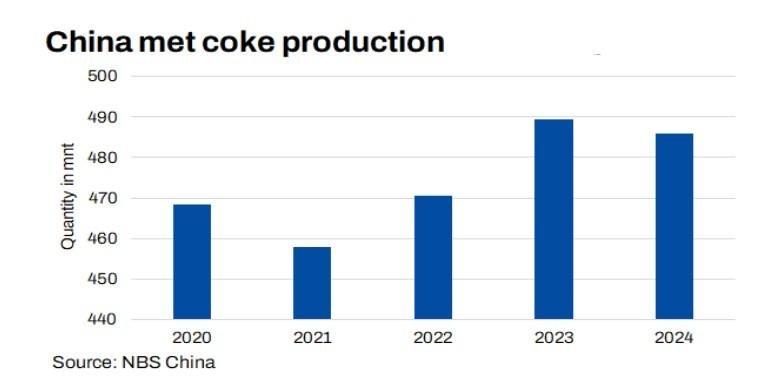

- Steelmakers are not restocking coke due to low steel prices

- Coke producers are limiting output to avoid further losses

Mysteel Global: The total stocks of metallurgical coke held by the 230 Chinese independent coke makers that Mysteel regularly tracks climbed further during the week to February 13 to top 1 million tonnes, rising by another 22,600 tonnes or 2.3% on week and touching a new high since mid-May 2023, the latest survey results show.

Survey respondents said the ongoing rise in coke stocks mainly reflected sluggish coke sales during the week. Most steelmakers were in no rush to replenish their coke inventories, despite the merchant coke makers having agreed to yet another reduction in their coke selling prices earlier in the week.

On Monday, leading mills in North China’s Hebei and East China’s Shandong province succeeded in persuading their coke suppliers to accept a further Yuan 50-55/tonne ($6.8-7.5/t) reduction in their met coke purchase prices, as Mysteel Global reported.

However, the lower coke prices failed to entice mills to restock more of the steelmaking feeds, partly because the steelmakers were confident about being able to negotiate further coke-price cuts in the near future.

Steel product prices failed to show any sign of upward movement during the survey week as the cold weather throughout much of China still weighed on construction activity, as reported. Moreover, although the Chinese New Year (CNY) holiday officially ended on February 4, many building contractors were not intending to recommence work on projects until after China’s Lantern Festival which this year fell on February 12.

The absence of any post-CNY uptick in steel prices eroded the profit margins of mills, prompting management to cut costs by squeezing raw materials procurement prices including those of coke.

Also, after steadily rising since mid-January production among Chinese blast furnace steel producers retreated during February 6-13 as some mills halted operations to conduct maintenance after running facilities hard during the eight-day holiday.

Mysteel’s survey of the 30 merchant coke producers it monitors closely revealed that as of February 13, they were losing an average of Yuan 37/t when selling their met coke, which was more severe than the Yuan 27/t loss recorded the previous week.

Given this, the coke makers were content to maintain stable operations this week, fearing that increasing coke supply would place prices under greater downward pressure and even worsen their business circumstances.

Consequently, daily output among the 230 sampled producers edged up by only 300 tonnes on week to 517,600 tonnes on average during February 6-12, the survey showed.

Given the persistent weakness in coke demand and relatively sufficient coke supply, domestic coke prices trended lower this week and will likely remain soft for the immediate future, market watchers said. As of February 13, China’s national composite coke price under Mysteel’s assessment had fallen by Yuan 44.6/t from the previous week to Yuan 1,451.6/t including the 13% VAT.

Note: This article has been written in accordance with a content exchange agreement between Mysteel Global and BigMint.

Article From Bigmint