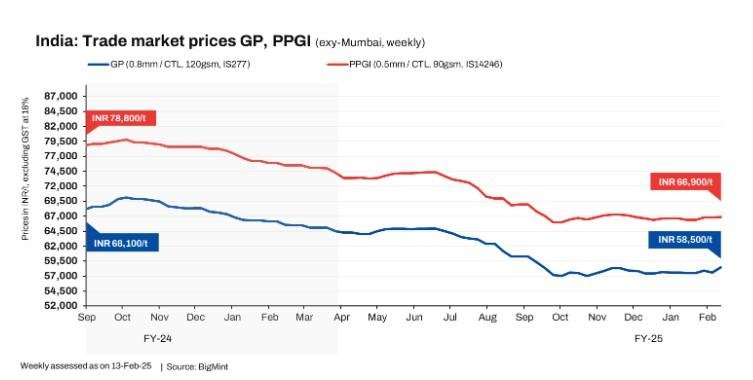

Trade-level coated flat steel prices rose this week after the mills announced a hike in their tags for February 2025 sales. The effective list price of galvanised plain (GP, 0.8mm, 120gsm, IS277) coils stood at INR 59,250-60,000/tonne ($/t) ex-Mumbai, while pre-painted galvanised iron (PPGI, 0.5mm, 90gsm, IS14246) coils were at INR 69,250-70,000/t ($/t) ex-Mumbai for February sales. The list price of one of the coated flat steel producers remained elusive.

For early January sales, mills’ list tags were around INR 58,000-59,250/tonne ($670-684/t) ex-Mumbai for GP (0.8mm, 120gsm, IS277), and INR 68,000-69,250/t ($785-800/t) for PPGI, (0.5mm, 90gsm, IS14246) coils on an ex-Mumbai basis.

Market updates

Short-lived improvement in demand: Improved buying was observed initially this week, however, it was short-lived and subsided by the mid-week. Buyers exercised caution while purchasing continues to be a pain point for distributors.

“The market has again been buzzing with news about the levy of steel import duty with the recent intimation about a hearing scheduled for Anti-dumping duty (ADD) on 27 February. Thus, mills are pushing distributors to lift their balance MoU quantities for the fiscal year 2025, propelling the latter to quote higher in the market,” said a distributor source based in western India.

The latest weekly assessment showed galvanised plain (GP, 0.8 mm/CTL, 120 gsm, IS277) steel prices at INR 58,500/t ($/t) exy-Mumbai, with offers varying in the range of INR 58,000-59,000/t ($/t). Similarly, pre-painted galvanised iron (PPGI, 0.5 mm/CTL, 90 gsm, IS14246) was assessed at INR 66,900/t ($767/t) exy-Mumbai, with offers at INR 66,000-67,500/t ($/t). The prices are minus GST at 18% (USD 1 = INR ; INR 1 = USD ).

