply chains, including exploring untapped reserves in Africa, is critical.

- Industry consolidation is expected, with larger players focusing on technological upgrades and sustainability initiatives to maintain competitiveness.

South Africa

- In South Africa, mining contributes 24% to GDP and sustains 1.7 million jobs.

- With immediate reforms, GDP growth could reach 3.3% by 2025, driven by investments in energy, ports, rail, and water, boosting exports, employment, and household consumption.

- South Africa’s ferro alloy sector faces energy shortages, with load-shedding affecting 80% of operations in 2024.

- Electricity costs surged by 500% from 2006 to 2024, reaching 300 ZARc/kWh, significantly increasing production expenses.

- Persistent energy challenges may push ferro alloy producers to seek alternative energy sources or shift operations to regions with stable power supply.

- Ferro chrome production costs in South Africa are among the highest globally at $1.20/lb Cr.

- The South African rand is projected to weaken further by 2026, potentially benefiting exporters but straining import-dependent industries.

- Investments in infrastructure remain stagnant; port inefficiencies have led to delays in exports, impacting competitiveness.

- Strategic policy reforms and private sector collaborations are needed to alleviate systemic bottlenecks.

Mozambique, South African ports

- Mozambique’s ports, such as Maputo, are emerging as alternatives to South Africa’s congested facilities, handling 50% more cargo in 2023 than in 2020.

- South African ports, plagued by inefficiencies, cost exporters an estimated $2 billion annually.

- Cross-border trade between Mozambique and South Africa grew 20% annually from 2020 to 2024, driven by increased demand for cost-effective logistics.

- In the future, Mozambique’s strategic port investments are likely to attract more regional trade, potentially reducing South Africa’s dominance.

- South Africa faces systemic challenges in energy, costs, and infrastructure, impacting its competitiveness. Meanwhile, Mozambique’s improving port infrastructure positions it as a regional trade hub, reshaping southern Africa’s logistics landscape.

Article Credit: Bigmint