- CISA data shows 4% jump in steel industry emissions in CY’24

- Emissions picked up in Q4CY’24 following stimulus announcements

- Large-scale transition to EAFs, scrap supply key challenges in short term

Morning Brief: China’s steel industry emissions increased by over 4% in 2024, according to data by the China Iron & Steel Association (CISA). Data for direct CO2 emissions were not available, although emissions volumes of other GHGs such as sulphur dioxide, nitrous oxide, as well as particulate matter were declared.

In CY’24, Chinese crude steel production decreased by 1.7% to 1.005 billion tonnes (bnt). It is surprising, therefore, that emissions actually increased.

According to research by Carbon Brief, steel output picked up after stimulus announcements in late September 2024, increasing 2% in October-November and 12% in December after a 4% reduction in the year to September.

The December increase, however, came from the reversal of a sharp 15% drop in production in December 2023, which was a last-minute measure to adhere to a cap set by the government for steel production during the year. As a result, steel production in December 2024 saw a dramatic increase y-o-y, but remained below 2022 levels.

Corresponding to the uptick in steel output in Q4C’24, the metallurgy sector recorded an increase in emissions, as per a Carbon Brief study.

China’s ‘Energy Conservation and Carbon Reduction Action Plan’ for 2024-2025 released by the State Council last year emphasised reducing carbon emissions from the steel sector in 2024-2025, aiming to reduce a total of 20 million tonnes (mnt) of standard coal and 53 mnt of CO2 emissions compared to 2023.

Switch to EAFs

Apart from the need to crack down on overcapacity in the steel industry, the Plan emphasises that by end-2025, the proportion of electric furnace steel in total crude steel output will be increased to 15%, and the utilisation of scrap steel will reach 300 mnt.

There were no new permits issued for coal-based steelmaking projects in the first half of 2024, according to data compiled from Chinese provincial governments. In the first six months of 2024, provincial governments permitted 7.1 mnt of steelmaking capacity, all of which consisted of electric arc furnace (EAF) mills.

However, insufficient scrap steel supply and higher operation costs have limited EAF steelmaking in the past decades. The production cost of EAF steelmaking in China is higher than the BF-BOF route. The situation becomes more challenging when the sector is trapped in overcapacity.

Scrap supply

China’s steel industry faces several challenges in improving the rate of scrap usage. High electricity costs and high scrap prices make EAF steelmaking less economically attractive. According to research, China’s steel recycling industry is fragmented, with many small, inefficient facilities with old technologies which reduce the recycling output and efficiency as well as quality, resulting in lower-quality scrap with impurity contamination.

Due to the massive amount of steel production from BF-BOFs, around 70% of China’s scrap is currently used in BOFs, while only 30% of the scrap is used in EAFs.

However, the government has taken proactive steps such as offering tax breaks to augment domestic scrap supply. China’s scrap steel consumption was around 250 mnt in 2022-2023. Scrap supply is estimated to increase to 300-320 mnt by 2025, and 350-380 mnt by 2030, according to the China Scrap Steel Association (CSSA).

The China Iron and Steel Association (CISA) projected in 2022 that the Chinese steel industry will have about 350 mnt/year of scrap available by 2030 and 500 mnt/year by 2050.

Govt initiatives

The government initiated an action plan in March 2024 to boost large-scale equipment renewals and replacements of consumer goods, as a measure to boost investment and consumption.

The plan outlines that by 2027, the recycling volume of scrapped vehicles is expected to double compared to the levels in 2023. As per research conducted by the Centre for Energy & Clean Air (CREA), the recycling of used household appliances is set to rise by 30% by 2027 as compared to 2023. The plan was followed by supporting measures including taxation and financial aid.

The State Taxation Administration has implemented reverse invoicing for companies engaged in scrap metal recycling. As a result, resource recycling companies that purchase from informal scrap collectors may receive a 13% VAT tax break, which enables recyclers to offer better prices for scrap.

Outlook

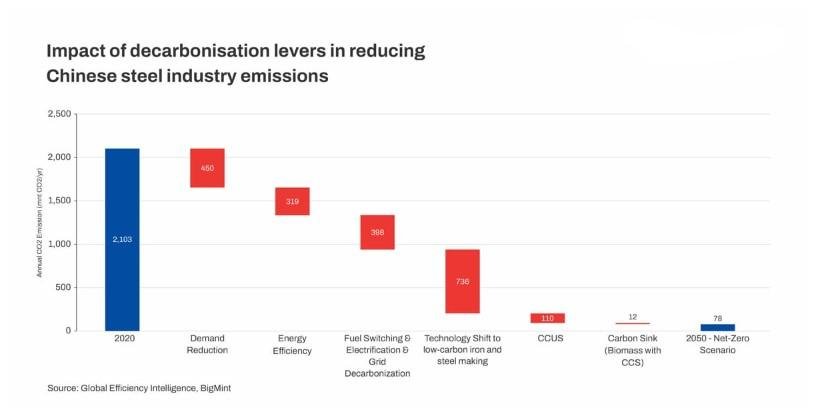

Besides the large-scale shift to EAF, the other key decarbonisation levers such as hydrogen metallurgy, grid decarbonisation, fuel switch, CCUS will have major impact on the low-carbon transition of the Chinese steel sector.

However, demand reduction will also play a role. Chinese steel consumption is expected to edge down even as material efficiency measures, steel light-weighting, design changes, etc. lead to decreased consumption of steel and a corresponding reduction in production and emissions.

However, in the short term, significant phase out of existing capacities that do not conform to energy benchmarks and focus on value-added steel are the key aspects of government policy.

Article From Bigmint