- Indian mills refrain from offering in EU amid dumping probes

- Offers to ME in Ramadan may downtrend amid China factor

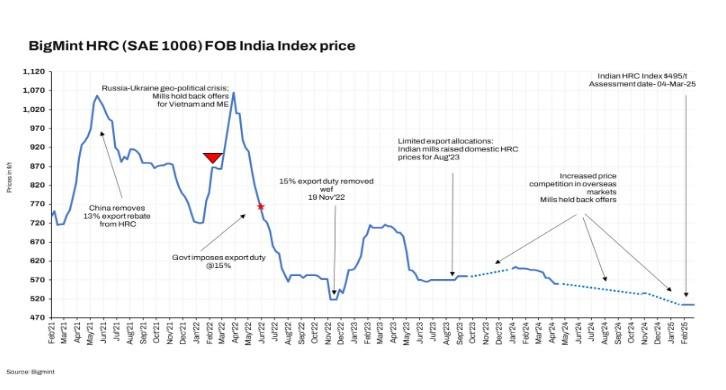

BigMint’s India hot-rolled coil (HRC) (SAE 1006) export index (for the Middle East and Vietnam) dropped by $10/t w-o-w to $495/t FOB east coast India against $505/t last week. Some recent export deals from India to the Middle East (ME) were seen as demand in this geography has improved slightly. European demand continues to face challenges due to weak market sentiment and ongoing anti-dumping investigations.

- ME’s imported HRC offers show mixed trend: Chinese HRC export offers to the Middle East increased by $5-10/t w-o-w to $500-515/t CFR UAE as compared to $495/t CFR UAE last week. Notably, HRC futures on the Shanghai Futures Exchange (SHFE) decreased by RMB 30/t ($4/t) d-o-d to RMB 3,395/t ($470/t) from RMB 3,425/t ($474/t) a day ago. However, on w-o-w basis, the same remained range-bound.

Indian HRC export offers to the ME dropped sharply by $15/t w-o-w to $515/t CFR UAE against $530/t in the previous week, amid a recent deal. A deal of around 5,000 tonnes (t) was heard concluded at similar price levels, for April 2025 shipment. Another deal of approximately 10,000 t was concluded at similar prices. The market has witnessed a slight pick-up in demand with the start of Ramadan, after a sluggish period ahead of it.

2. Indian mills not actively offering to EU: Indian steel mills have adopted a wait-and-see approach, refraining from actively offering HRCs in the EU market, as participants are awaiting the results of anti-dumping investigations.

European HRC prices witnessed a slight increase, ahead of the EU safeguard review. However, demand remained sluggish, but some buyers are making cautious purchases, expecting prices to rise.

3. China’s HRC offers to Vietnam remain steady: Chinese hot-rolled coil (SAE1006) export offers to Vietnam held steady w-o-w after anti-dumping duties were imposed on the country. Indicative offers remained at $485-$490/t CFR Ho Chi Minh City (HCMC).

Hoa Phat Group, the leading industrial manufacturing group in Vietnam, has increased its monthly HRC (SAE1006, non-skin-passed) prices by around $11/t for April 2025 shipments, sources informed BigMint. Post-revision, prices stood at approximately $517/t or VND 13,240,000 /t for the southern region, excluding VAT.

Outlook

India’s HRC export offers are likely to downtrend, influenced by improved Middle Eastern demand in the holy month of Ramadan but competitive Chinese pricing. Indian mills, however, may adopt a wait-and-see approach, as European demand remains weak due to ongoing anti-dumping investigations.

Article From bigmint