- Around 50,000 t of pellet deals heard in Raipur

- Sponge iron, billet prices rise INR 500-600/t w-o-w

Raipur pellet prices started the week on a stable note, supported by active transactions and rising sponge iron and semi-finished steel prices over the past week. Market participants reported moderate buying interest as several buyers had already secured materials in previous weeks and were awaiting deliveries.

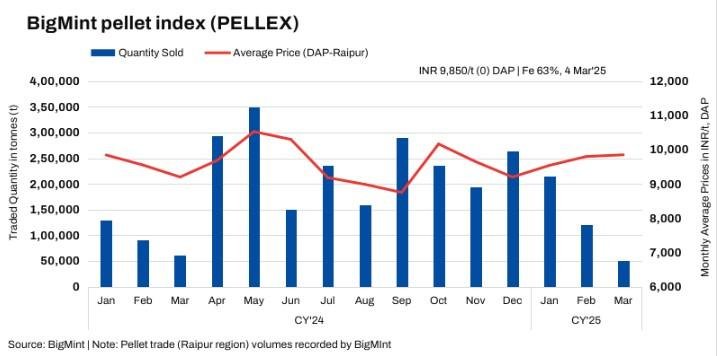

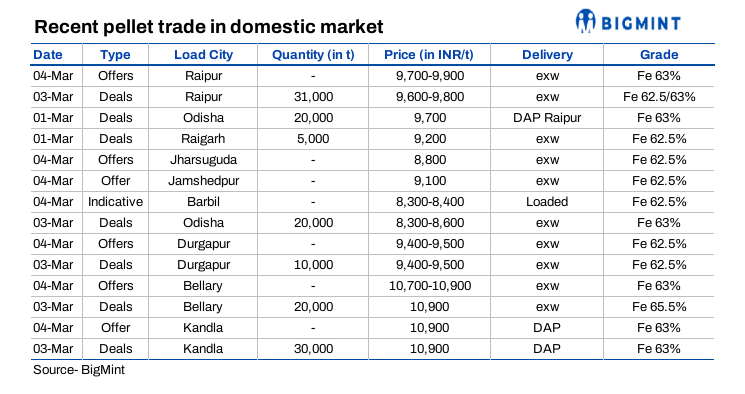

BigMint’s bi-weekly domestic pellet (Fe63%) index remained stable at INR 9,850/t ($113/t) DAP Raipur on 4 March 2025 compared to the previous assessment on 28 February. In this publishing window, around 31,000 t of pellet (Fe62.5/63%) deals were concluded by steelmakers at INR 9,850-9,950/t ($113-114/t) DAP Raipur. While around 20,000 t were booked by Raipur buyers at INR 9,700/t ($111/t) DAP.

Sellers in Raipur have maintained their offers, with a few transactions also being reported from Odisha, primarily driven by cost advantage. A manufacturer from Raipur commented: “We are seeing a few inquiries, but prices remain stable as we are still dispatching previous orders.”

Pellet offers in Raipur for Fe63% (+/- 0.5%) material remained stable at INR 9,700-9,900/t ($112-114/t) exw over the past couple of days. Odisha-based producers offered pellets in Raipur at INR 9,400-9,900/t ($108-114/t) DAP this week.

A Raipur-based trader informed, “Buyers are making purchases only for immediate needs, as many already have pending deliveries from previous orders. Local pellet producers are receiving inquiries at current price levels despite the cautious buying sentiment, indicating a steady demand.”

The recent increase of approximately INR 500-600/t ($6-7/t) in sponge iron and semi-finished steel prices in central India has boosted buying confidence. This uptick in downstream prices has resulted in a higher volumes of raw material trade. However, some steelmakers are still opting for NMDC lumps as an alternative to pellets.

Odisha-origin pellet sales to buyers in Raipur may see increased momentum due to competitive pricing. A Raipur-based buyer said, “Odisha offers are slightly cheaper, so we are seeing some deals happening from that region.”

Market participants expect that prices will remain firm in the near term, given the pending dispatches of old deals. Overall, the market remains stable, with sellers focusing on order completions while buyers take a cautious approach to new bookings.

Rationale

- PELLEX has been derived using data points, i.e., trades, offers, and bids. To download the detailed methodology, click here.

- Four (4) deals have been reported so far in this publishing window and Three (3) were taken for calculations. The T1 trade category was accorded 50% weightage.

- Sixteen (16) firm offers, bids, and indicative prices were heard. Fourteen (14) were taken for price calculation and given the balance 50% weightage.

Factors impacting pellet prices

- Sponge iron tags up w-o-w: P-DRI prices rose by INR 450/t ($5/t) w-o-w at INR 25,150/t ($288/t) exw-Raipur on 4 March. However, prices climbed by INR 250/t ($3/t) d-o-d today. Activity remained slow in today’s trading session amid weak buying interest.

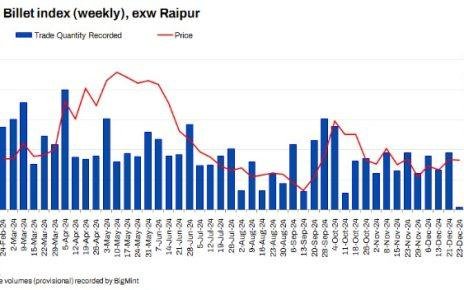

- Billet prices rise w-o-w: Billet prices in Raipur increased by INR 600/t ($7/t) w-o-w to INR 40,150/t ($460/t) exw today. D-o-d, prices rose by INR 350/t ($4/t). The index rose today due to increased buying activity in semi-finished and finished steel, with stronger demand boosting spot offers and encouraging active bookings.

Outlook

According to BigMint’s analysis, pellet prices are expected to remain stable at the current level, with need-based buying by the local steelmakers.

Article From bigmint