- Daehan Steel, YK Steel’s stocks see 11.2% w-o-w fall

- Korea Special Steel’s inventory surges 21.8% w-o-w

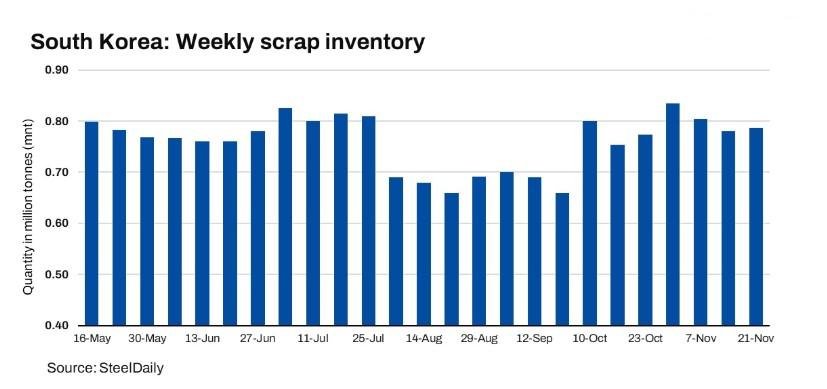

SteelDaily: This week, the combined ferrous scrap inventory of eight major South Korean steel mills remained largely stable. There was a marginal hike, which could be attributed to cuts in scrap procurement prices nationwide. The lower prices led to slightly higher inventory levels, as steelmakers stocked up on scrap.

Stocks were up marginally by 0.5% to 787,000 tonnes (t), compared to the previous week’s 783,000 t.

Inventory levels in both the central and southern regions were similar to those of last week, although there were variations in the increases and decreases at different factories.

Region-wise inventory

Central region: In the central region, scrap inventory increased by 0.9% w-o-w to 418,000 t.

In terms of companies, Hyundai Steel’s Dangjin plant saw a 0.2% w-o-w increase in inventory, while Dongkuk Steel’s inventory rose by 4.3% w-o-w. In contrast, Hyundai Steel’s Incheon plant maintained the same inventory level as the previous week. Meanwhile, Hwanyang Steel experienced a 5.4% decrease in its inventory.

Southern region: In the southern region, inventory levels remained steady at 369,000 t, unchanged from the previous week. Hyundai Steel’s Pohang plant saw stable inventory levels w-o-w, while POSCO’s inventory increased by 6.4% compared to the previous week.

The combined inventories of Daehan Steel and YK Steel decreased by 11.2% w-o-w, while Korea Iron and Steel’s inventory fell by 3.2% compared to the previous week.

In addition, Korea Special Steel, the last steelmaker outside Pohang and Gwangyang to cut prices, saw its inventory rise by about 21.8% compared to the prior week.

A market participant stated, “Now, scrap suppliers’ focus is on reducing inventory rather than increasing it. With weak product demand, efforts to lower inventory may intensify by the end of the year. As a result, steelmakers are stocking up on ferrous scrap while it is still available at lower prices.”

Note: This article has been written in accordance with a content exchange agreement between SteelDaily and BigMint.