- OMC announces iron ore auction on 19 Feb’25

- Lack of high-grade material seen in eastern region

Odisha’s iron ore prices remained stable this week as trade activities slowed down ahead of the upcoming OMC auction scheduled for 19 February. Market participants expect that the base prices and total offered quantity will be announced in the next couple of days.

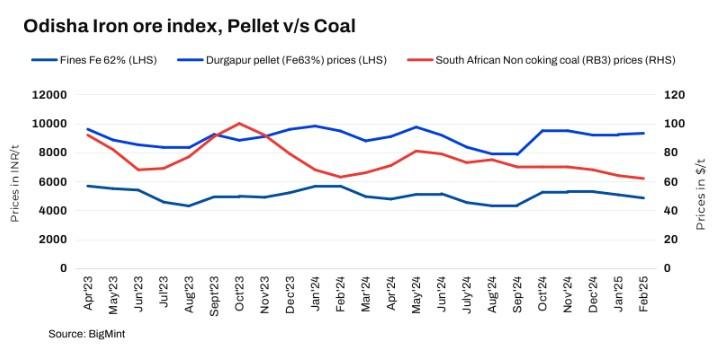

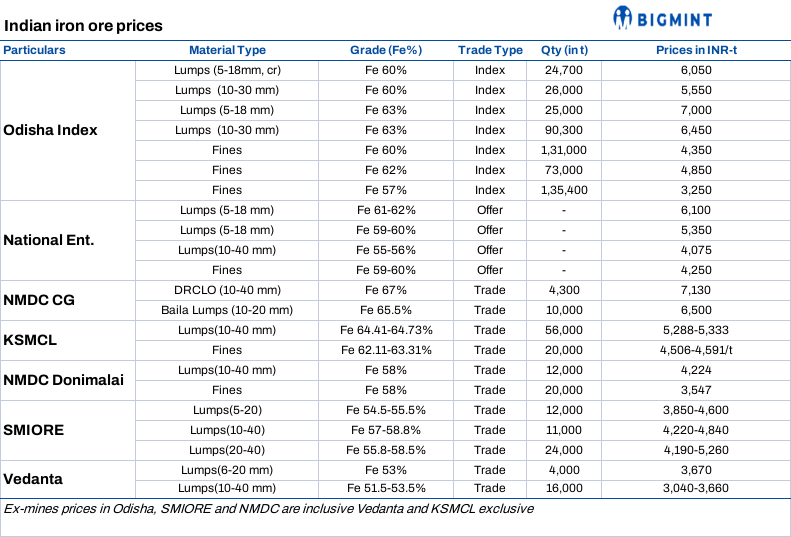

BigMint’s Odisha iron ore fines (Fe 62%) index inched up by INR 50/t ($0.5/t) w-o-w to INR 4,850/t ($56/t) ex-mines on 15 February 2025. Around 38,000 t iron ore fines (Fe60-62%) deals were concluded at INR 4,500-5,000/t ($52-58/t) ex-mines this week. Overall, around 540,000 t of iron ore (fines and lumps) deals were recorded from Odisha this week.

Major miners had already completed most of their sales earlier this week for the first half of February, while a few revoked their offers in anticipation of the OMC auction scheduled next week to get clarity.

A trader commented: “We are seeing a shortage of material in the market as miners hold back sales amid the lack of stocks specifically for higher grade material. Everything will become clearer post OMC auction.”

Despite the uncertainty, demand for iron ore remains steady. However, buyers are waiting for price clarity before making bulk purchases.

A buyer informed, “The auction results will determine the market trend, and we expect price levels to remain supportive as very few miners have high-grade stocks.”

Currently, only a select number of miners are providing higher-grade material, and market sentiment strongly indicates that OMC’s bidding result will effectively support these trades.

A market participant expressed on current dynamics, “With March restocking underway, buyers are actively procuring material, and any upward movement in OMC prices could push Odisha’s iron ore prices higher.”

Factors affecting iron ore market:

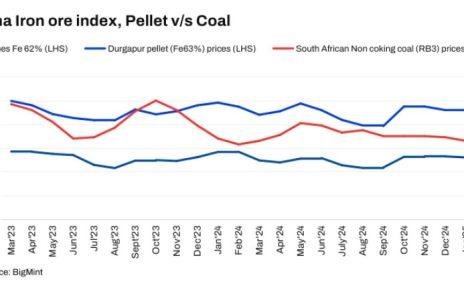

Pellet offers remain stable w-o-w: Pellet (6-20 mm, Fe 62.5%) prices in Odisha’s Barbil remained stable w-o-w at INR 8,300/t ($96/t) loaded to wagon. Pellet (Fe 62.5%, 6-20 mm) prices in Durgapur reported w-o-w unchanged at INR 9,300/t ($107/t) exw on 14 February.

Sponge iron prices up w-o-w: According to BigMint’s assessment, sponge iron C-DRI (FeM 80%) prices in Rourkela rose by INR 150/t ($2/t) w-o-w to INR 25,850/t ($298/t) on 15 February. Similarly, steel billet (100*100 mm) offers in Rourkela increased by INR 100/t ($1/t) w-o-w to INR 38,100/t ($440/t) today.

Rationale

- T1 – Five (5) deals of Fe62% fines were recorded in the publishing window, and three (3) were considered for price computation and given a 50% weightage for index calculation.

- T2 – BigMint received twenty-eight (28) offers and indicative prices under the T2 category (offers, indicative, and bids) in this publishing window. Twenty three (23) were taken into consideration and given a 50% weightage. To check BigMint’s iron ore assessment, pricing methodology, and specification document, click here.

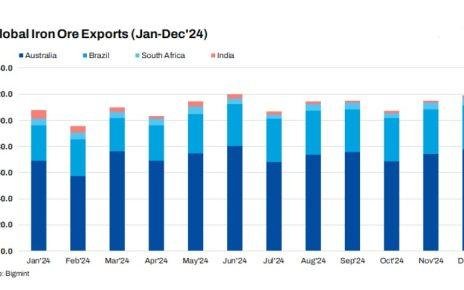

Raw material export market:

India pellet (Fe 63%, 3% Al) export index (FOB east coast remained stable w-o-w at $105/t on 14 February. A domestic pellet maker concluded an export deal for around 50,000 t of pellets (Fe 63%, 2% AL2O3) at $110-112/t FOB India. Another export deal of 55,000 t pellet was recorded at $117/t CFR China from the east coast

BigMint’s bi-weekly Indian low-grade iron ore fines (Fe 57%) export index rose by $1.5/t w-o-w to $69.5/t FOB east coast, India, on 13 February. However, prices fell by $1/t against the previous assessment on 10 February. This week, approximately 250,000 t of iron ore fines were traded for exports from India. While some exporters received bids from buyers, negotiations continued without final deals in certain cases.

Outlook

According to BigMint analysis, demand and prices for iron ore in Odisha are expected to rise as steelmakers restock in March. However, clarity on tradable prices will follow the results of the OMC auction and new offers from merchant miners.

Article From bigmint