- Import shipments assessed at 1.09 mnt

- Growing preference for semis weighs on scrap imports

- Tariffs, subdued demand may continue to impact imports

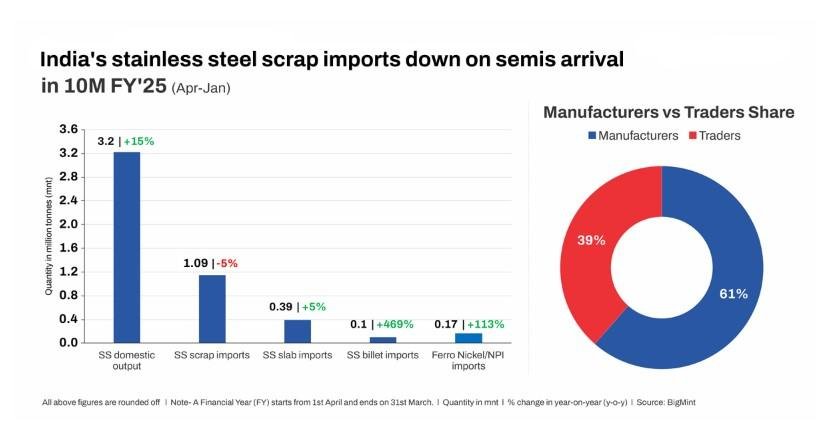

Morning Brief: India’s stainless steel (SS) scrap imports saw a 5% decline in the April-January period of the current fiscal (10MFY’25) settling at 1.09 mnt against 1.15 mnt seen in the same period last year.

Domestic stainless steel output saw an increase of 15% in 10MFY’25. While an increase in production would typically lead to higher scrap imports, the combination of higher billet imports and competitive pricing for semi-finished materials altered this dynamic.

Out of the total stainless steel scrap imports, manufacturers accounted for 61% with 0.67 mnt, while traders imported 39%, totaling 0.40 mnt. Although the number of manufacturers importing scrap was lower than that of traders, their share was higher in terms of volume due to the larger quantities they imported.

Series-wise, grade-wise performance

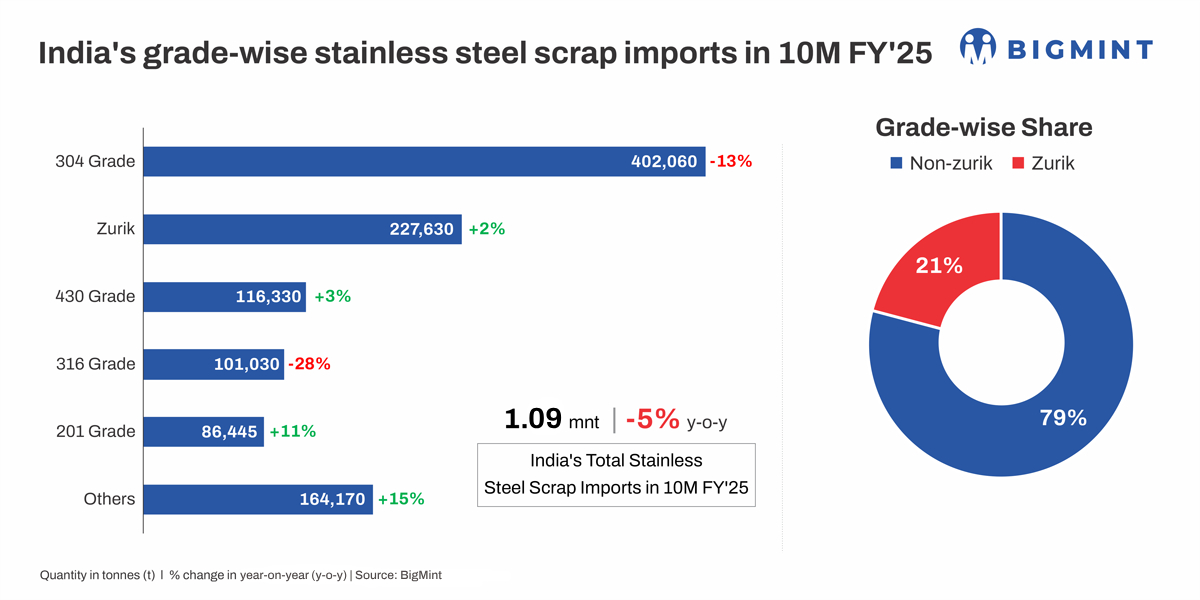

Significantly, arrivals of the 300 series saw a 13% decline in this review period to 0.75 mnt (0.83 mnt). In terms of grades, the 304 fell 13% and 316 by a hefty 28%.

