- Turkiye scrap bids fall on softer rebar prices

- Pak rides competitively priced previous bookings

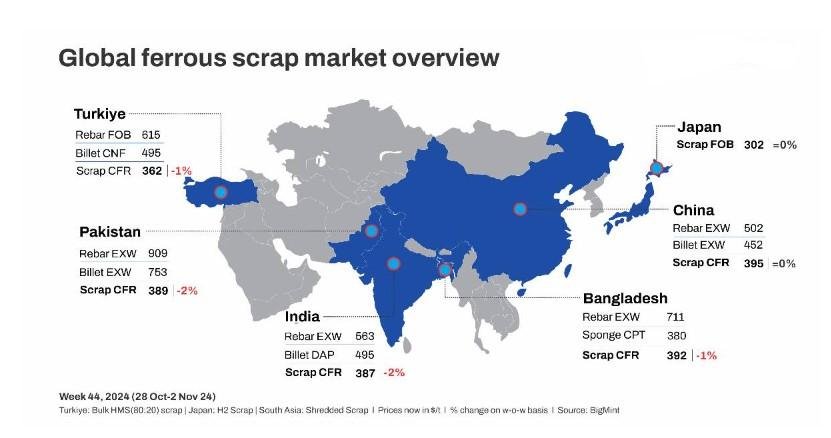

The global ferrous scrap market was muted this week. Prices ranged from $363/t CFR (Turkiye) to $395/t CFR (China) in the week under review, edging down by 1-2% w-o-w in key locations.

In Turkiye, imported scrap prices fell amid softer domestic rebar sales. Meanwhile, India’s market remained quiet due to the Diwali holidays, resulting in lower shredded prices. Pakistan also saw a decline in prices amid reduced buying activity, as previously booked materials arrived at competitive rates, while Bangladesh faced a drop in offers following limited buyer interest and ongoing letter of credit (LC) issues.

In South Korea, import volumes hit their lowest level this year, reflecting weak domestic demand. Conversely, Vietnam registered a slight increase in prices of Japanese and US scrap, despite overall weakened demand in the market.

Turkiye: This week, Turkiye’s imported scrap prices fell 1% w-o-w to $362/tonne (t) CFR, with the market experiencing downward pressure as mills leveraged softer domestic rebar sales to negotiate lower prices. US-origin HMS (80:20) offers were assessed at $363/t CFR, reflecting a slight decline due to weak sales and limited export activity. Mills managed to absorb the dip, thanks to strong sales in previous months, which allowed them to delay restocking.

As the week progressed, Turkiye secured deals from US and Baltic suppliers, while LME futures rose to $380/t. Although mills required around 32-35 vessels, demand was subdued amid an oversupply from Europe. Mills targeted US-origin scrap at about $360/t CFR and EU scrap at $355/t, with hopes for a gradual recovery with the onset of winter.

By the week’s end, prices held steady and sellers felt confident that a local bottom had been reached ahead of the US presidential elections. While sellers expect some upward movement as election uncertainties ease, concerns about limited global demand suggest that any price increases could be modest.

Around 5-6 bulk mixed scrap cargoes were booked from the US and Europe. Major bookings from the EU included 40,000 t of HMS (80:20), shredded, and bonus scrap at $360/t, $380/t, and $380/t, respectively. Meanwhile, US-origin HMS (80:20), shredded, and bonus mixed were at $362/t, $382/t, and $382/t CFR Turkey, with US-origin HMS (80:20) priced at $363/t.

India: India’s imported scrap market remained quiet this week, with prices edging down by 2% to $387/t CFR, as the Diwali holidays led to reduced buyer interest and softer demand. Workable prices of shredded dropped to around $385-386/t CFR Nhava Sheva, with busheling at $400/t depending on suppliers, and bids for HMS (80:20) ranged at $362-370/t CFR Mundra/Chennai. While immediate demand was muted, traders aimed to secure lower prices, anticipating new shipments by late November.

After Diwali, activity is expected to pick up as suppliers look to clear inventories before the harsh winter sets in, which could disrupt European supply flows. Buyers are eyeing more competitive levels of around $360/t for HMS (80:20) and $372-375/t for HMS 1, and some industry players are optimistic that fresh supplies will arrive from the EU by mid-November. However, any severe winter weather in Europe could shift supplies from alternate regions such as the US, Brazil, and Australia into the Indian market.

Pakistan: This week, Pakistan’s imported scrap prices saw a 2% dip to $389/t CFR amid a decline in buying activity as previously booked materials arrived at more competitive prices, creating pressure on new offerings. Many buyers scaled back their purchases, drawn to the attractive rates of pre-booked supplies, while weak rebar sales added to the caution in the market. Offers for shredded from the UK and Europe ranged at $388-395/t CFR Qasim, with about 2,000 t booked at $388-390/t.

Furthermore, the cooling domestic market influenced buyer sentiment, keeping shredded offers steady at $392-394/t CFR. Despite a slight rise in rebar prices, weak demand in the construction sector left mills in Karachi hesitant to make new purchases. Compounding these challenges, increased tax enforcement led to price hikes for local steel bars, adding to costs and creating further volatility in the market.

Bangladesh: This week, Bangladesh’s imported scrap prices witnessed a 1% decline to $392/t, with buying interest limited due to ongoing difficulties with opening LCs and a sluggish domestic steel market. Buyers remained inactive, as weak construction demand stalled purchasing decisions. Shredded offers from Australia and New Zealand were at $400-405/t CFR Chattogram, but buyers were only willing to engage at around $395-400/t, resulting in no deals.

As the week went on, buyer sentiment remained cautious due to slow construction activity. Sellers adjusted prices, with offers from Singapore and Malaysia at $420/t and Australian shredded at $410/t CFR Chattogram. However, ongoing LC issues and weak steel market conditions limited significant transactions, reflecting the financial challenges for Bangladeshi buyers.

South Korea: South Korea’s major ports reported 28,004 t of steel scrap arrivals this week, down 14,646 t from last week, marking the lowest weekly import volume this year. Weak domestic demand has driven down rebar production to under 20,000 t amid dampening interest from EAF mills. Manufacturers are increasingly turning to domestic scrap as steel factory operations slow. From January to August, the self-sufficiency rate for steel scrap touched 91%, significantly higher than in previous years.

Vietnam: Imported ferrous scrap prices from Japan rose by approximately $6/t in Vietnam following currency fluctuations, with US scrap prices increasing by the same amount. H2 scrap offers were reportedly at $345-350/t CFR.

However, overall demand in Vietnam’s import market weakened due to sluggishness in the finished products sector. Market insiders indicate that Vietnamese mills are well-stocked, with 30,000 t of previously booked Indonesian billets arriving at a local port this week. Although buying activity remains stable, some mills are looking to restock ahead of the new year, reflecting cautious optimism despite the overall decline in demand.

UAE: UAE-based steel manufacturers raised alarms with Indian Customs about illegal steel scrap imports, facilitated by falsified documentation. They highlighted issues such as altered bills of lading and counterfeit inspection certificates, urging the Indian government to act swiftly. Emphasising adherence to the Comprehensive Economic Partnership Agreement (CEPA), they seek increased vigilance and enforcement to protect legitimate trade and uphold international maritime laws.

Article Credit: Bigmint