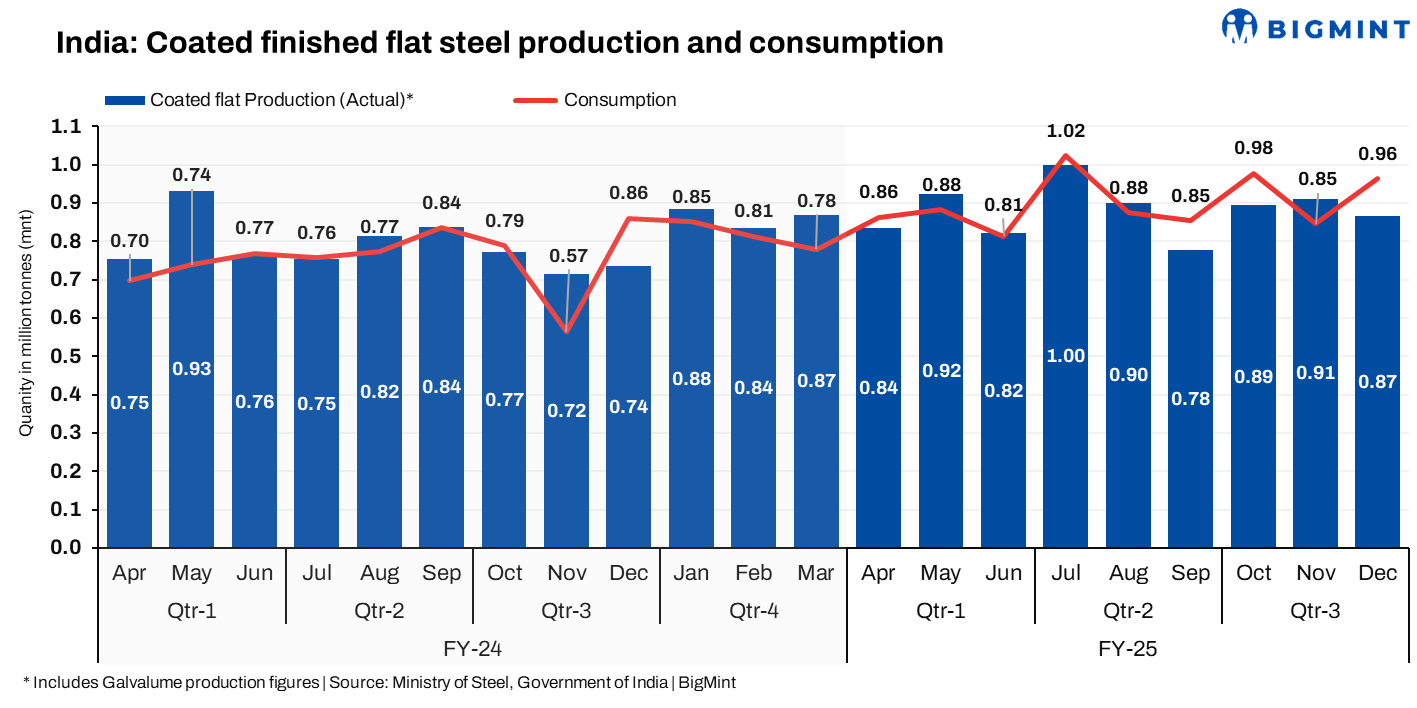

Improved production adds to inventory: Production levels stand improved adding to the inventory in the distribution network. During the 9M FY 2025 (April-December), the production of coated flat steel (including Galvalume) stood at 7.93 million tonnes (mnt) compared with 7.08 mnt in the corresponding period of the previous year (CPLY), as per the Joint Plant Committee (JPC) data. Similarly, on a quarterly comparison, the production stands higher by 0.11 mnt at 2.22 mnt in Q3 FY 2025 (October-December). An update on the January 2025 figures is expected in the upcoming week.

The consumption of coated flat steel increased by around 1.32 mnt y-o-y in the 9M FY 2025 to 8.10 mnt. In Q3 FY 2025, it increased by a notional 0.03 mnt to reach 2.79 mnt quarter-on-quarter. Moreover, the consumption of coated finished-flat steel has remained higher than the production levels this fiscal year.