Meanwhile, the zurik grade saw a marginal increase of 2%. Domestic recyclers separate zurik scrap into 304 scrap and red metals, which are subsequently sold to local producers. While the 430 grade experienced a 3% rise, the 201 grade saw an 11% increase during the same period.

Factors impacting SS scrap imports

Shift towards semis

A significant factor behind the decline in India’s stainless steel scrap imports is the growing preference for semi-finished products such as slabs and billets, which offer cost advantages over scrap.

Indonesia, in particular, has become a key supplier of 300-series semi-finished slabs, with steady imports reaching 0.39 mnt in 10MFY’25, a marginal rise of 3% y-o-y compared against 0.38 mnt in CPLY. This shift has been further supported by the increased availability of nickel pig iron and ferro-nickel, which are used in producing stainless steel billets, further reducing the need for scrap.

As per provisional data maintained by BigMint, billet imports jumped dramatically from just 0.017 mnt in 10MFY’24 to 0.1 mnt in the corresponding period of 10MFY’25, marking a 469% increase. While Sweden was India’s largest billet supplier in 2023, Indonesia emerged as the top supplier in 2024, with nearly 90,000 t – an impressive shift from the previous year, when its share was negligible. This change has significantly reduced India’s reliance on scrap, particularly for long product manufacturing.

Additionally, India’s ferro nickel/NPI imports rose significantly by 113% reaching 0.17 mnt in 10MFY’25 compared to 0.08 mnt in 10MFY’24. Since ferro-nickel/NPI can be a substitute for scrap, its increased imports can reduce scrap arrivals. The influx of ferro nickel/NPI is applying further downward pressure on scrap prices.

Growth in domestic production

India’s stainless steel production grew by 15% in 10MFY’25 to 3.2 mnt, up from 2.7 mnt in 10MFY’24. Notably, the production of finished flats and longs increased by 14% and 18% y-o-y, respectively. This boost in domestic output reduced the need for imported scrap, as producers could rely more on locally sourced materials and semi-finished products.

Low finished SS demand drives need-based buying: Indian SS demand was relatively low in 10MFY’25 which led mills to opt for need-based procurement of imported scrap, to avoid inventory-build-up. Plus, stable domestic scrap availability and pressure on finished SS prices led to a focus on local sourcing and selective, cost-effective imports.

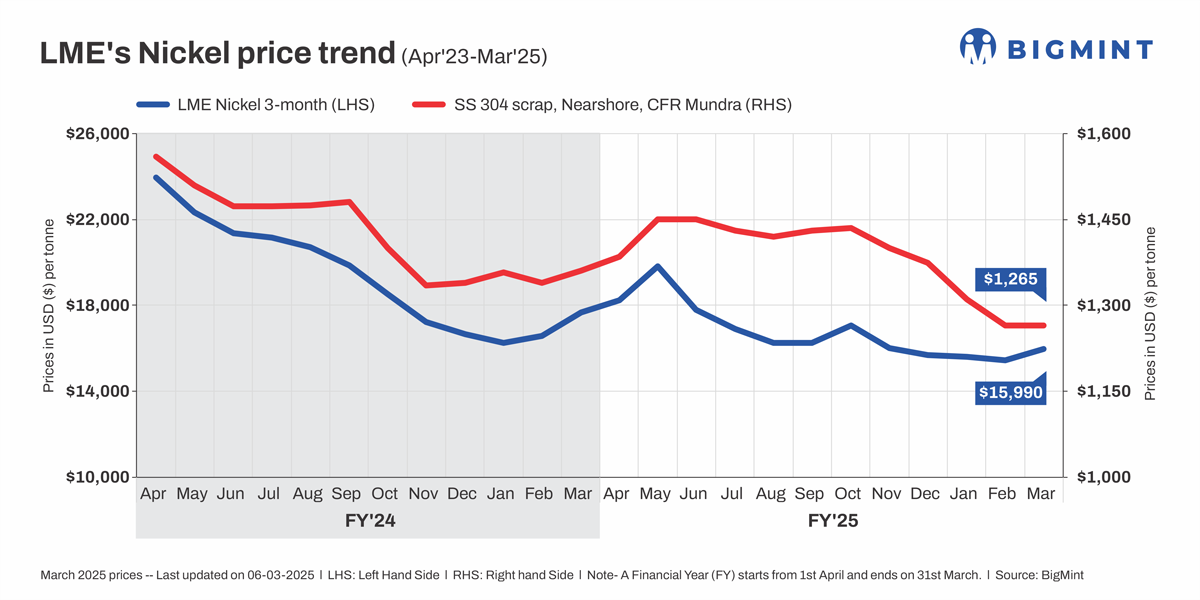

Preference for domestic scrap: As per BigMint’s assessments, SS 304 scrap from the near shore regions were $1,410/t CFR Mundra, 2% lower compared to $1,440/t in 10MFY’24. Meanwhile, domestic SS 304 scrap was at INR 120,330/t ex-Delhi.

