- H2 scrap offers fall amid weakening JPY

- Moderate demand seen for imported scrap

- Rising finished steel prices may support mill scrap purchase

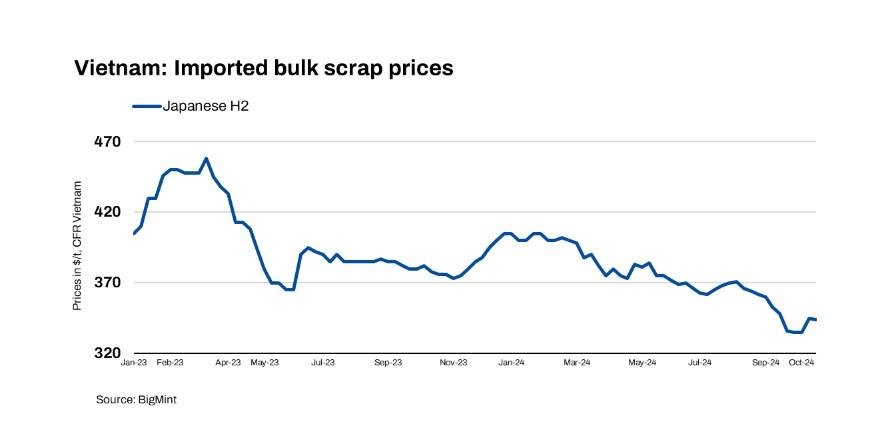

Imported bulk scrap prices from Japan fell slightly by around $2/tonne (t) in the Vietnamese market, while US scrap offers have also inched down by $2-3/t.

As per market sources, H2 scrap offers to Vietnam were reported at $340-345/t CFR, down $5/t w-o-w, with indicative bids around $330-335/t CFR. While demand remains moderate, further price increases could push Vietnamese mills to consider alternative materials if levels exceed $350/t CFR.

A trader informed: “Trade activity has been muted due to bid-offer gap, though rising finished steel prices in Vietnam may indicate increasing scrap demand from mills.

US-origin deep-sea bulk HMS (80:20) cargo offers were at $375/t CFR, matching last week’s levels, while bids were heard at $365/t CFR. Australian-origin offers were at $370-374/t CFR, with bids at $363-365/t CFR.

H2 scrap prices have begun to rise slightly towards last mid-week but due to a weaker JPY, it witnessed a fall with the currency trading near a two-month low of JPY 149.4, down from JPY 143.8 a week earlier.

H2 scrap offers decreased to JPY 44,000-45,000/t ($294-301/t) but rebounded towards weekend to approximately JPY 46,000/t. Bids from Vietnam were reported at around $330-335/t CFR (JPY 43,900-44,700/t) FOB Japan, after accounting for freight costs of about $30-35/t.

Assessments

- Weekly assessment for deep-sea bulk US cargoes of HMS (80:20) CFR Vietnam stood at $366/t, down by $2/t w-o-w.

- Weekly assessment for Japanese-origin H2, a major tradable grade in Vietnam’s scrap market, was at $344/t CFR down by $1/t w-o-w.

Prices for higher-grade scrap also dipped slightly during the week.

A Vietnamese trader reported that offers for heavy scrap (HS) and Shindachi were around $370/t CFR Vietnam, translating to approximately JPY 50,000/t FOB Japan. Other suppliers quoted prices ranging from JPY 48,500 to JPY 49,500/t by last weekend.

However, bids from Vietnam experienced a pullback, settling between $350 and 355/t, which equates to approximately JPY 47,000 to 47,500/t FOB Japan, according to a Japanese trader.

Local steel mills raised offers at the start of the week, increasing prices by $5-8/t for both rebar and wire rods.

Outlook: Market participants indicated that the recent meeting of China’s housing ministry did not meet expectations, leading to a stable seaborne outlook.

The price outlook remains mixed due to sluggish demand for construction steel in Vietnam. It depends on how long suppliers in Japan and buyers in Vietnam can be patient; while demand has not improved yet, sales are expected to rise in the last quarter.

Additionally, sources expect deepsea bulk prices to stay rangebound in the short term. As winter approaches, deepsea prices are likely to remain stable due to reduced construction activity and scrap collection.

Aticle Credit: Bigmint