- CRC prices remain stable

- Export offers hold steady

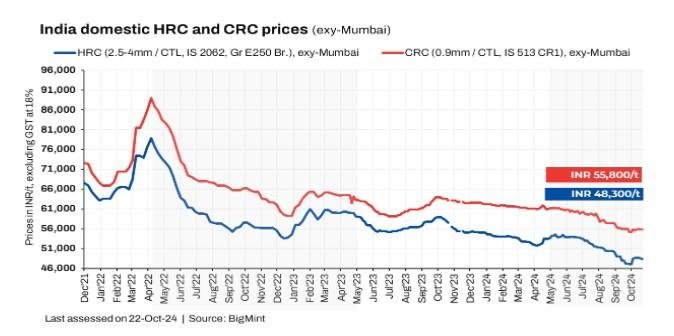

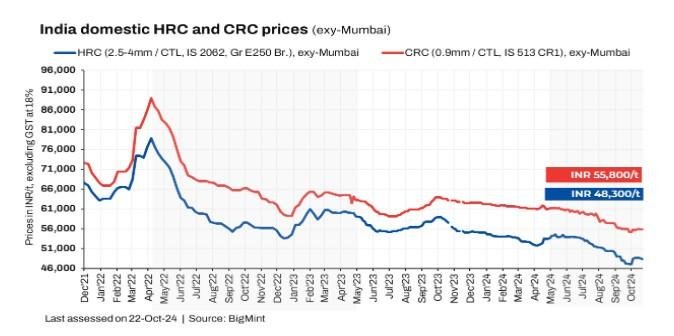

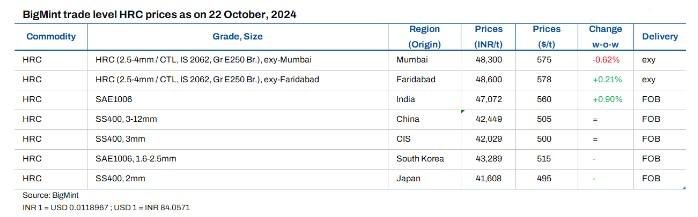

Hot-rolled coil (HRC) prices fell by up to INR 500/tonne (t) ($6/t) this week to INR 48,300-50,000/t ($575-595/t), amid subdued market activity, characterised by limited demand and need-based buying. Conversely, cold-rolled coil (CRC) prices exhibited stability, maintaining a range of INR 55,700 to 59,100/t ($663-703/t) across various regions.

BigMint’s benchmark assessment (bi-weekly) for HRCs (IS2062, Gr E250, 2.5-8 mm) fell by INR 200/t ($2/t) to INR 48,300/t ($575/t) on 22 October 2024. However, CRCs (IS513, Gr O, 0.9 mm) remained stable at INR 55,800/t ($664/t). These prices are quoted ex-Mumbai,India, excluding 18% GST, and are for cut-to-length (CTL) deliveries.

Market updates

1. Traders’ market witnesses correction: A sluggish traders’ market emerged ahead of Diwali, characterised by low demand and need-based purchase activity. Additionally, trading in the southern markets was adversely affected by persistent heavy rainfall.

A market participant noted, “As Diwali approaches, trading activity has been restricted to primarily need-based procurement. Auto OEMs and project sales, as well as some other sectors, are providing support; however, this is limited to a select number of participants.”

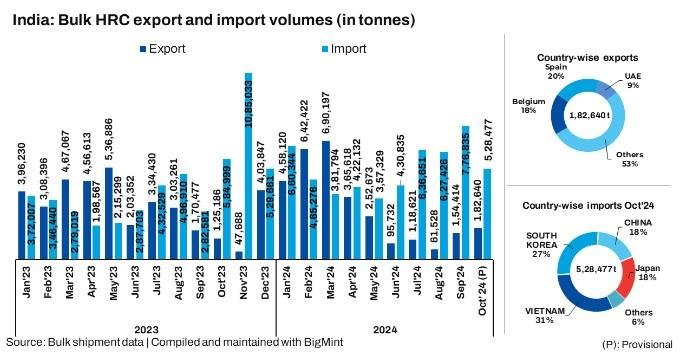

2. Import trends: The cumulative import volume, based on BigMint’s vessel line-up data, stood at 528,477 t till 21 October 2024. It was 776,835 t in September and 627,426 t in August. However, an additional 35,719 t are expected by the end of October, and another 51,260 t are scheduled to arrive in the first week of November.

Market updates

1. Traders’ market witnesses correction: A sluggish traders’ market emerged ahead of Diwali, characterised by low demand and need-based purchase activity. Additionally, trading in the southern markets was adversely affected by persistent heavy rainfall.

A market participant noted, “As Diwali approaches, trading activity has been restricted to primarily need-based procurement. Auto OEMs and project sales, as well as some other sectors, are providing support; however, this is limited to a select number of participants.”

2. Import trends: The cumulative import volume, based on BigMint’s vessel line-up data, stood at 528,477 t till 21 October 2024. It was 776,835 t in September and 627,426 t in August. However, an additional 35,719 t are expected by the end of October, and another 51,260 t are scheduled to arrive in the first week of November.

Article credit: Bigmint