- Bid-offer mismatch, muted steel market impact India

- Turkish prices drop, steel mills wary amid weak sales

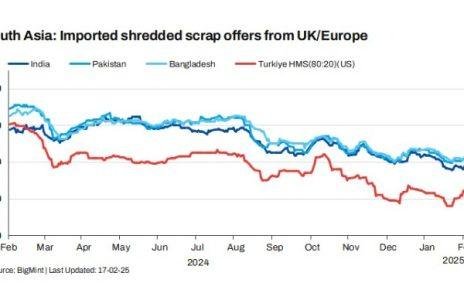

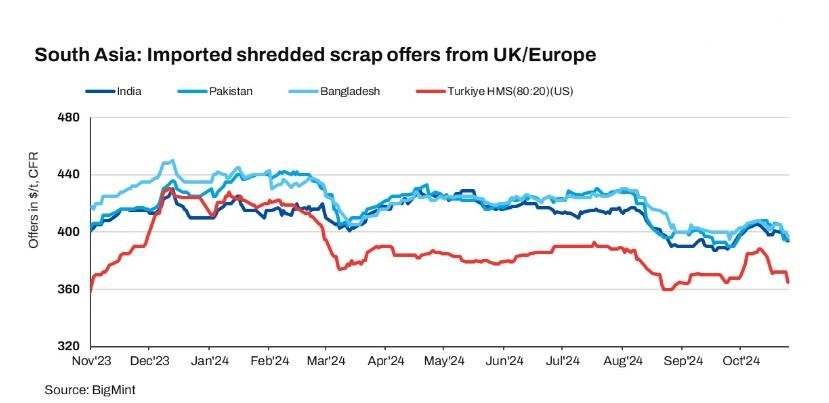

South Asia’s imported ferrous scrap markets remained under pressure today, reflecting sluggish demand across India, Pakistan, and Bangladesh amid weak domestic steel sales and cautious buyer sentiment. Prices dropped d-o-d across South Asia.

In India, a mismatch between buyer and seller expectations, coupled with a slowdown in steel activity ahead of key festivals, kept the market muted. Pakistan also saw reduced demand as previously booked material arrived, leading buyers to avoid fresh bookings. Bangladesh’s market was similarly quiet, with high inventories and low interest in bulk purchases. Meanwhile, Turkiye’s imported scrap market saw a sharp price drop, as domestic mills resisted high-priced offers.

Overview

India: India’s demand for imported scrap remained subdued, with activity dampened by a bid-offer mismatch and a slowdown in the domestic steel market ahead of key festivals. Indicative offers for shredded from the US and UK/Europe were at around $390-395/t CFR Nhava Sheva, while HMS (80:20) was quoted at $370-380/t CFR.

A trading company representative said, “The market response to offers has been muted, as buyer and seller expectations remain mis-aligned.”

Pakistan: Pakistan’s buyers slowed down on booking imported scrap from the seaborne market, as previously booked material have been arriving and are being offered at competitive prices. Furthermore, sluggish domestic steel sales reduced the demand for raw materials.

Indicative offers for shredded scrap from the UK/Europe were at $395-398/t CFR Qasim, while bids were at $390-392/t CFR.

Bangladesh: Bangladesh’s imported scrap market stayed slow today, with only limited buying interest. Major buyers remained on the sidelines due to high inventories and ongoing sluggish steel market sentiment, with most activity limited to small-scale purchases.

Indicative offers for shredded from Australia held firm at $405/t, but buyers countered with bids at around $395/t, showing minimal interest in bulk transactions.

Overall, poor demand for finished products, especially steel bars and billets, continued to dampen the market today.

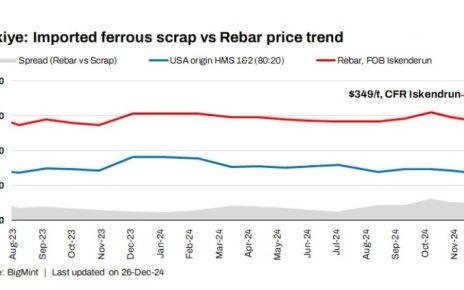

Turkiye: The Turkish imported scrap market saw a significant drop today, as deep-sea ferrous scrap prices fell sharply, under pressure from mills. Offers for US-origin HMS (80:20) were assessed at $365/t CFR, down $7/t from the previous day. EU-origin HMS was at around $360/t CFR or lower, as mills resisted higher prices. EU recyclers were hesitant to accepting these levels, given current dock prices, with HMS in the Benelux region reported at EUR 285/t.

Recently, a Marmara mill secured an EU-origin deal for 25,000 t, with HMS (80:20) at $358/t CFR and bonus at $378/t CFR.

Notably, steelmakers are cautious, with one Turkish mill source noting a delay in bids due to sluggish finished steel sales, keeping market sentiment largely bearish for the near term.

Price assessments

India: UK-origin shredded scrap indicatives edged down by $1/t to $394/t CFR Nhava Sheva compared to the previous day.

Pakistan: UK-origin shredded indicatives remained stable d-o-d at $395/t CFR Qasim.

Bangladesh: UK-origin shredded prices inched down by $3/t d-o-d to $397/t CFR Chattogram.

Turkiye: US-origin HMS (80:20) bulk prices dropped by $7/t to $365/t CFR Turkiye compared to yesterday.

Article Credit: Bigmint