- Alang faces pressure from falling tags, US steel tariffs

- Gadani shows slight activity but stays largely inactive

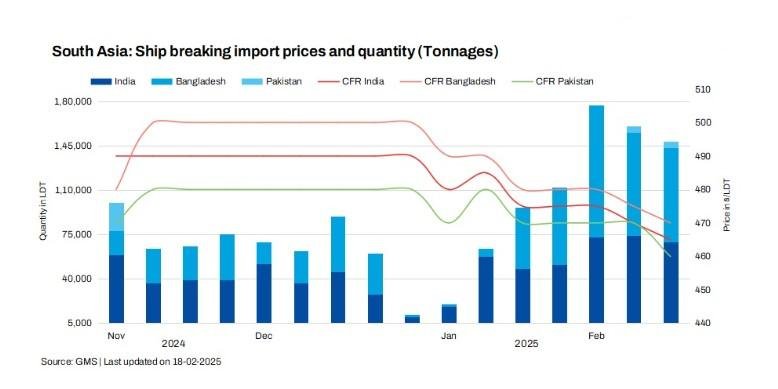

South Asia’s ship-breaking markets faced challenges in week 8 of CY’25. Alang’s market weakened due to concerns over the possibility of increased Chinese steel shipments and declining prices. Pakistan’s Gadani cluster showed limited activity, while Bangladesh’s Chattogram struggled with political and economic uncertainty, despite busy anchorages and declining bids.

Alang’s market faces uncertainties amid US steel tariff announcement

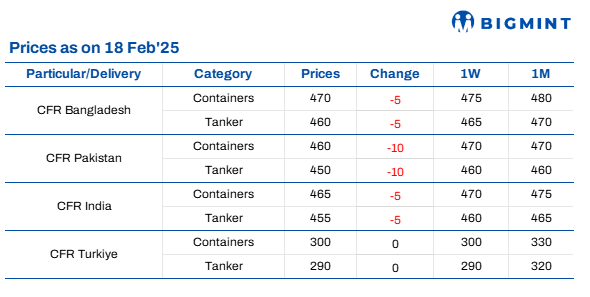

India’s ship-breaking market faced challenges, as the US announced 25% tariffs on Chinese steel, raising concerns that excess Chinese inventory could flood markets in the Indian sub-continent, leading to price cuts. This amplified the downward pressure on Indian steel prices, which have already dropped by over $11/t in recent weeks. Amid sluggish demand and limited activity, the local market remained weak.

According to a participant, “The market softened, with lower levels observed. However, sellers held firm on higher asking prices, leading to minimal activity last week. Bulk carrier prices were expected at around $425/light displacement tonnage (LDT), while sellers demanded $445/LDT, creating a $20/LDT gap that stalled negotiations.”

Another participant suggested that with no active sales and a sluggish market, prices declined by $10/LDT across all segments.

Current offers

- Dry bulk carriers: $420-430/LDT

- Containers: $470-480/LDT

- Tankers: $435-445/LDT

In week 8, Alang Port received 69,368 LDT, down slightly from 74,349 LDT in the previous week.

Pakistani buyers hold off from purchases until prices decline

In week 8, Pakistan’s ship recycling rates remained unattractive due to economic instability, government issues, and potential IMF corruption probes. Cash shortages and reliance on US dollar transactions forced secondary buyers to reduce offers, leading to a price decline.

However, the market showed signs of revival, as Gadani’s yards recorded a few recent sales and one delivery after months of inactivity. However, no new arrivals were reported at the anchorage, and despite competitive local offers, larger LDT vessels continued to head to Alang, leaving Gadani’s activity subdued.

Market participants expect a wait-and-watch approach until bulk carrier prices drop below $440/LDT.

In week 8, Gadani Port received 5,204 LDT, steady w-o-w. A rebound has taken place after months of inactivity.

Bangladeshi market faces strain amid stagnant economy

In week 8, Bangladesh’s ship recycling market faced challenges despite the arrival of larger LDT vessels from the Far East, including floating storage units (FSUs), Capesize bulkers, and LNG tankers. Chattogram’s anchorage remained active, but political uncertainty and a stagnating economy weighed on the sector.

The approaching deadline for yard infrastructure upgrades under the Hong Kong Convention added financial strain, with top recyclers already fully booked, leading to lower upcoming offers and prompting ship owners to seek cost-effective alternatives.

While global tariffs posed a risk, Bangladesh’s geographic advantage provided some insulation.

In week 8, Chattogram Port received 74,268 LDT, down from 81,597 LDT in the previous week.

Article From Bigmint