- Over 2-mnt iron ore fetch premium at OMC auction

- Supply tightens as ECs of other private miners expire

The iron ore market in Odisha remained steady this week, as auction results from the Odisha Mining Corporation (OMC) provided price support, while availability from other merchant miners remained scarce. The market has seen restricted supply after the environmental clearance (EC) limits of several miners expired for the current financial year. As a result, buyers have turned to OMC auctions to secure material.

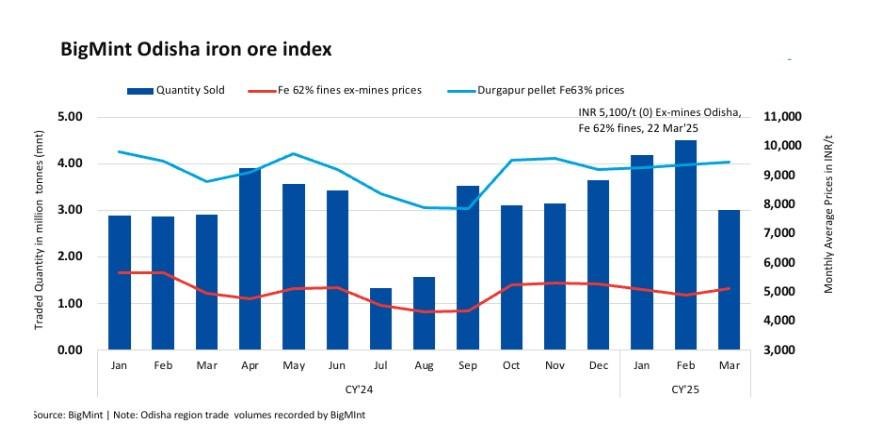

BigMint’s Odisha iron ore fines (Fe 62%) index remained stable w-o-w at INR 5,100/t ($55/t) ex-mines on 22 March. Overall, deals for around 150,000 t of iron ore (fines and lumps) were recorded from Odisha this week.

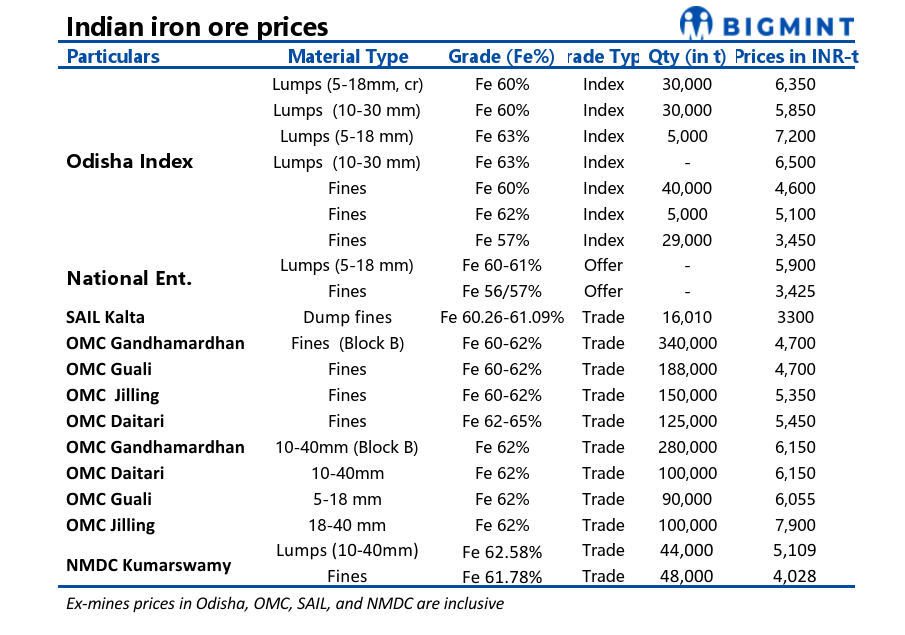

At OMC’s auction for 2.344 mnt of iron ore (1.324 mnt fines and 1.02 mnt lumps, Fe 51-65%) on 20 March, around 1.286 mnt of fines and 0.991 mnt of lumps were booked at INR 3,700-5,500/t and INR 5,600-7,900/t ex-mines, respectively. Weighted average bids rose by INR 200/t for fines and INR 100/t for lumps against last month. OMC had increased base prices by around INR 200-300/t m-o-m for fines, while the base prices of lumps were increased by INR 750/t. Tight availability of iron ore amid expired EC limits led to an active response from buyers.

A trader based in Odisha stated, “The OMC auction witnessed an uptick in bids due to supply constraints. With limited material available from private miners, buyers had no choice but to depend on auctioned material.”

Market participants expect prices to remain range-bound in the coming days, as most buyers have already procured iron ore on need basis during the recent OMC auctions. A steelmaker informed BigMint, “Demand is likely to remain subdued until April, when new EC limits come in.”

A merchant miner commented, “With EC limits exhausted, we are unable to dispatch fresh material until April. Most buyers are aware of this situation and have already covered their requirements through OMC auctions.”

With limited trading activity and fresh supply expected only in the next month, market sentiment is expected to remain subdued for the next two weeks. However, price fluctuations may occur amid unexpected supply-side developments or changes in domestic demand trends.

Factors affecting iron ore market

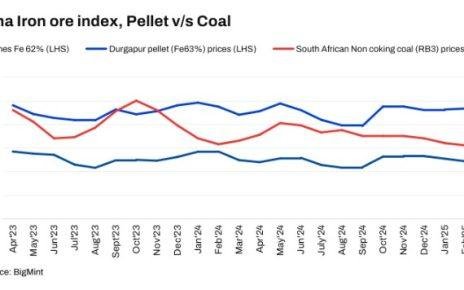

Pellet offers stable w-o-w: Pellet (6-20 mm, Fe 62.5%) prices in Odisha’s Barbil remained stable w-o-w at INR 8,500/t ($99/t) loaded to wagon. Pellet (Fe 62.5%, 6-20 mm) prices in Durgapur were also range-bound w-o-w at INR 9,450/t ($109/t) exw on 20 March.

Sponge iron prices up w-o-w: According to BigMint’s assessment, sponge iron C-DRI (FeM 80%) prices in Rourkela rose by INR 1,000/t ($11/t) w-o-w to INR 27,500/t ($313/t) on 23 March. Meanwhile, steel billet (100*100 mm) offers in Rourkela increased by INR 1,200/t ($14/t) w-o-w to INR 40,000/t ($458/t) today.

Rationale

- T1 – Four (4) deals of Fe62% fines were recorded in the publishing window, and two (2) were considered for price computation and given a 50% weightage for index calculation.

- T2 – BigMint received nineteen (19) offers and indicative prices under the T2 category (offers, indicative, and bids) in this publishing window. Fifteen (15) were taken into consideration and given a 50% weightage. To check BigMint’s iron ore assessment, pricing methodology, and specification document, click here.

Outlook

According to BigMint’s analysis, iron ore prices in the eastern part of the country are expected to remain range-bound. Additionally, trade will remain slow in the coming days.

Article From Bigmint

Do Follow: Intersteelbd