- India stays quiet amid bid-offer gaps, liquidity issues

- Pak resists high offers, shows interest in UAE scrap

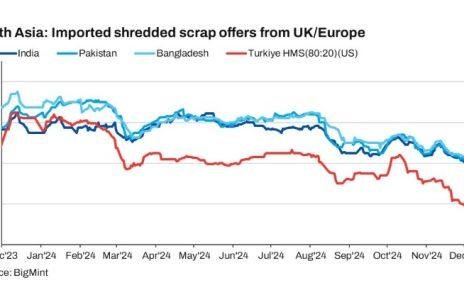

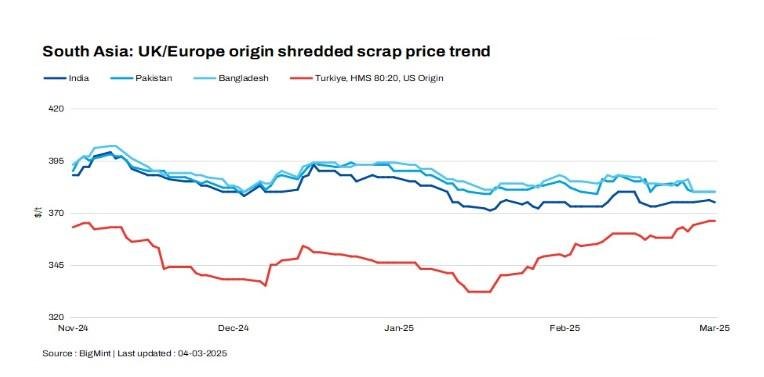

South Asia’s imported scrap markets remained subdued, weighed down by sluggish demand, liquidity constraints, and cautious buying amid Ramadan. Offers for UK-origin shredded remained unchanged d-o-d in Pakistan and Bangladesh, while they edged down by $1/tonne (t) in India.

India faced a persistent bid-offer gap amid weak steel demand, while Pakistan saw limited activity as mills resisted high offers, with buyers favouring UAE material for faster transit. In Bangladesh, letter of credit (LC) opening delays and high deep-sea bulk offers kept market movements slow.

Meanwhile, Turkiye’s scrap market remained range-bound, and mills were hesitant to accept higher prices due to weak rebar sales. US bulk HMS (80:20) offers remained stable d-o-d today.

Overview

India: India’s imported scrap market remained sluggish today due to weak buying interest, a persistent bid-offer gap, tight cash flows, and lower-than-expected demand from the steel sector. Indicative offers for UK/Europe-origin shredded stood at $375-380/t CFR Nhava Sheva, while bids hovered at around $365-370/t CFR. Notably, US-origin offers remained absent due to high freights and unviable prices.

Meanwhile, HMS (80:20) offers from the UK/Europe were at $350-355/t CFR, with bids heard at $340-345/t CFR.

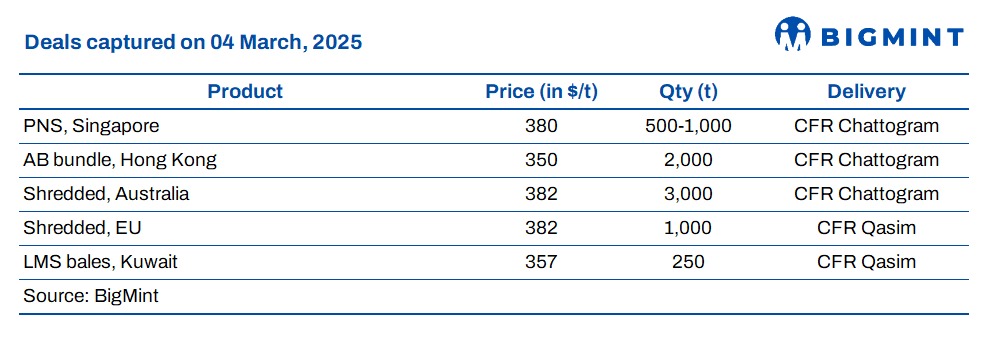

Pakistan: Pakistan’s imported scrap market remained sluggish, as Ramadan dampened buying interest. The segment was further weighed down by weak liquidity and subdued steel demand. Mills resisted high offers, with UK/European shredded at $380-382/t CFR Qasim, though buyers sought $375-378/t CFR. UAE-origin shredded was offered at $385/t CFR but could be negotiated down to $380/t. HMS stood at $358/t CFR, reflecting weak sentiment.

Notably, buyers showed more interest in UAE material due to faster transit.

Meanwhile, domestic scrap prices were at PKR 140,000-145,000/t ($501-519/t) and rebars were at PKR 245,000-250,000/t ($876-895/t).

Bangladesh: Bangladesh’s imported scrap market remained slow, as Ramadan impacted buying interest, with LC openings continuing at a sluggish pace. Deep-sea bulk inquiries saw limited activity, as buyers resisted high offers. Malaysian PNS was offered at $390/t CFR, but bids stood at $382/t.

Suppliers from Hong Kong focused more on PNS, H-beams, and HMS rather than shredded. The domestic market also remained quiet amid a slowdown in construction and infrastructure activities.

Turkiye: The Turkish imported scrap market remained range-bound, with prices inching down amid slow activity and limited restocking urgency. Turkish mills resisted further increases due to sluggish rebar sales, despite strong US sell-side sentiment. An EU-origin deal was booked at $358/t CFR, while US/Baltic-origin scrap hovered at around $365/t CFR. The US scrap market was firm, with expectations of rising prices due to tight supply and strong demand from mini-mills.

However, weak rebar sentiment in Turkiye raised doubts about mills’ willingness to accept higher scrap prices, keeping the market cautious at the start of the week.

Price assessments

India: UK-origin shredded indicatives were assessed at $375/t CFR Nhava Sheva, down by $1/t d-o-d.

Pakistan: UK-origin shredded indicatives remained flat d-o-d at $380/t CFR Qasim.

Bangladesh: UK-origin shredded indicatives were assessed stable d-o-d at $380/t CFR Chattogram.

Turkiye: US-origin HMS (80:20) bulk scrap prices were assessed unchanged d-o-d at $366/t CFR Turkiye.

Article From bigmint