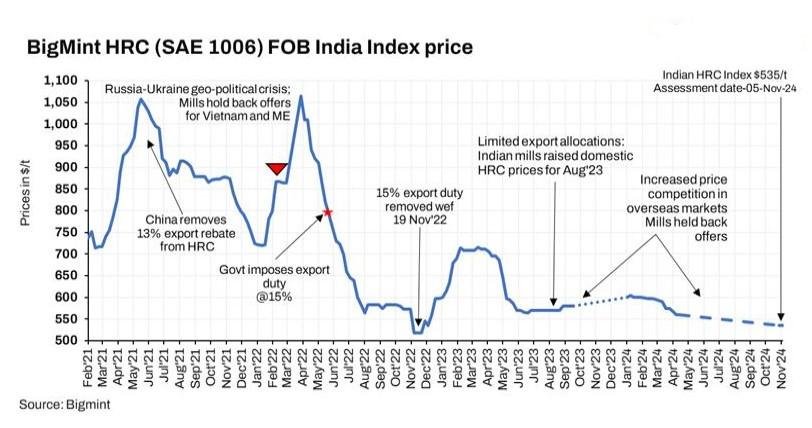

BigMint’s India hot-rolled coil (HRC, SAE1006) export index (for the Middle East and Vietnam) remains stable amid weak global market sentiments. Prices are assessed at around $535/t FOB east coast, India. Market sentiments in the ME remained weak due to limited trade activities. Anti-dumping probes in the European Union (EU) along with weak demand in the region has kept market sentiments subdued.

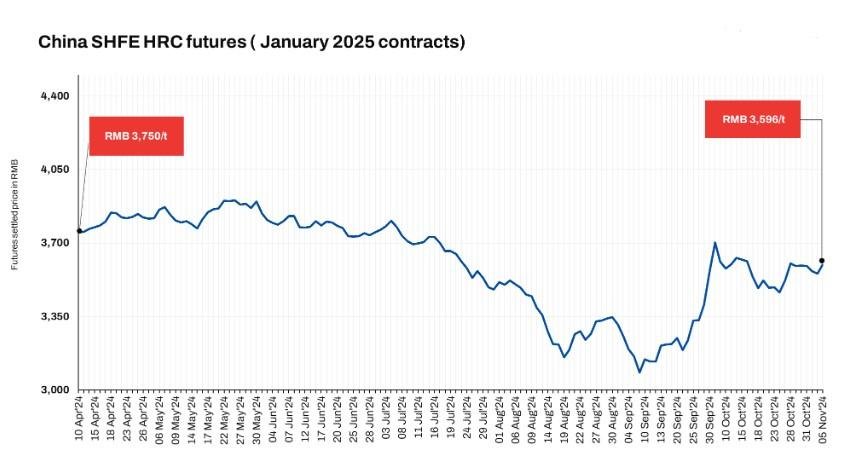

1.HRC export offers to ME remains stable: Indian HRC export prices to the Middle East remained stable for the week at $560/t CFR, as per BigMint sources. However, Chinese HRC (S235 and S275) export offers to the ME remain rangebound w-o-w, with current offers hovering around $525-530/t CFR UAE. Chinese SHFE HRC futures remain rangebound for the week at RMB 3,596/t ($506/t), whereas, on d-o-d basis, prices increased by RMB 43/t ($6/t) d-o-d compared to RMB 3,553/t ($500/t).

2.HRC offers to EU rangebound w-o-w: India’s HRC export offers to Europe (S275, 3mm) remained range-bound at $590-595/t CFR Antwerp ($540-545/t FOB, east coast, India). Indian steel mills’ export offers remained uncompetitive in the European market due to their high levels compared with domestic prices, and trade restrictions imposed in the EU. Additionally, India utilised only 3% of its EU steel safeguard quota for HRC in the October-December quarter due to weak European demand and an ongoing anti-dumping investigation.

3.China’s offers to Vietnam remain stable w-o-w: China’s HRC (SAE1006) export offers to Vietnam remained stable for the week, with offers hovering around $530-535/t CFR Ho Chi Minh City (HCMC). In response to softening domestic demand and increased competition from Chinese imports, Vietnam’s leading industrial group, Hoa Phat, reduced its monthly HRC (SAE1006, non-skinpass) prices by approximately $13/t for January-February 2025 shipments. Post revision, prices stood at $537/t or VND 13,590,000/t for the southern region, excluding VAT.

Outlook

The outlook for Indian HRC exports remains uncertain, as Chinese suppliers maintain competitive price levels. Global market participants are cautious, awaiting anti-dumping decisions. Notably, Indian steel mills have utilised a minimal 3% of their EU steel safeguard quota in the October-December quarter, due to sluggish regional demand and ongoing global anti-dumping issues.

Article from Bigmint