- Move to impact iron ore, cement, graphite industries

- Stakeholders may send in responses by 15 Mar’25

The Ministry of Mines has proposed amendments to the Minerals (Other than Atomic and HydroCarbon Energy Minerals) Concession Rules, 2016 to boost the beneficiation of low-grade iron ore. The ministry has also proposed to rationalise the royalty rate of limestone, lime kankar, lime shell, marl, and dolomite.

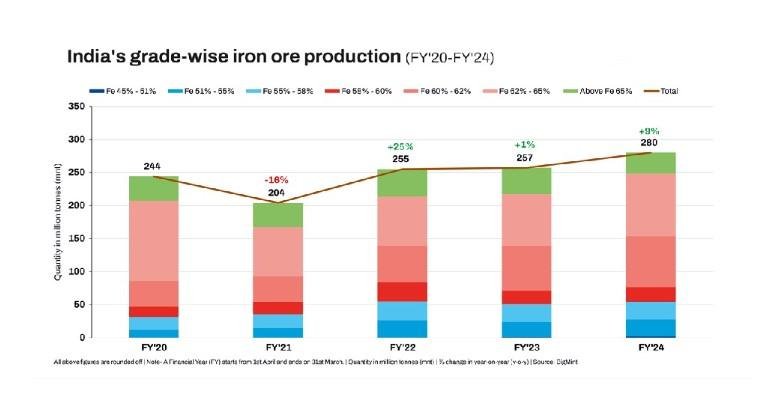

In a note inviting public comments, the ministry is proposing to charge 10% of the average sale price as royalty on an ad valorem basis on low-grade haematite iron ore of less than Fe 58% being beneficiated to Fe 62% or up to a grade as notified by the state government for a specific area.

With the changes, the lessees will also allow the sale of low-grade ore, including banded haematite quartzite and banded haematite jasper, to anyone who will be beneficiating it, as long as the person is registered under Rule 45 of the Mineral Conservation and Development Rules, 2017.

The sale will require the seller and purchasers to declare respective grades, before and after beneficiation, volumes, and the royalty paid on it, etc. In case the buyer is processing the material in combination with their own ore, they may exclude the seller’s quantity on which royalty has been paid when computing their royalty dues.

Royalty shall also be charged on the input material, irrespective of the location and ownership of the beneficiation plant, if Fe<58% is beneficiated to Fe>62% or above, or to a superior grade notified by the state government. Royalty will be charged on unprocessed run of mine (ROM) if processing leads to a decrease in the economic value of the ore.

The Indian Bureau of Mines’ published average sale price of haematite iron ore having Fe content below the threshold value, including banded haematite quartzite and banded haematite jasper, shall be equal to 75% of the average sale price of the lowest grade of haematite iron ore.

Industry participants can send their views to the ministry by 15 March 2025.

For limestone and other minerals (lime kankar, lime shell, marl, dolomite) that are also used in making cement, quicklime mortar, and in the chemical and steel industries, the government will charge auctioned and non-auctioned mines differently, with a 50% higher royalty on the latter. Lime kankar and dolomite will be moved from the minor mineral list to the major minerals one. Non-auctioned mines will be similarly charged a higher royalty rate.

On graphite, now identified as one of 24 critical and strategic minerals and whose prices vary depending on grade, the government has suggested levying royalty on an ad valorem basis so that royalty accruals in different grades would proportionately reflect the changes in the prices of minerals.

The government noted that royalty rates for graphite for the grade ‘with 80% or more fixed carbon’ may be kept at 4% of the average sale price on an ad valorem basis to attract investment in the sector. The last three grades (with less than 80% fixed carbon) may all be charged one single rate of royalty, that is 12% of the average sale price, on an ad valorem basis. This is expected to encourage beneficiation of ore.

Rubidium is another metal whose mining the government aims to encourage. It is a silver-white soft metal that belongs to the alkali metal family and is recovered commercially from lepidolite as a by-product of lithium extraction. If the production of the principal mineral ceases to be economically viable, then the by-product will cease to be recovered too. Rubidium is used in rapidly growing modern technological applications, such as wireless communications, defence, aerospace, medical and aviation.

It has not been mined previously in India, and therefore, its royalty rate is not specifically provided in the act. However, it will henceforth be charged a royalty rate of 4% of the average sale price for primary (i.e., produced from ore) and 2% of the same for the by-product.

Article From Bigmint