- Indian, Turkish markets slow down, impact UAE

- Export market also witnesses sluggish activity

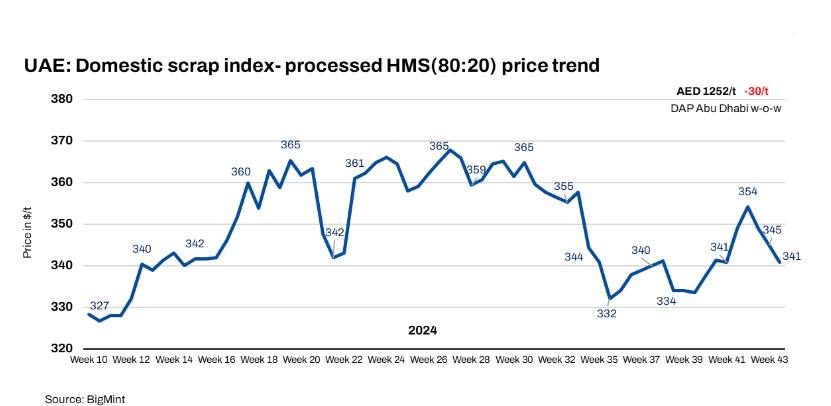

UAE’s domestic ferrous scrap index witnessed a sharp decline of $8/tonne (AED 30/t) w-o-w, primarily due to weaker domestic purchase activities. Market sources said that trading activity was slow this week, with only selective deals by major mills.

A UAE-based supplier said, “Current prices stand at AED 1,250/t ($340/t) for processed HMS and AED 1,350/t($368/t) for shredded. The recent hike in rebar prices may or may not impact local scrap offers immediately. With export activity still slow, domestic scrap availability remains steady.”

A Dubai-based trading house representative indicated that a major mill resumed buying this week after being absent last week. They noted that prices of shredded were at AED 1,350/t and HMS processed at AED 1,270-1,275/t ($346-347/t). Price expectations were closely tied to trends in India and Turkiye, both of which witnessed a slowdown following a period of active bookings.

In BigMint’s week 43 market survey, weak trade activity was observed, with approximately 3,000 t of shredded traded at AED 1350/t($367/t), followed by 2,000-3,000 t of HMS processed traded at AED 1,250-1,280/t($340-349/t) DAP Abu Dhabi.

BigMint’s bi-weekly assessment recorded a sharp decline w-o-w in HMS (80:20) processed scrap prices, which stood at AED 1,252/t ($341/t) DAP Abu Dhabi.

Export market scenario

The export market witnessed moderate inquiries but slow activity. An offer from the UAE for HMS 1 was available at $390/t CFR west coast of India for shipment this week in containers. A Dhaka-based buyer noted HMS/PNS offers at $420/t from the UAE, but these prices were deemed unworkable. For Pakistan, indicative UAE prices included HMS at $385/t, HMS sheared at $395/t, and GI bundle at $380/t, all on CFR Qasim basis.

Offers for UAE-origin scrap are currently in the range of $400-405/t for HMS 1, with bids slightly lower at $395-398/t. For HMS 1 and PNS mixed materials, offers are at $405-410/t CFR Chattogram. A recent deal for a 1,000-t lot of HMS mixed with PNS was quoted at $415/t, destined for Chattogram.

There was a demand slow-down in India, primarily due to a downturn in finished steel sales and the ongoing festival season. Meanwhile, a deal for 2,000 t of fabrication scrap was concluded at $410/t CFR Mundra.

HMS (80:20) Spread

The average spread between CFR Nhava Sheva HMS (80:20) and UAE local HMS (80:20) processed scrap rose to approximately $32-34/t. Imported HMS prices for CFR west coast India declined to $375/t, while UAE processed HMS offers dropped to $341/t DAP.

Steel market update

Emsteel(Emirates steel), one of the leading steel producers in the UAE, raised rebar offers by around $30/t (AED 110/t) m-o-m for its November 2024 deliveries. Revised prices are at $695/t (AED 2,552/t) exw compared to $665/t (AED 2,442/t) exw last month, sources informed. The company decided to increase offers amid healthy domestic demand and improved financial targets in H2CY’24, BigMint learnt.

UAE retail rebar sales are projected to reach over 300,000 t in October, supported by strong demand. Some traders raised prices, with retail rebars at AED 2,240-2,260/t($610-615/t) for secondary mills and AED 2,350-2,360/t ($640-643/t) for benchmark ones, up AED 15-20/t($4-5/t) from last week (excluding 5% VAT).

Market sources also noted that a billet vessel, likely for Hamriyah Steel, was waiting to be unloaded at the Hamriyah Port. Emsteel has started memorandum of understanding (MoU) discussions with rebar distributors for next year, aiming for better revenue after lower-than-expected H1 profits.

Outlook

Industry experts expect domestic ferrous scrap prices to remain stable or slightly up in the coming weeks, with rebar demand improving. Following the increase in Emsteel’s rebar offers, other mills are expected to raise their prices in the coming days but not immediately, according to market insiders.

Article Credit: Bigmint