- Trades remain subdued after OMC auction

- Over INR 1,500/t ($18/t) drop witnessed in steel prices

- Market enters wait-and-watch mode before festive holidays

The iron ore market in Odisha saw restricted buying interest this week with miners raising prices following OMC’s auction. Trading volumes remained subdued due to weak demand from sponge iron makers and a downturn in the export market.

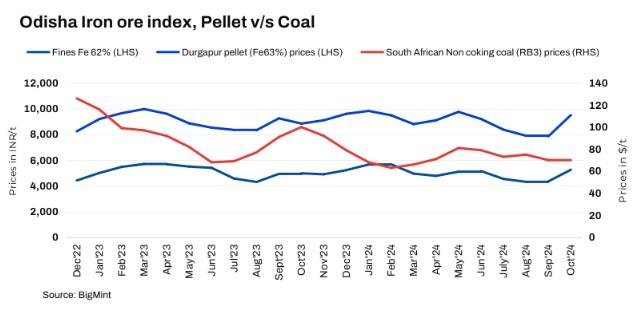

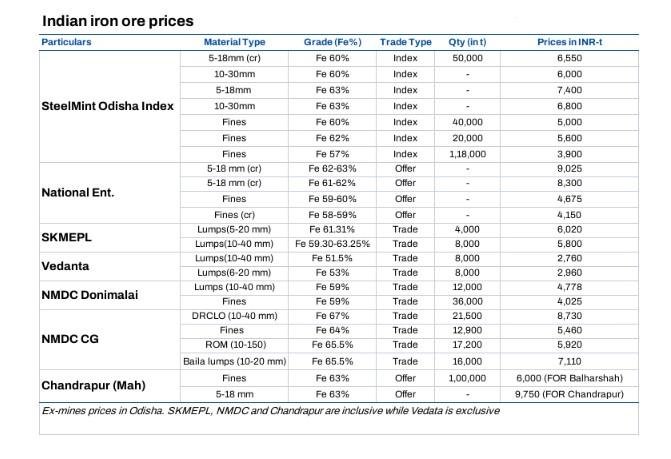

BigMint’s Odisha iron ore fines (Fe 62%) index remained stable w-o-w to INR 5,600/t ($67/t) ex-mines on 26 October 2024. Around 20,000 t of high-grade fines (Fe62+%) deals were recorded with some discounts from miners in this publishing window. BigMint recorded around 225,000 t of iron ore deals this week from the central-eastern region concluded by Odisha miners and traders.

The recent drop in sponge iron and finished steel prices have reduced interest in purchase of iron ore. Although there was a good premium in last week’s OMC iron ore auction, transactions have been slow, indicating that buyers in the region are being cautious. Sponge iron and billet prices declined by over INR 1,500/t ($18/t) this week in the central-eastern region amid weak market sentiments along with a lack of buying interest.

Miners have opted to keep their offers stable for the next few days, as they expect an improvement in steel market sentiment. The recent increase in iron ore prices by NMDC has encouraged miners in Odisha to maintain their current offers.

A miner commented, “Inquiries from buyers have significantly decreased leading up to the Diwali festival due to prevailing weak market sentiment. Steel plants, in particular, have been hesitant to accept the increased offers at current prices.”

Rationale

- T1 – Two (2) deals of Fe 62% fines were recorded in the publishing window. One (1) was considered for price computation and was given a 50% weightage for index calculation.

- T2 – BigMint received nineteen (19) offers and indicative prices under T2 offers, indicative, and bids in this publishing window. Eighteen (18) were taken into consideration and given a 50% weightage. To check BigMint’s iron ore assessment, pricing methodology, and specification document, click here.

Market highlights

- Domestic pellet prices rise w-o-w: Pellet prices in the domestic and seaborne markets showed a mixed trend this week with fluctuations in the global iron ore fines index. Pellet (6-20 mm, Fe 62.5%) prices in Odisha’s Barbil rose by INR 850/t ($10/t) w-o-w to INR 8,950/t ($106/t) loaded to wagon. Pellet (Fe 62.5%, 6-20 mm) prices in Durgapur rose by INR 50/t ($0.5/t)w-o-w to INR 10,000/t ($119/t) exw on 18 October. BigMint’s India pellet (Fe 63%, 3% Al) export index (FOB east coast) recorded stable w-o-w at $94/t on 25 October.

- Fines export prices stable w-o-w: BigMint’s bi-weekly Indian low-grade iron ore fines (Fe 57%) export index remained stable w-o-w at $60/tonne (t) FOB east coast, India, on 24 October 2024, with no deals reported in this period. Exporters largely took a wait-and-watch approach, refraining from making deals, as they expected a potential increase in seaborne prices.

- Sponge iron prices decline w-o-w: BigMint’s assessment of sponge iron C-DRI (FeM 80%) prices in Rourkela sharply fell by INR 1,700/t ($20/t) w-o-w at INR 27,900/t ($332/t) on 26 October. Meanwhile, steel billet (100*100 mm) offers in Rourkela decreased by INR 1,950/t ($23/t) w-o-w to INR 38,300/t ($455/t) today.

Outlook

Prices are expected to stay stable at current levels amid limited trading activity, as both miners and buyers have adopted a wait-and-see approach in response to current market dynamics.

Article Credit: Bigmint