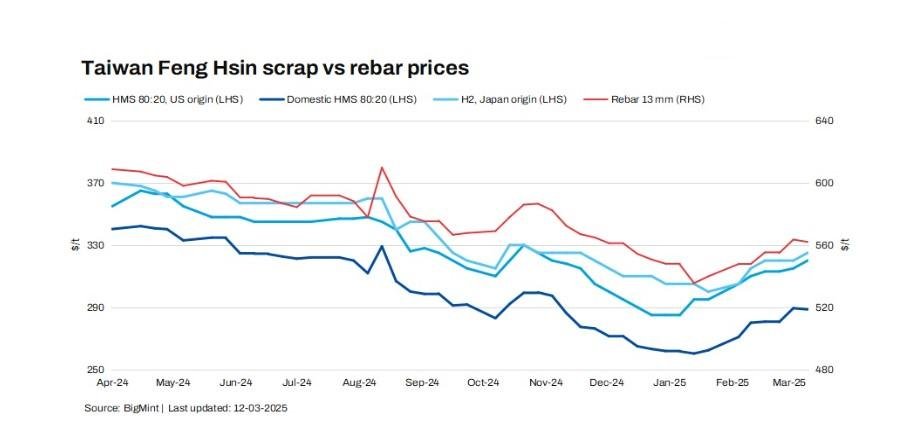

Mysteel Global: Feng Hsin Steel, Taiwan’s largest rebar producer, headquartered in Taichung in central Taiwan, has decided to roll over its rebar list prices and buying prices for local scrap for transactions over March 10-14, according to a company official.

For the business discussions till this Friday, the Taiwanese mini-mill continues to offer its 13mm dia rebar at TWD 18,500/tonne ($561/t) EXW, and its procurement price for local HMS 1&2 80:20 scrap also stays unchanged on week at TWD 9,500/t, the official confirmed.

Although prices of global scrap delivered to Taiwan continued to rise over the past week, mini-mills in Taiwan are holding their rebar list prices given the lackluster demand, Mysteel Global noted.

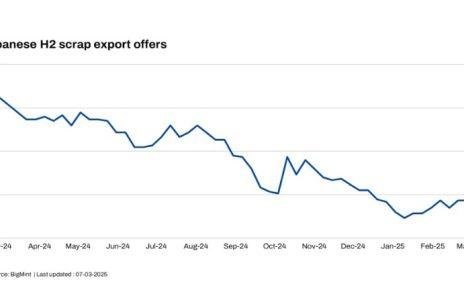

As of March 10, the price of US-sourced HMS 1&2 80:20 scrap was reported at $320/t CFR Taiwan, higher by $5/t on week, while the price of Japan-origin H2 scrap grew by $5/t on week to reach $325/t CFR Taiwan, according to a local market source.

Many construction steel users in Taiwan are reluctant to build up rebar stocks as they aim to reduce their stocks at hand to avoid potential risks. Meanwhile, rebar prices in the Chinese mainland also weakened, aggravating the wait-and-see sentiment in Taiwan’s steel market.

China’s national price of HRB400E 20mm dia rebar, a pointer to China’s steel-market sentiment, was assessed by Mysteel at Yuan 3,380/tonne ($467/t) including the 13% VAT as of March 10, falling by Yuan 59/t from one week earlier.

Construction steel sales in the spot market recovered more slowly than the market had expected, with the daily trading volume of rebar, wire rod and bar-in-coil among the 237 trading houses nationwide under Mysteel’s tracking reaching 96,624 tonnes/day on average, lower by 12,340 t/d or 11.3% from the previous week.

Note: This article has been written in accordance with a content exchange agreement between Mysteel Global and BigMint.

Article From Bigmint