- round 100 mnt deficit may emerge in global HCC market by 2045-2050

- Growing methane emissions, strict climate regulations threaten to reduce supplies

- Expected mid- to long-term price surge to impact large Indian steel mills

Morning Brief: There is a growing threat of diminishing supplies of prime coking coal in the global market which casts a long shadow on the steel industry in different countries that are gearing up to increase their production through the BF-BOF route.

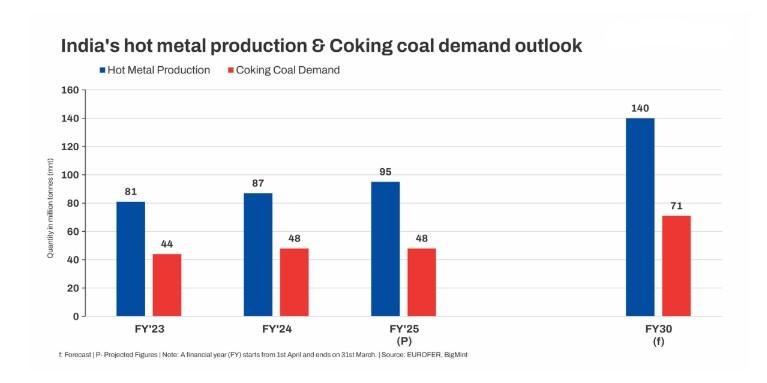

India, of course, is the first case in point. India’s production of steel through the BF-BOF route is slated to rise to around 55% by 2030 from around 44-45% currently, as per BigMint data.

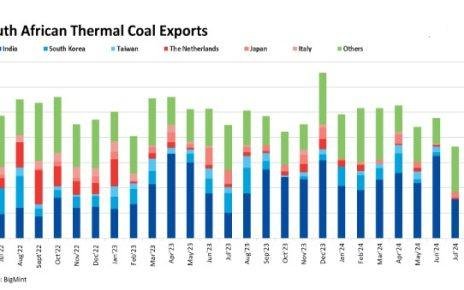

Australia still remains the key source of coking coal supplies to India, although the domestic mills have diversified their sources of imports.

The long-term threat of diminishing prime coking coal supplies into the global market from Australia, which would directly impact the Indian market, is a matter of concern for the big domestic steel mills which have robust capacity expansion plans.

How are Indian buyers adjusting?

All the leading Indian buyers of high-grade coking coal from Australia have taken lessons from the sharp spike in prices in 2022 following the phenomenal surge in energy prices globally due to geopolitical disturbances and trade imbalances.

As India relies on imported coking coal to meet around 90% of its requirements, the domestic steel industry has wisely chosen to:

a) increase the blend of domestic coking coal through adoption of stamp charging technology

b) focus on building domestic washeries and reviving old ones

c) Diversify import sources to lessen dependence on any one country and thereby maintain some hold in the market

d) Build coking coal mining assets in different countries to feed domestic mills in India

e) Reduce the coke rate

f) blast furnaces through increased use of PCI as a cost-effective measure and also reduce overreliance on prime coal by sourcing weaker and tier-2 grades of coking coal for blending mainly from Russia

Growing supply threat from Australia

“Despite efforts to diversify, Australia remains the top coking coal supplier to India and the growth in India’s BF technology for steelmaking will increase the reliance on imports, which is kind of an energy security challenge for India,” said Simon Nicholas, Lead Analyst, Global Steel, IEEFA, at the recently held Coaltrans India 2025 in New Delhi.

“There is growing doubt about the long-term supply of hard coking coal from Australia. Around four years ago, Tata Steel’s CEO visiting Australia at that time had expressed concerns that not enough investments are happening to boost coking coal capacity in Queensland,” stated Nicholas.

“In fact, there is growing apprehension that by 2050 there might emerge a 100 mnt deficit in the global coking coal market,” he said.

Factors triggering supply deficit

*Australian govt overestimating exports: The Australian government has been consistently overestimating the outlook on total exports. Back in 2020, the government had projected met coal exports at 210 mnt, while total exports were lower than 160 mnt. “Maybe the government is trying to project a rosier picture on the supply front to appease coal industry interests,” suggested Nicholas.

Over the last five years exports from Australia have declined because of significant slowdown in sales to China, India diversifying imports, frequent disruptive weather events in Queensland, etc.

*Met coal project pipeline dries up: In its 2024 outlook report, the IEA has noted that exports from Australia may decline by 5% till 2027. Despite periods of high margins, the metallurgical coal project pipeline in the country is drying up, it said.

*Diversified miners selling off assets: Anglo American has sold off its coking coal assets and BHP has also sold its lower-grade coal mines. Rio Tinto exited met coal mining in 2018. Growing ESG concerns, of course, remain the key reason. Miners encouraged by shareholders and the financial sector are slowly divesting assets. Pure-play coal miners are lapping up these assets in order to diversify to met coal from thermal coal.

It is considered safer to invest in developed assets rather than building greenfield projects due to toughening climate laws. Even BHP has raised objection to high royalty rates in Queensland to declare that it may not be feasible to continue operations for long. Royalties today are far higher than in 2021.

*Banks abandoning coal: The National Australia Bank (NAB) in its 2024 climate report has stated that the group will not provide project finance to a greenfield metallurgical coal mine. The NAB is reducing exposure to coal in the mid to long-term much like the Commonwealth Bank because it expects steelmaking technology to mature resulting in lower demand for met coal and lower CO2 emissions.

*Methane emissions from mining: Concerns have been raised regarding the significant underreporting of methane emissions from met coal mining in Queensland. Controlling methane emissions, with severe potential of short-term global warming, has emerged as a key plank of climate action in Australia.

Outlook

Declining supplies from Australia are doubtless a major bother for the large domestic steel mills. Although the US may increase production and exports in the mid-term, prospects are undermined by high costs. However, gradually dwindling European demand may drive US suppliers to focus more on India.

Canada is hamstrung by strict climate regulations. Russia has increased exports phenomenally but undeveloped logistics networks, high rail freights, and economic and trade pressure are expected to weigh on coal exports.

Interestingly, China may start moving some volumes into the seaborne market from 2030 onwards amid growing reliance of its domestic steel industry on EAF technology.

Therefore, the supply deficit in the hard coking coal (HCC) market which is expected to emerge around 2035-2040 may drive up prices of the commodity, thereby hurting Indian users the most.

Article From bigmint