- Vietnamese HMS bulk scrap prices edge up; US offers hold firm

- Improvement in construction sector may spark demand recovery

The Vietnamese imported scrap price from the US saw a $5/tonne (t) increase last week, although demand remained weak due to the slow recovery of construction activity after the holidays.

Japanese tender results had little impact on market sentiment, as Vietnam’s domestic scrap prices strengthened, with some mills raising purchase prices, a Vietnam-based mill source said.

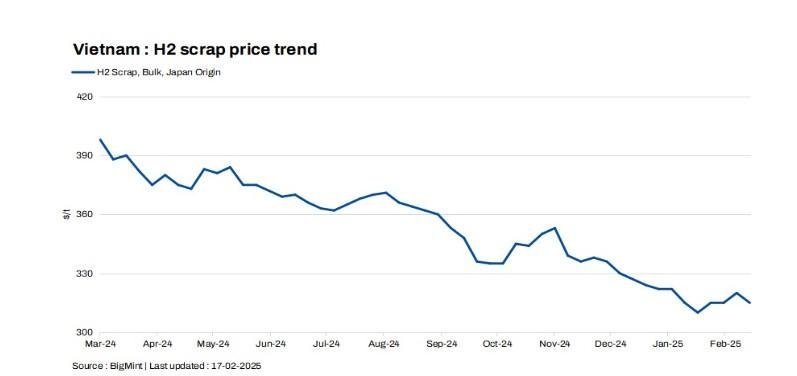

Japanese bulk H2 scrap offers ranged from $315-320/t CFR Vietnam, showing a decline of $5-10/t w-o-w. A Vietnamese market insider noted that post-holiday longs sales were sluggish, and the Kanto tender results were disappointing.

Domestic market

Long steel mills kept their official rebar and wire rod prices steady despite weak end-user demand. Meanwhile, the local billet market showed little activity this week, with BOF semis priced at VND 11,650/kg ($457/t) DDP, and IF billets trading around VND 11,450/kg ($450/t) DDP.

CFR assessments

- Deep-sea bulk US HMS (80:20) cargoes were assessed at $350/t, up by $5/t w-o-w

- Japanese-origin H2, a key tradable grade in Vietnam’s scrap market, decreased by $5/t to $315/t CFR Vietnam.

Market commentary

HS offers in Vietnam were at $355-360/t, but no transactions were confirmed due to a significant bid-offer gap and lack of buying interest.

A market participant mentioned, “US-origin deep-sea cargo offers increased to $360/t CFR Vietnam, while Australian-origin offers remained steady at $355/t CFR Vietnam. Meanwhile, indicative bids for open-origin cargoes ranged between $340-345/t CFR Vietnam.”

Another market participant indicated that buyers were under no pressure to make purchases, with very little buying interest noted. A China-based trader remarked, “At the moment, market activity in Vietnam is quiet across different scrap grades.”

A Vietnam-based trader source highlighted that “domestic scrap prices in Vietnam rose this week due to limited supply and concerns over VAT invoices.”

A Vietnam-based mill official mentioned that the “tender results had minimal impact on market sentiment, as prices in Vietnam have recently strengthened, with some mills increasing domestic purchase prices.”

Outlook

Market insiders foresee that producers are offering discounts due to weak market conditions. However, market participants expect a recovery in demand as construction activity resumes.

Article From Bigmint