- Vietnam buyers cautious as bid-offer gap widens

- Turkiye seeks Apr shipments despite higher offers

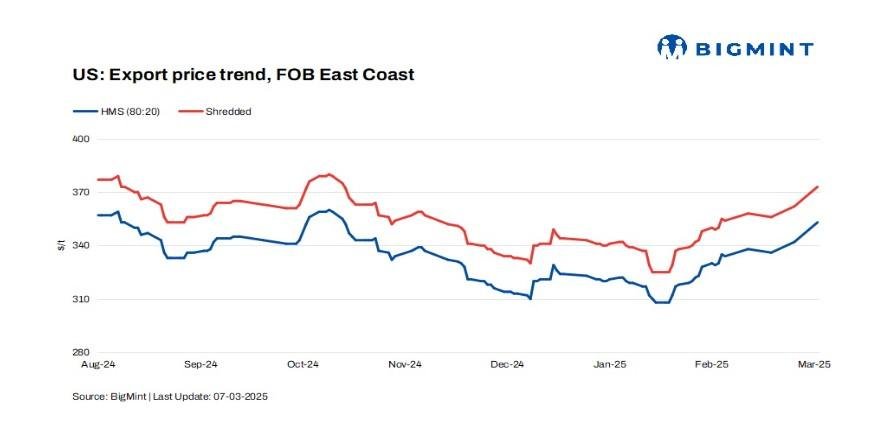

US ferrous scrap export offers rose amid strong demand from key markets, particularly Turkiye. Tight supply and firm seller sentiment pushed prices higher, with US-origin HMS 80:20 bulk scrap seeing gains across major destinations.

FOB assessments (US East Coast, bulk)

- Shredded up by $11/t w-o-w to $373/t.

- HMS 80:20 increased by $11/t w-o-w to $353/t.

CFR assessments (bulk)

- HMS 80:20 was at $367/t CFR Turkiye, up by $3/t w-o-w.

- HMS 80:20 stood at $355/t CFR Vietnam, up by $3/t w-o-w.

- HMS 80:20 was at $370/t CFR Chattogram, up by $7/t w-o-w.

Market updates on key importers

Turkiye: Turkiye’s demand for US-origin ferrous scrap remains strong, with mills accepting higher prices amid tight supply. US-origin HMS 80:20 bulk scrap prices rose as sellers held firm, supported by bullish sentiment in the US market. Mills, operating on LC terms of up to 90 days, are actively seeking April shipments and are willing to pay more to secure material.

Despite rising scrap costs, mills remain cautious about ramping up rebar production, adding pressure to the market. Strong US domestic demand is further limiting supply, pushing Baltic and US cargoes above $370/t CFR. Traders anticipate continued price strength as the US market remains bullish.

As per market insiders, US-origin scrap currently is priced at around $378-380/t, while Baltic material follows closely at $374-375/t. The UK market is in the $366-367/t range, with lower-quality grades near $362-363/t and standard material at 365-366/t.

Bangladesh: US HMS 80:20 bulk prices held steady at $363/t CFR, with offers ranging between $370-374/t. While a few buyers are active, most continue to struggle with LC issuance, though conditions have slightly improved compared to the previous months. Despite this, bulk inquiries remain limited.

A Chattogram-based mill official said, “Demand remains scarce, with major projects either significantly slowing down or completely halted. New projects are not coming in, and, overall, demand is nearly half of what we saw in February.”

Vietnam: Vietnam’s demand for US-origin scrap saw a slight increase as rising local steel prices encouraged buying. US deep-sea HMS 80:20 offers climbed to $370-375/t CFR, but buyers placed lower bids at $350/t CFR, creating a gap between offers and bids.

US deep-sea bulk HMS 80:20 cargoes were assessed at $355/t, up by $3/t w-o-w amid firm supplier sentiment. While some mills showed renewed interest, overall demand remained cautious as buyers weighed price stability against short-term market uncertainties.

Outlook

As per recent market feedback, current European HMS bulk workable levels stand at $370-372/t CFR Turkiye, but sellers are likely to offer higher at $375-376/t. US suppliers are asking for $390/t, with no interest in selling below $380/t. Given Turkiye’s market needs, resistance to higher offers is expected to be minimal.

The US metals sector faces rising uncertainty as new tariffs on Canadian and Mexican metals take effect, potentially disrupting supply chains and increasing costs. While ferrous scrap imports have historically been exempt from Section 232 tariffs, industry concerns persist ahead of the second phase of tariffs on 12 March 2025.

Canada and Mexico remain key ferrous scrap suppliers to the US, and any disruptions could tighten domestic supply, pushing prices higher. While US mills may seek alternatives, strong demand from Turkiye and Bangladesh may limit options, keeping global scrap prices firm.

Article From Bigmint