Imported scrap prices saw a decline majorly due to the drop in LME nickel prices. In 10MFY’25, LME nickel prices stood at $16,960/t, down by 14% y-o-y. The drop in LME nickel prices was majorly due to rising inventories at warehouses which saw an increase of 81,580 t, reaching 125,511 t in 10MFY’25 from 43,931 t in the CPLY.

Despite the decrease in imported scrap prices, buyers preferred local material as the landed cost of imported scrap reached INR 123,000-125,000/t, which was INR 3,000-5,000/t higher compared to domestic material.

Ripple effect of Trump’s tariffs on trade

India is in a solid economic position but is closely monitoring the US where developments could have significant implications for global markets.

The US has been the largest supplier of ferrous and stainless steel scrap to India and many other countries, and with domestic demand for scrap rising in the US, exports to countries such as India might see a decrease.

US supplied 0.2 mnt of stainless steel scrap to India in 2024 of the total 1.1 mnt, accounting for 9%.

Two possible scenarios

First, the US, being a scrap-dependent market for ferrous metals, might increase its imports from countries such as Canada and Mexico, as the tariffs on steel could limit its ability to import finished steel products.

The second scenario involves the US consuming more of its own domestic ferrous scrap to produce steel, which would reduce the availability of scrap for export to other countries and increase the tags as well.

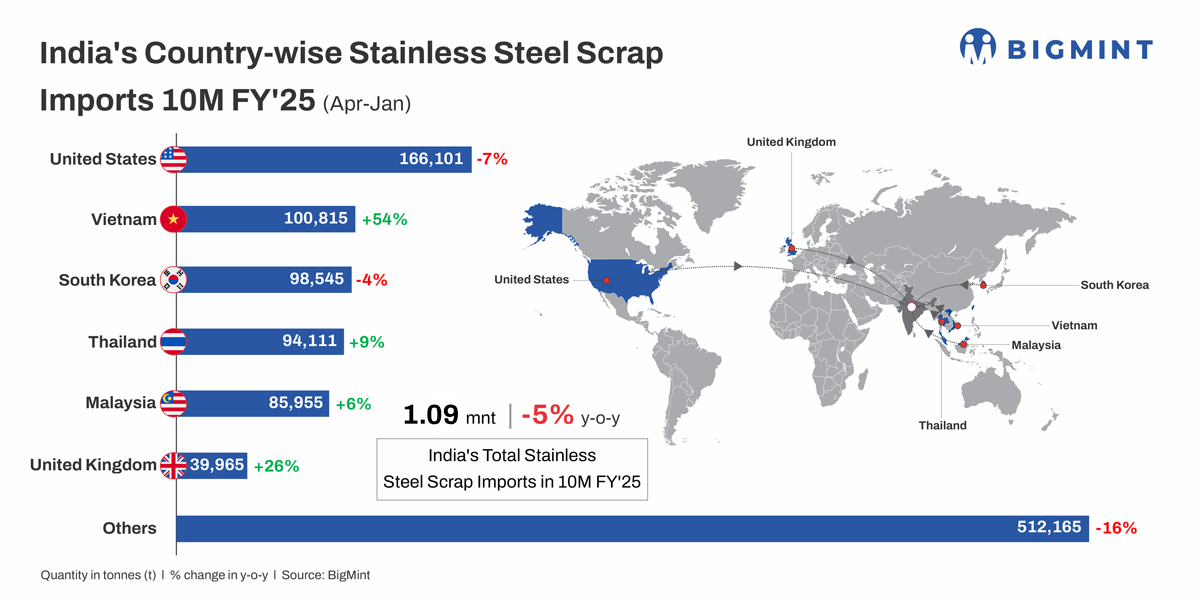

Country-wise imports

In 10MFY’25, India saw a 7% decrease in imports from the United States compared to the same period last year. On the other hand, imports from Vietnam experienced a significant 54% increase, while imports from South Korea declined by 4%. India also saw positive growth in imports from Thailand and Malaysia, with increases of 9% and 6%, respectively. Imports from the United Kingdom grew by 26%. However, the “Others” category saw a 16% decline in imports.

Outlook

India’s SS scrap imports are likely to trend lower in the short- to medium-term because ferro-nickel imports in the first half of CY’24 surged by around 64% to 82,766 t. This trend is expected to sustain in the coming months. Moreover, continued rise in imports of semis such as slabs and blooms from Indonesia can put further pressure on imported scrap. Also, market participants are cautious about the impacts of Trump’s tariffs.

Article From bigmint