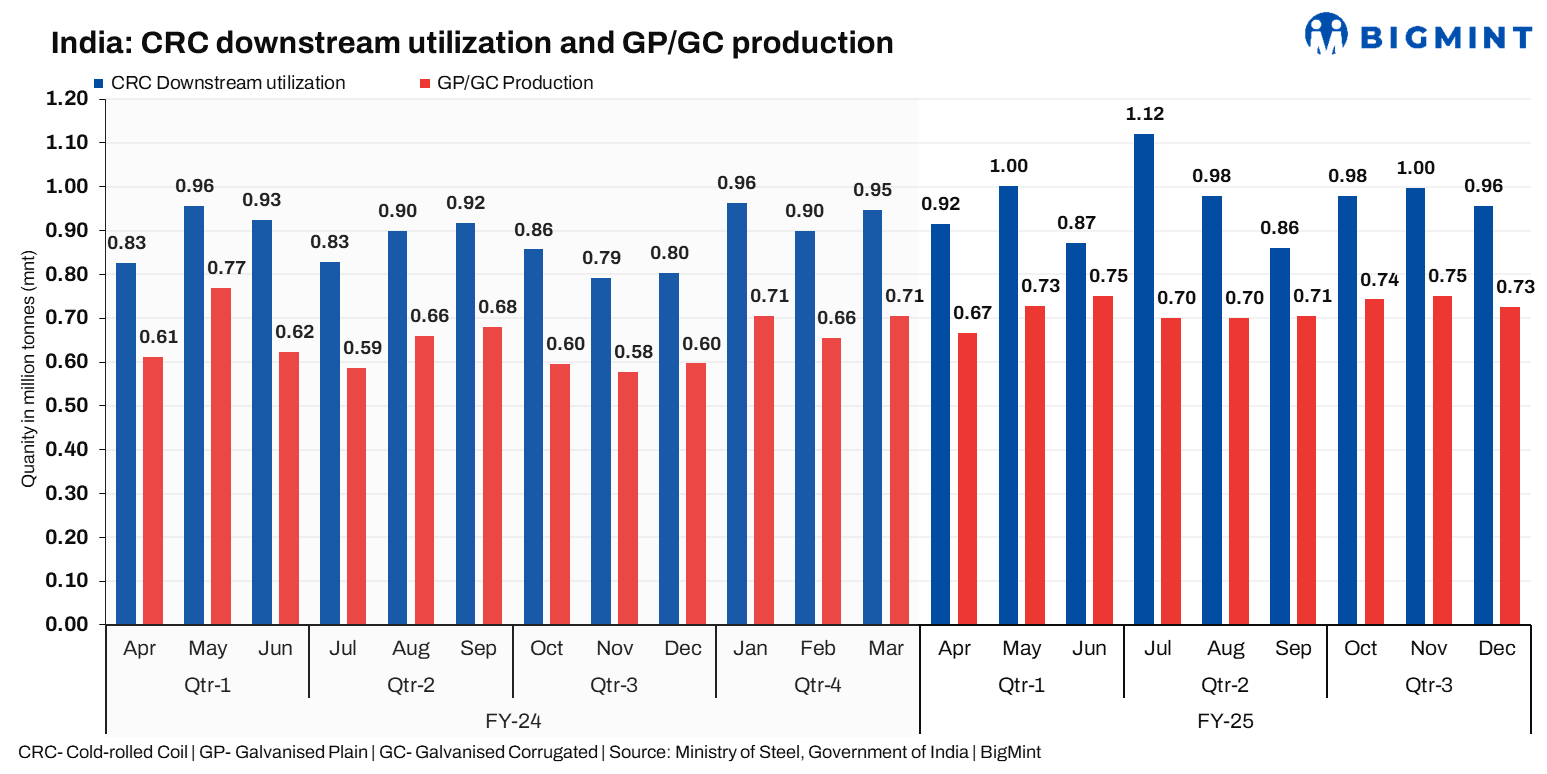

The CRC volumes utilised for downstream production stood at 8.68 mnt in 9M FY 2025 compared to 7.80 mnt in CPLY. Meanwhile, galvanised plain (GP), and galvanised corrugated (GC) steel production volume stood at 6.47 mnt in 9M FY 2025 compared to 5.70 mnt in CPLY. Moreover, the average utilization of cold-rolled coils (CRC) for Galvanised flat steel production increased to 76% in Q3 FY 2025 compared with the previous quarter’s 72%.

Outlook: Trade-level prices are likely to move in a narrow band in the near term. MoU honouring has picked up pace in the final quarter of the year easing inventories with mills. However, this might lead to inventory pile-up in the distribution channel. Distributors are concerned about the outflow of inventories from their yards considering the calculated risk-taking approach of end-users while procuring.

Article From bigmint