- G4 grade continues to be most sought after in auctions

- Hind Unitrade remains the largest bidder at 20,000 t

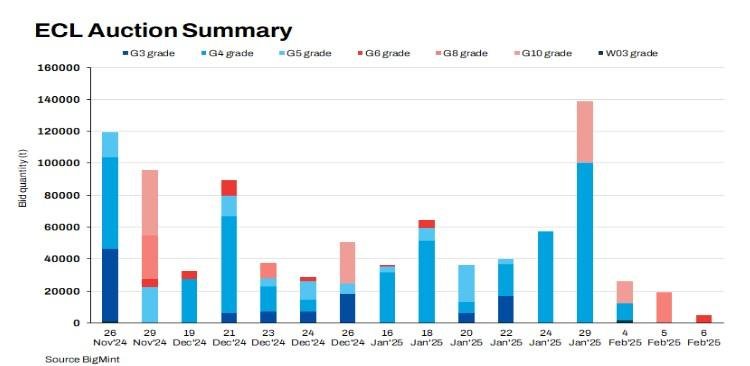

Auctions held by CIL subsidiary Eastern Coalfields Limited (ECL) on 22, 24 and 29 January and 4, 5, and 6 February 2025, reflected significant shifts in coal sales trends, marking distinct bidding behaviours. The total sales volume across these six auctions reached 288,050 t, indicating evolving buyer preferences and varied bid prices.

Sales trends:

The auction on 22 January recorded total sales of 40,000 t at an average bid price of INR 7,063/t, whereas the 24 January auction saw a sharp rise in sales to 57,500 t, with the average bid price increasing to INR 7,275/t. The highest sales volume was observed on 29 January, with 139,000 t sold at an average price of INR 5,949/t. The 4 February auction recorded sales of 27,650 t at an average price of INR 4,241/t, followed by 18,900 t on 5 February at INR 2,183/t, and 5,000 t on 6 February at INR 2,998/t.

Grade-wise performance

G4 continues to dominate: The G4 grade saw high demand across auctions. On 24 January, 57,000 t of G4 coal was sold at an average price of INR 7,326/t, significantly higher than the 19,500 t sold on 22 January at INR 6,898/t. The highest sale for G4 was on 29 January, with 100,000 t sold at an average bid price of INR 6,585/t.

Emergence of G10 and G8: G10 coal was prominent in the 29 January auction, with 38,500 t sold at INR 2,317/t, while the 4 February auction saw an additional 14,150 t at the same price. G8 emerged in the 5 February auction, where 18,900 t was sold at INR 2,183/t.

G5 and G6 observe varied demand: G5 sales fluctuated, with 3,500 t sold on 22 January at INR 4,061/t and a small quantity of 500 t on 24 January at INR 5,292/t. The highest bid price for G5 was recorded on 29 January, at INR 5,406/t for 500 t. Meanwhile, 12,000 t of G5 was sold on 4 February at INR 4,645/t. G6 was sold in the 6 February auction, with 5,000 t bid at INR 2,998/t.

Top buyers in each auction:

On 22 January, the leading buyers were Ranisati Coal Carriers Private Limited with 5,100 t and Neelkanth Sales and Logistics with 5,000 t.

On 24 January, Gauri Shankar Enterprises purchased 6,000 t, while RCB Minerals Private Limited acquired 3,800 t.

The 29 January auction saw Hind Unitrade Pvt Ltd securing 20,000 t, followed by Shree Vasudha Coal Traders with 8,000 t.

For the 4 February auction, Rudra Enterprises and K.S.K. Agencies both purchased 2,500 t each.

On 5 February, Happy Niwas Private Limited was the highest buyer with 8,000 t, and Mark Trading Company acquired 1,100 t.

On 6 February, the top buyers were Sintu Gorai with 600 t and Jonaki Enterprise with 400 t.

Market implications

The auctions underscore shifting demand patterns, with high sales in G4 and steady interest in lower-grade coal like G10 and G8. The variations in bid prices and volumes indicate a more segmented approach among buyers, aligning their procurement strategies based on operational needs and price competitiveness.

Article From Bigmint