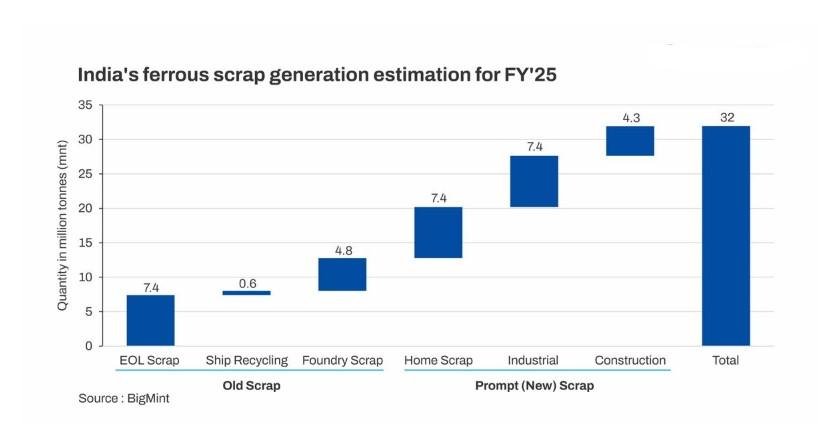

- Domestic scrap generation to reach 32 mnt in FY’25

- Supply shortfall of 8.5 mnt; dependence on imports to remain

- Scrap consumption to reach around 60-65 mnt by FY’30

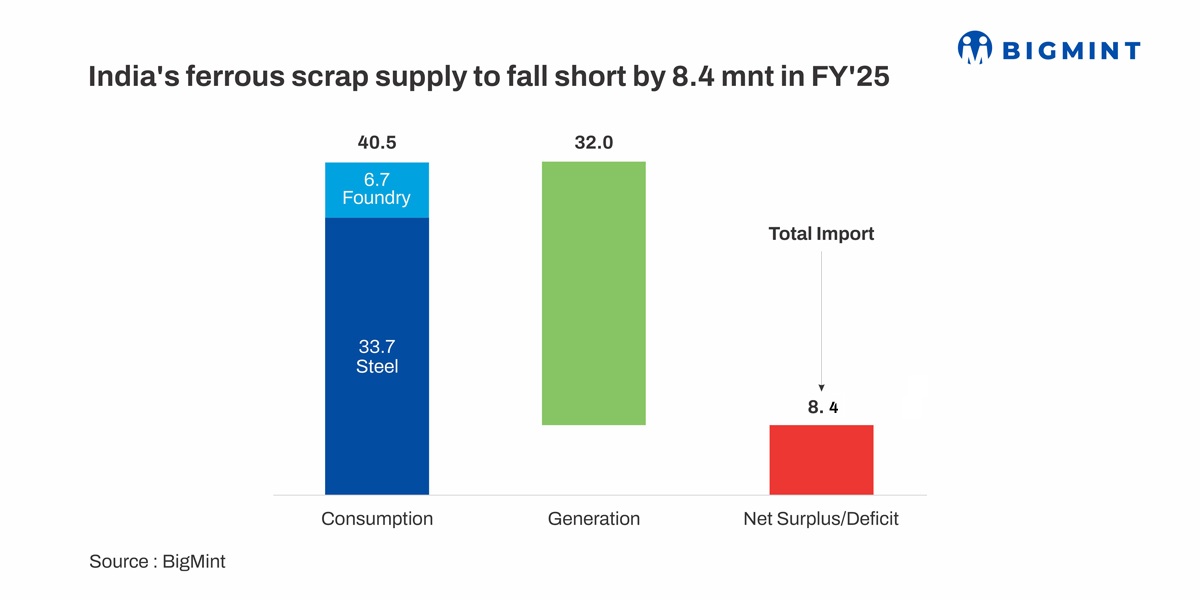

Morning Brief: India’s ferrous scrap generation is expected to grow by 8% y-o-y to 32 million tonnes (mnt) in FY’25, up from 29.7 mnt in FY’24, according to BigMint estimates. Total ferrous scrap consumption is projected to reach 40.4 mnt, widening the domestic supply deficit to 8.4 mnt.

To bridge this gap, India is likely to import around 8.2 mnt of ferrous scrap in FY’25, reinforcing its dependence on global scrap markets. While domestic scrap availability is improving due to affirmative policy interventions and investments in developing organised scrap collection and processing infrastructure, supply remains insufficient in meeting rising demand from secondary steel production in the country, as well as the foundry sector.

Supply & demand trends in FY’25

BigMint’s domestic scrap generation methodology segregates ferrous scrap into three key forms: home scrap, prompt scrap, and obsolete scrap, which includes end-of-life (EOL) vehicles, ships, construction materials, consumer appliances, etc. While domestic collection has improved, demand continues to outpace supply, driven by growing secondary steel production and higher scrap utilisation in steelmaking.

Total ferrous scrap consumption in FY’25 is expected to reach 40.4 mnt, with 33.7 mnt utilised in steel production and 6.7 mnt likely to be consumed by the foundry sector. The increasing use of scrap-based steel production aligns with India’s decarbonisation goals.

Total domestic steel scrap generation, on the other hand, is likely to reach around 32 mnt of which over 19 mnt are prompt scrap and home scrap derived from industrial production and from steel mills, while obsolete scrap generation is projected at 12.8 mnt.

Policy support, decarbonisation to drive scrap market

India’s transition towards sustainable steelmaking is being guided by the Ministry of Steel’s Vision 2047 roadmap. The plan aims to increase the share of scrap in steelmaking to 30% by FY’30, up from 20% currently. The Ministry has set an absolute target to reduce the average steelmaking emissions intensity in India and has formulated a green taxonomy for creation of domestic demand for low-emissions steel products.

As an important decarbonisation lever, scrap usage will surely be prioritised and policy focus is likely to be on creation of an organised value chain in the country. The Vehicle Scrappage Policy (2021) is expected to enhance EOL scrap availability in the mid-term. Due to the relatively smaller lifecycle of cars and other vehicles, this policy seeks to catch the low-hanging fruit for fast-tracking domestic generation on an immediate basis.

However, the impact remains gradual, and industry stakeholders will need to focus on improving collection efficiency and streamlining the recycling ecosystem.

Outlook FY’30

Looking ahead, India’s ferrous scrap consumption is projected to reach 60-65 mnt by FY’30, in line with an estimated crude steel production of 210-215 mnt. Domestic scrap generation is expected to increase to 45 mnt, but a supply shortfall of 15-20 mnt will remain.

To address this gap, India will need to focus on strengthening its domestic scrap recovery infrastructure while balancing imports and usage of alternative metallics such as sponge iron and pig iron. While iron ore-based steelmaking will remain dominant in FY’30, the shift toward scrap-based production will accelerate as India moves toward its net-zero emissions target of 2070.

Article from Bigmint