- Pakistan market slows due to Ramadan

- Indian buyers show lukewarm demand

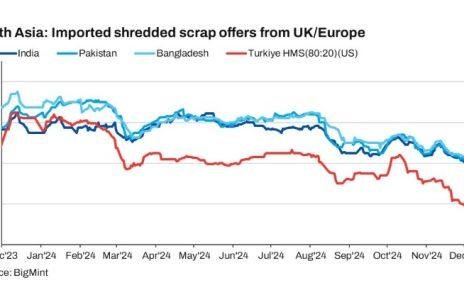

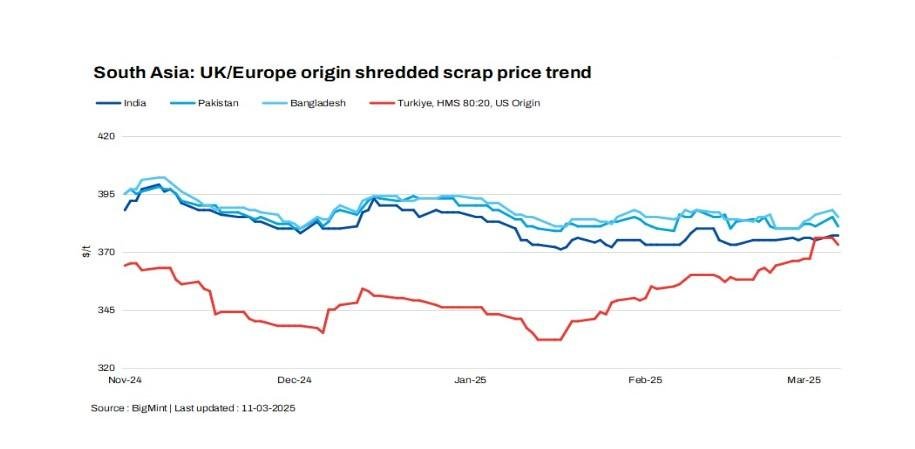

The South Asian imported ferrous scrap market showed mixed trends, with India, Pakistan, and Bangladesh remaining subdued due to weak demand and Ramadan-related slowdowns. Buyers remained cautious amid a bid-offer gap, while Turkiye saw firmer sentiment driven by rising FOB prices and resilient seller expectations.

Overview

India: Imported scrap demand in India stayed lukewarm, with buyers cautious due to the ongoing mismatch between bids and offers.

Indicative offers for UK/EU-origin shredded scrap stood at $375-380/t CFR Nhava Sheva, while HMS 80:20 from the same region was quoted at $355-360/t. However, actual buying interest was weaker, with bids for shredded material around $370-375/t. US turnings were offered at $335/t, with bids at $332/t, and Australian HMS was offered at $365/t CFR Chennai, while buyers responded with bids at nearly $355/t.

Although the UK and EU suppliers are hopeful of price increases in line with the US market, weak demand across India, Pakistan, and Bangladesh suggests any significant upward momentum is unlikely in the near term.

Pakistan: The Imported scrap market remained largely inactive this week, with Ramadan festivities slowing down trading momentum. Offers for UK/EU-origin shredded scrap hovered around $380-385/t CFR Qasim, but bids stayed lower at $378-380/t, reflecting weak buying appetite. No counter bids were seen for ship plate scrap either, despite indicative offers around $383/LDT.

Most market participants are operating at reduced capacity at around 50%, as many use this period for maintenance or pause activity. Payment delays and a general caution toward taking on new liabilities have further dampened sentiment. Additionally, strong availability of domestic scrap is limiting the urgency for imports.

Despite the current lull, liquidity isn’t a major concern, and traders are eyeing a potential pickup in demand post-Eid, with bookings expected in April-May once the market outlook becomes clearer.

Bangladesh: In Bangladesh, the imported scrap market remains quiet, with no significant offers or deals reported this week. Buyer sentiment stays cautious amid weak demand and ongoing pricing uncertainty.

Japanese H2 scrap is estimated at around $360-365/t CFR Chattogram, supported by firm freight rates from Japan, currently at $50-55/t. Rising FOB prices from Japan have also added to the upward pressure, though overall market activity remains subdued for now.

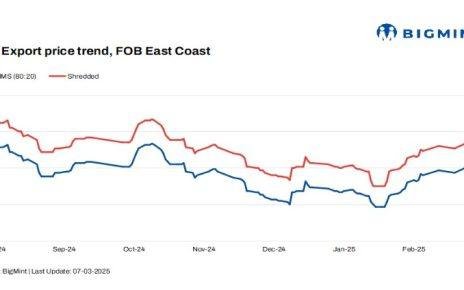

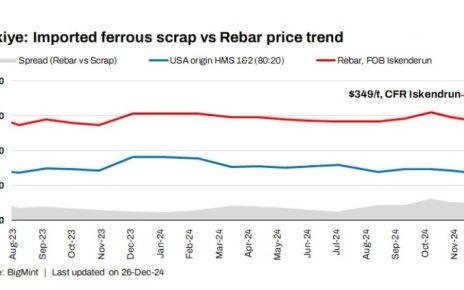

Turkiye: Turkish imported scrap prices edged down by $3/t d-o-d amid limited activity. Sellers held firm on their expectations despite falling HMS collection costs in Benelux. US-origin HMS (80:20) was indicated at $370-375/mt CFR, while EU-origin scrap was around $366-370/t CFR, normalised to $371-375/t CFR.

A bid for EU-origin HMS was rejected as recyclers remained bullish. The Euro slightly depreciated but remained stronger than the previous week. Despite currency challenges, sentiment pointed towards an upward price movement, with expectations of $370/t CFR for EU scrap and $375/t CFR for US-origin material.

Price assessments

India: UK-origin shredded indicatives were assessed remained stable at $377/t CFR Nhava Sheva.

Pakistan: UK-origin shredded indicatives stood at $381/t CFR Qasim, down by $4/t d-o-d.

Bangladesh: UK-origin shredded indicatives inched down by $3/t d-o-d to $385/t CFR Chattogram.

Turkiye: US-origin HMS (80:20) bulk scrap prices edge down by $3/t at $373/t CFR Turkiye.

Article From Bigmint