- Fluctuating steel demand impacts prices

- Cautious buying weighs on silico prices

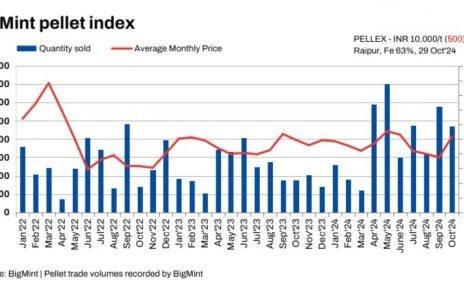

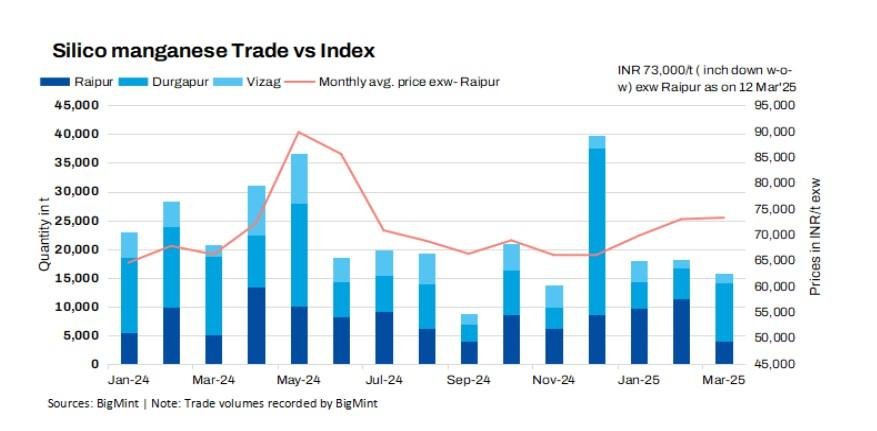

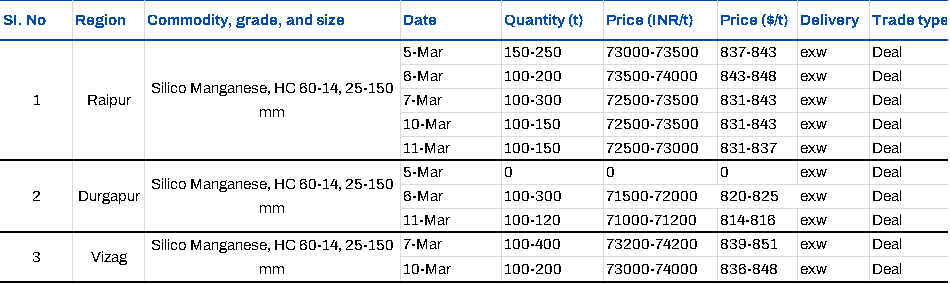

Domestic prices of 60-14 grade silico manganese edged down w-o-w by INR 550/tonne (t) ($6/t) to INR 71,600-73,100/t ($821-838/t) exw on 11 March 2025, as per BigMint’s assessment. Prices decreased due to the ongoing supply-demand imbalance in the market, coupled with persistent decline in steel demand. These factors have contributed to a reduction in market activity and pricing pressure across key producing regions.

In Raipur, offers mainly hovered at around INR 72,800-74,000/t ($835-$848/t); meanwhile, in Vizag, prices ranged between INR 73,500-74,500/t ($842-854/t) exw, with a few deals closing at these rates.

Meanwhile, the premium 60-15 grade remained unaltered w-o-w at around INR 75,000-76,000/t ($860-871/t) exw in Durgapur and Raipur.

Confirmed deals (as per BigMint)

Market overview

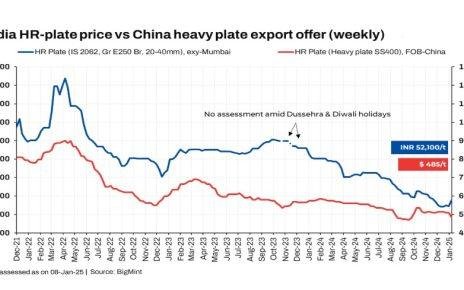

Instability in steel demand: Fluctuating demand for steel has resulted in a slight decline in silico manganese prices. This is due to ongoing market uncertainty, where reduced steel production and lower steel consumption have weakened demand for ferro alloys. As a result, the pricing pressure on silico manganese has increased, with a negative impact on market sentiment and transactions, contributing to the downward trend in prices in the short term.

Meanwhile, BigMint’s daily steel billet index closed at INR 39,900/t exw-Raipur on 12 March, down by INR 500/t w-o-w.

Supply-demand divergence pulls down prices: The supply-demand gap persists as demand remains sluggish while the market faces an oversupply situation. This imbalance has led to a downward pressure on prices, with producers struggling to align production levels with weak demand. Excess supply continues to exert strain on the market, further limiting opportunities for price recovery and contributing to an overall cautious market outlook in the short term.

Silico manganese export offers edge down w-o-w: Indian silico manganese export prices experienced a slight w-o-w decline, primarily driven by need-based procurement from buyers. This cautious approach reflects the prevailing market sentiment, where subdued downstream demand has limited purchasing activity. As a result, buyers are focused on meeting immediate requirements rather than committing to large orders.

BigMint’s assessment on 11 March of export prices of the 65-16 grade stood at $954/tonne (t) FOB, down by $4/t w-o-w. Meanwhile, the 60-14 variant also saw a decline of $9/t w-o-w to $857/t FOB.

Purchases to meet immediate demand: The market experienced need-based buying, as buyers focus on meeting immediate needs rather than engaging in large-scale procurement. This trend is primarily driven by cautious sentiment and the ongoing weakness in downstream demand, causing buyers to adopt a more conservative approach.

Outlook

The outlook for silico manganese prices remains cautious, with weak downstream demand and supply-demand imbalances. Prices are expected to fluctuate, depending on shifts in steel demand and global manganese ore prices.

Article from Bigmint